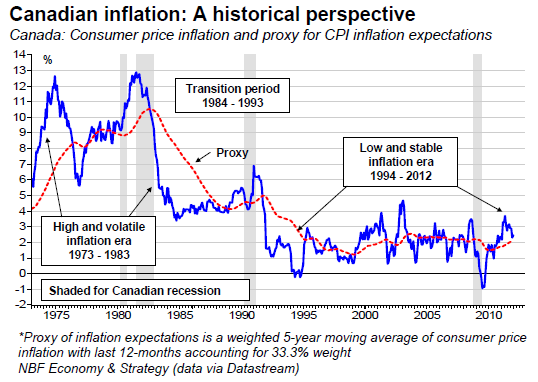

Adjusting for inflation or inflation expectations plays a critical role in fairly evaluating equity market valuation metrics over time. Canadian inflation history has gone through significant changes since the 70’s going from a period of high and volatile inflation to a period of low and stable price growth.

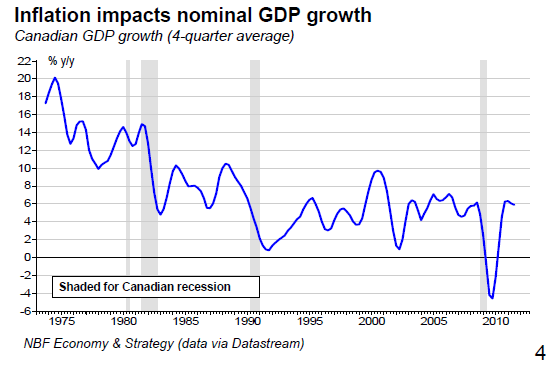

Price inflation has a direct impact on nominal GDP growth and ultimately growth in revenues. As a result discounting models will provide different results depending on what inputs are being used. In sum, it is sensible to adjust valuation metrics for inflation.

Equity market valuations

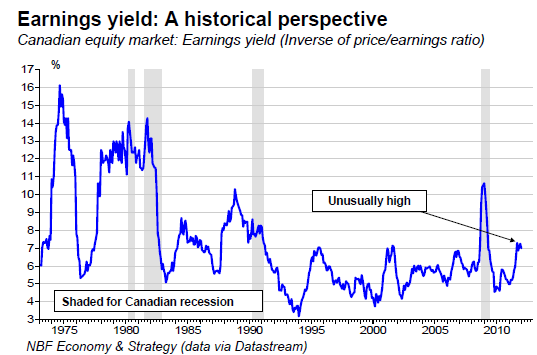

The Canadian equity market’s earnings yield is currently at the high end of its 20-year range. However, this chart shows us that the average earnings yield was much higher prior to the 90’s.

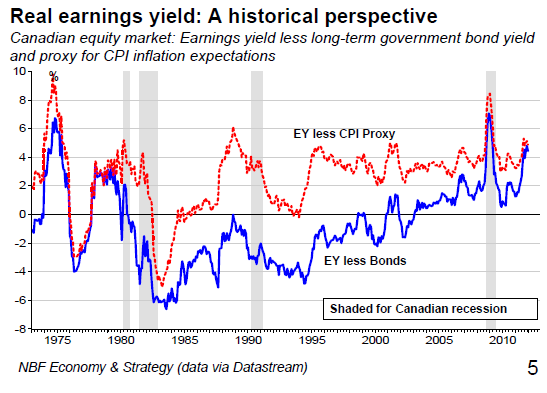

However, when adjusted for market interest rates or inflation expectations the earning yield provides investors with a compelling argument suggesting the Canadian equity market is not expensive in both absolute terms and relative to long-term government bonds.

Valuation metric: Earnings yield

Equity market valuations

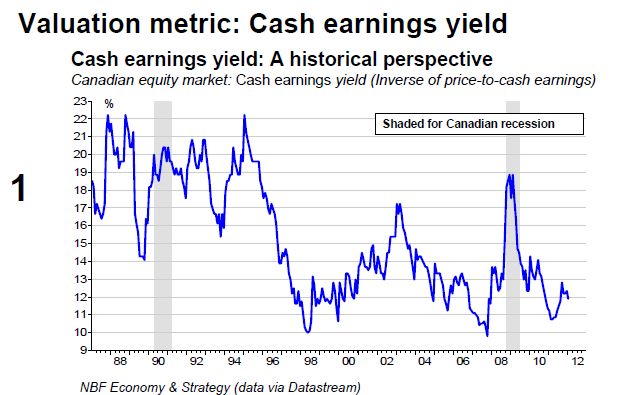

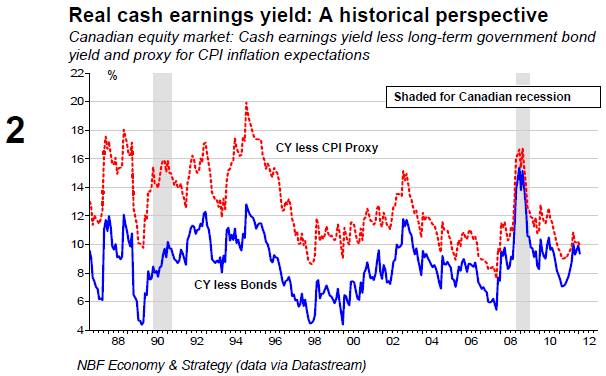

On a cash earnings basis, yields look much less attractive than they did when looking at the earnings yield. The metric is now approaching levels which have in the past proved to mark an overvalued market.

