As most of you know I’ve been bullish on the stock markets for quite sometime now. I know there are a lot of investors that are bearish on the US markets and are looking for them to crash on burn. From my perspective nothing is broken that would tell me at this point in time to expect a major correction. So far the charts have been playing out beautifully and if nothing is broken there is no need to fix it.

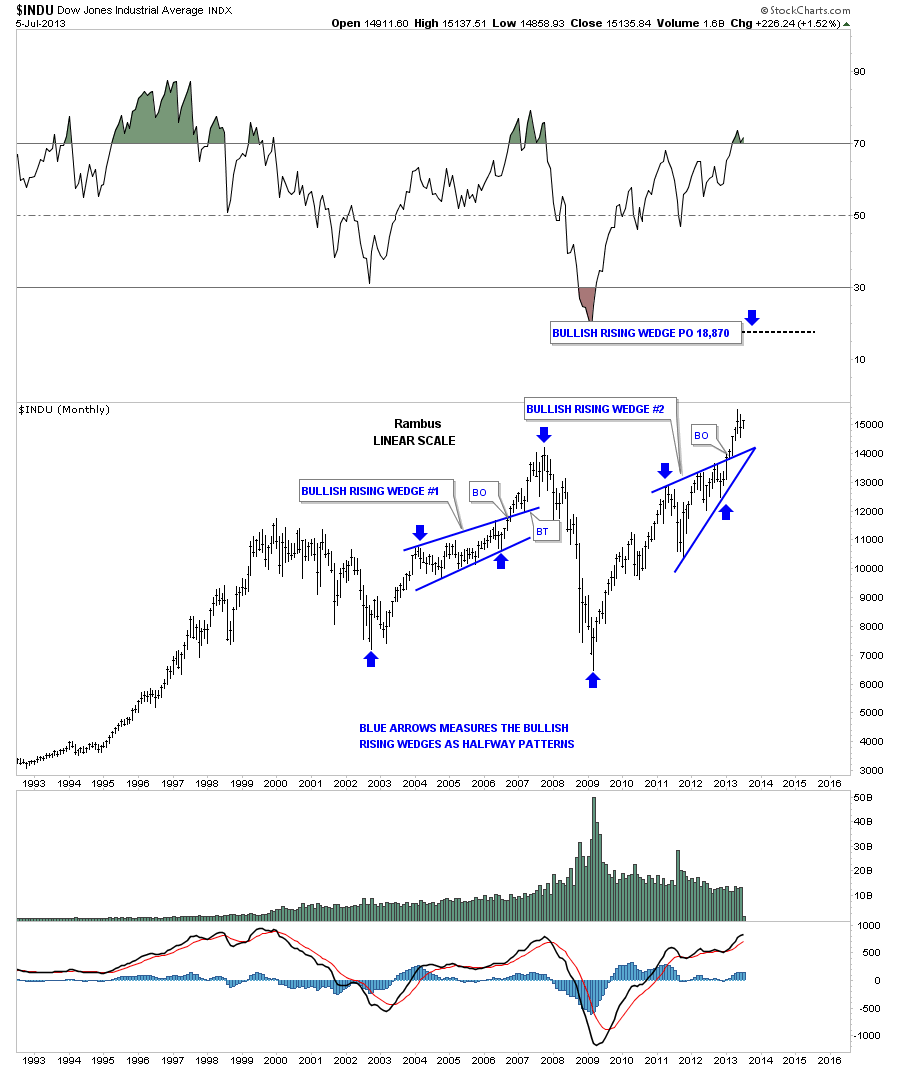

The first chart I would like to show you is a very long term monthly look at the INDU that seems to be repeating a pattern that formed back in 2002 to 2007 rally phase. I’ve shown this chart several times in the past that shows the bullish rising wedge that formed as a halfway pattern in the middle of the 2002 to 2007 rally. No one at the time recognized this pattern, the bullish rising wedge, because everyone always considers these patterns as bearish. Nothing could be further from the truth as I have shown many times they act and perform just as any other consolidation if the price action breaks out through the top rail. The chart below shows the bullish rising wedge that formed in 2002 to 2007 as a halfway pattern that measured out perfectly in time and price to the 2007 high just before the crash. You can see our current bullish rising wedge that I’ve been showing since the breakout about 6 months or so ago.

