[The guest commentary below is the second we’ve published from James Tolard, an old and dear friend as well as a supremely gifted commodity trader. Jim’s style is to surf the big trends, trading just a few times a year. He lives in a rural area outside of Paris, but we’ve coaxed him out of semi-retirement to write occasionally on an eclectic range of subjects suited to his deep intellect, worldliness and wit. This time, he is sharply at odds with our own, very bearish outlook for 2013. We have no qualms about sharing his thoughts with you, however, because Jim’s against-the-grain instincts have been right far more often than our own. RA]

One of the things that baffled me all summer, and into the stench of the campaign finale, was the supposedly odd “friendliness”’ of the U.S. stock market and the weakness of the dollar. I was fairly bullish on stocks going into October, for a surge to – sit down for this — Dow 20,000! But as October pulled in with a screech, and elections just a month away, I am old enough to have expected little good from either the Ides of March or those of October. So, I blushed, backed off, and decided to let the market tell me what kind of correction or sell-off it might need.

Now, contrary to all emotional expectations, we are facing the real possibility that a strong run-up may well launch in the coming weeks. So, assuming that I am going to be right, what do I use to support my arguments? First is the low borrowing rate. While the normal person or even smallish business cannot borrow 3% or less, large firms can. The banks are still re-building their reserves and doctoring their balance sheets, so they are holding onto the money very tightly like the bankers of yore, lending only to those who don’t need it. This accurately describes the condition of the largest companies and private equity firms. They can re-finance their present debt and assume debt at less than 3% to 4% — and who the hell can’t make 3%-4% in a big business today? The rush to sell commercial paper is well known to you all, so I won’t rehearse the facts: Buy low sell high. The present interest rates have many well-heeled takers, and if you have the means, I’d suggest borrowing now while the low rates lasts.