The cash earnings yield relative to long-term bond yields is close to its average or fair value but when the cash earnings yield is deflated by inflation, equities are in historically overvalued territory.

Equity market valuations

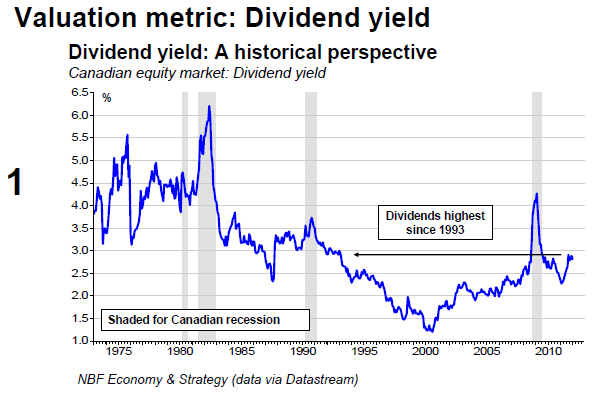

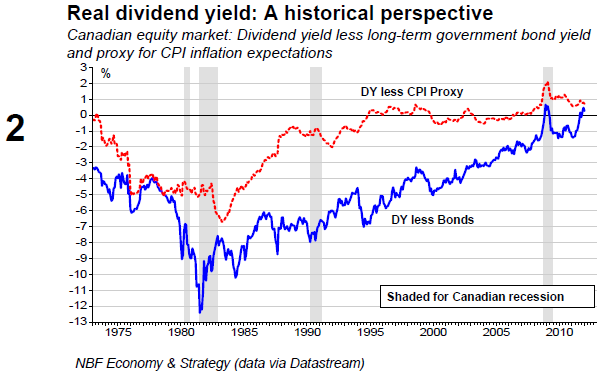

Canadian equities are currently showing the second highest period of dividend yield since 1993, only surpassed by the 2008-09 recession period. However, dividend yields were generally above 3% prior to the 1990 recession.

The real dividend yield is without a doubt historically elevated at just under 1%. In addition, the spread between the dividend yield and long-term bonds has never been this wide, with dividend distribution above that of long bonds, something unseen in the past 45 years.

Equity market valuations

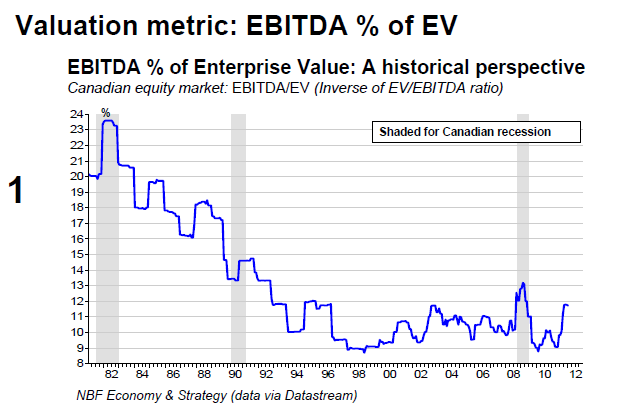

When comparing operating earnings (EBITDA) to enterprise value (EV) we observe that a significant change took place between 1980 and 1995 with the yield falling by over 12 percentage points. However, this ratio is at the top of its 20-year range, a sign that points to an undervalued market.

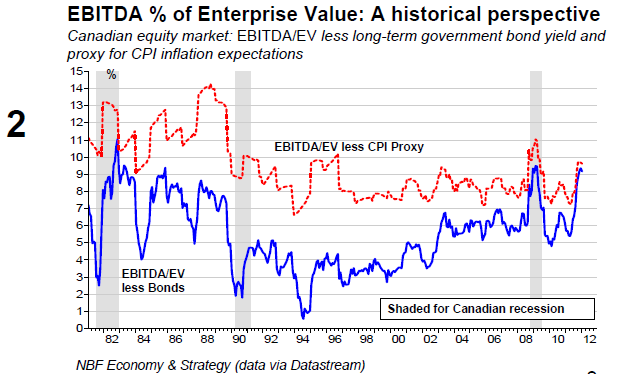

The EBITDA/EV ratio is also at a relatively high level when compared to the long-term government bond yield, matching the rate seen in the 2008-09 recession. The spread with the inflation proxy points to a similar conclusion since 1990.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Canadian Equity Market: Is it Cheap?

Published 03/12/2012, 02:10 AM

Updated 05/14/2017, 06:45 AM

The Canadian Equity Market: Is it Cheap?

Equity market valuations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.