The Canadian dollar seems to trade with the weather lately. It fell from a peak in hot sunny July to a bottom in cold snowy February. From there it just sat until mid April when it started rising with the temperature as the ice and snow melted. Seems an easy currency to trade huh?

Well if you are about to buy the loonie, as traders call it, you might want to know that the mountains in the west are due for 5 inches of snow today. Oh, and the chart of the currency is approaching a critical area.

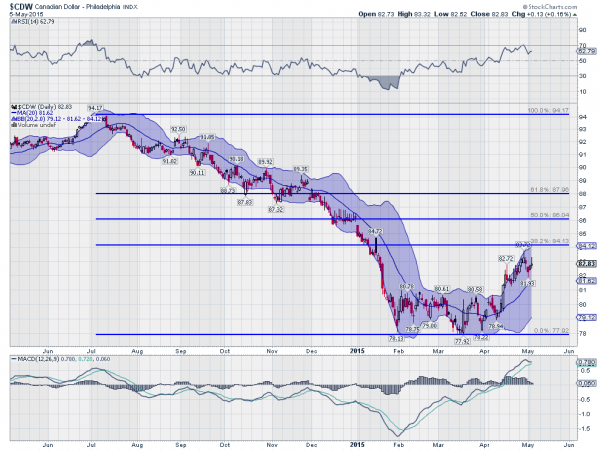

The chart shows that fall in value over the back half of 2014 and the stabilization. The bounce now is nearing the 38.2% retracement of the move lower. This is a key measure for traders, especially currency traders. It is an important Fibonacci level, but it is more than that. This particular Fibonacci is a turning point for a show of strength. Until the loonie gets over this level it is characterized as a bounce, not a reversal.

Meaning that failure there is the bet. And the momentum indicators are playing along with that. The MACD is rolling lower and about to cross down, while the RSI is reaching overbought territory. Should it ‘correct’ through time instead of a move lower then a continuation over 38.2% should attract more interest in the currency and target a move to the 61.8% retracement near 88.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.