This winter has been harsh everywhere. Snow in the Carolina’s, Dallas, and southern California is just crazy. But in the northeast and midwest it was a second crazy winter. I live outside of Cleveland and there is so much snow I can’t get my car out of the garage. There is no where for the plow to put the snow. And the ice on my roof, ugh. I just paid some guy $275 to climb a ladder and bang a hammer on 7 feet of 6 inch thick ice to break up an ice damn. So knowing that Spring is right around the corner is like seeing a light at the end of the tunnel.

Winter (read snow) starts around Halloween in Cleveland so my misery has been going on for 4 months. A long time for a 3 month season. But I think of my neighbors to the north and how bad they have it. Yes they are used to the snow and cold but what I am referring to is the cold spell in the Canadian dollar. The Loonie has been chilling since the beginning of July. That is a long winter for the currency. But there are signs of spring arriving there as well.

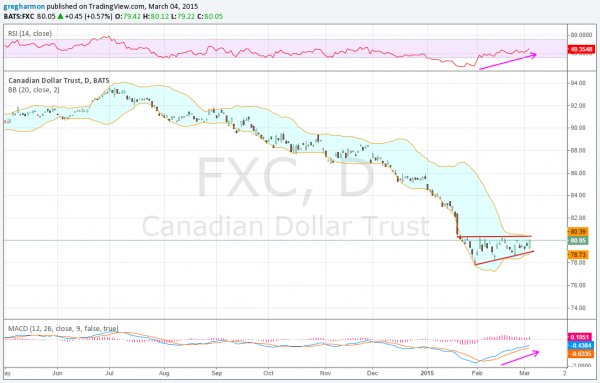

The chart of the currency ETF that mirrors the Canadian dollar, the Rydex CurrencyShares CAD Trust (NYSE:FXC) above gives the signals. The first is at the top of the chart where the RSI, a momentum indicator, has been moving higher since the beginning of February. Like a crocus peeking through the snow, it is piercing the mid line on its way towards the bullish zone. The MACD at the bottom is also driving higher. The divergence of these momentum indicators, leading price to the upside puts the Loonie on your radar.

Looking at the price action itself, the currency made a bottom to end January and started higher. Finding resistance at about 80.30 its pullbacks have been shallower each time. This creates a technical pattern called an ascending triangle. A technician would look for a move of about 2.50 on a break of the triangle. And the Bollinger Bands® shown by the blue envelope are tightening suggesting a break may happen very soon. Will it be a spring bounce for the Loonie?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.