Weak-Dollar Benefits

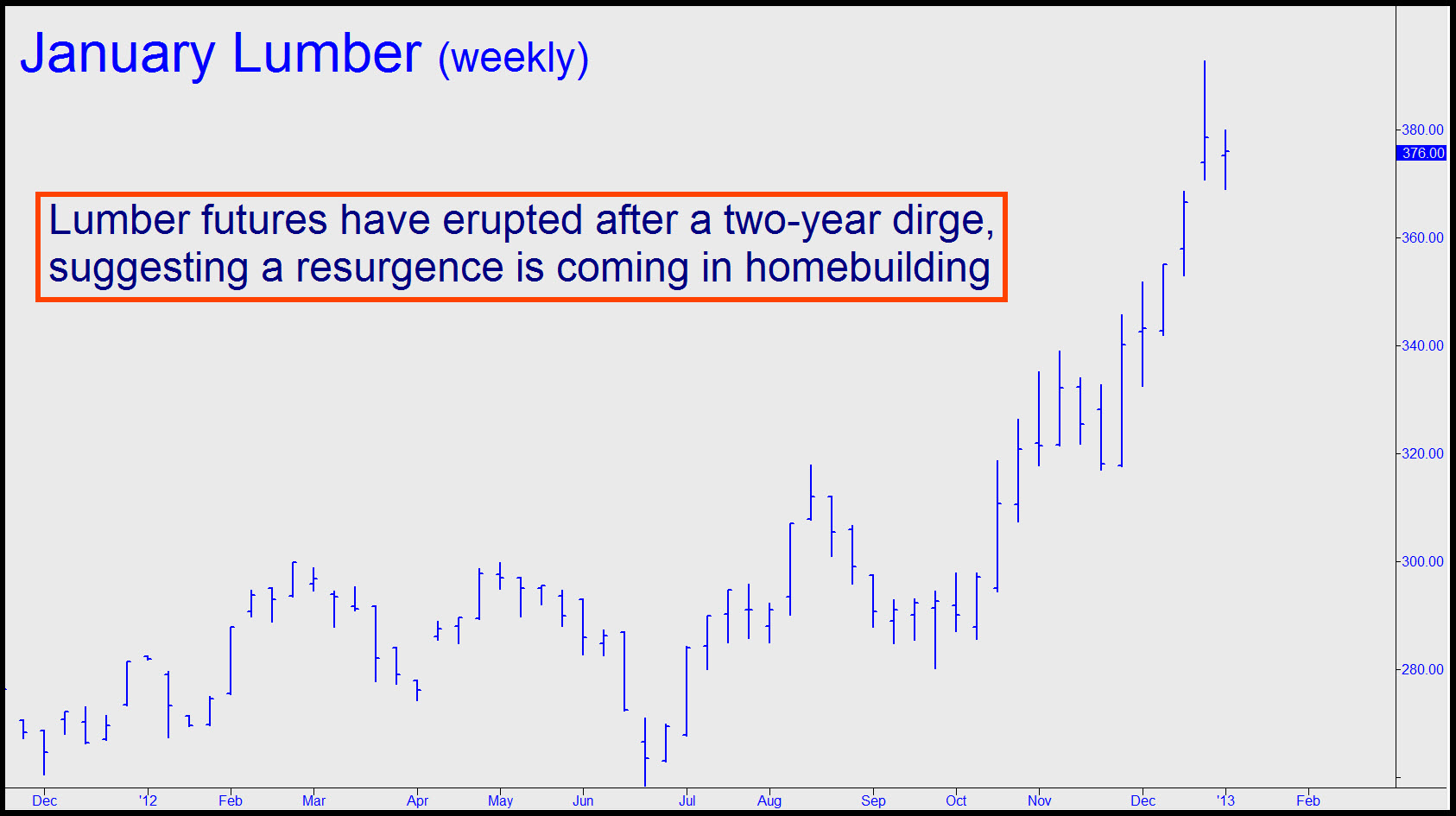

Second reason and bullish sign: Lumber and construction are increasing, and lumber has managed to emerge from its listless two-year bottom. Meanwhile, there is plenty of money for builders and probably not so much for buyers, but that can be fixed. Third reason, and most baffling, even though I see it here: No matter how shrill the bank propaganda is about Greece, Spain, et al., the EU is in good shape on paper. Hence, the euro versus the dollar is favorable toward U.S exports . Despite all else, a lower dollar is good for U.S. business in that it is one of the factors that stimulates overseas buyers.

So, the low borrowing rates, the raw materials for construction and the weaker dollar should provide the support for a higher stock market. Also, some key U.S. stocks are leaner and more profitable than three years ago. They have plenty of retained earnings sitting in Scrooge McDuck bins in the basement. It helps that they have little competition. On the consumer side, the sheeple are in the process of growing back their heavily trimmed fleeces, but many are not yet ready to spend like they are rich. While we await their resurgence and the slow lifting of their spirits, let the band strike up a tune and cheap wine to flow.

As for Armageddon…

What about those dire predictions of an End of Days? My dear friends, there is one thing for certain: The global economy is on course for a crash that will subsume commercial institutions and traditions that have dominated all sectors of life in the West for nearly 250 years. But the U.S. and Europe are not going to turn into an economic South Sudan overnight. Rather, money and credit will continue to flow, trade to expand, and hundreds of millions of consumers brought on line. Let’s enjoy it while it lasts.

Concerning gold’s prospects in such an environment, we should note that gold has risen when the Dow rose, when the Dow fell, and when the Dow was flat. Here is my belated Christmas present, as well as a Passover gift ahead of time: If the Dow surges above 15000 or perhaps even smashes though 20000, gold will easily reach $2500. So there. I said it, my belly is sloshing with a modest St. Emilion vintage, but that clears the head rather than blighting it. Can this happen? I think so. Of course, none of this correlates with the external “mood” of the press, the politicians, and so on, but they never know in any event, do they? And, those numbers are not really that amazing. Suppose the Dow hits 20,000. That is only about 6600 points from here, a mere mis-programmed instruction in a high-speed trader’s algorithm. And gold at 2500 or more? I sold some around 1,800 just less than two years ago, and so from a current 1,700, at least, that implies a rally of just $800. No matter how odd that kind of a move might seem now, I am persuaded that it is the only real direction for the market.

And lastly, there’s all of that silly stuff about the fiscal cliff and the national debt. Forget it. Debt will continue to metastasize, big companies will hold onto their tax breaks, and the military will surrender perhaps $10 to $20 billion of a current budget of around $700 billion. Taxpayers will pay more, and everyone will declare victory. Can you understand the Tax Code? How about the effect of riders on the budget? If you can, I’d suggest that we carve your head into Mt. Rushmore, right next to Teddy Roosevelt’s.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Case For Dow 20,000 And $2500 Gold

Published 01/03/2013, 02:47 AM

Updated 07/09/2023, 06:31 AM

The Case For Dow 20,000 And $2500 Gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.