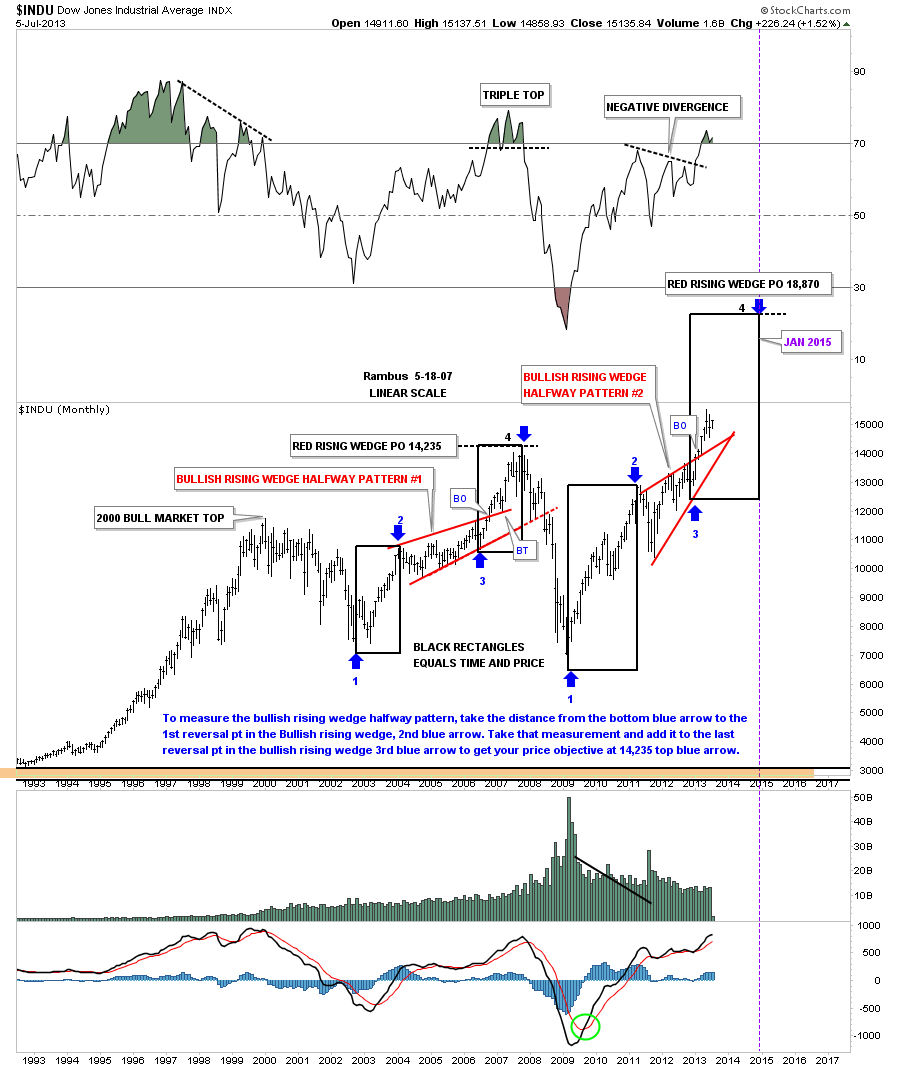

This next chart is the exact same chart as shown above. It may look a little busy but it shows you what I’m look for with our current bullish rising wedge #2. Note the two black rectangles from 2002 to 2007 that measured out the bullish rising wedge #1 as a halfway pattern in time and price. Now look at our current bullish rising wedge #2 that is showing a price objective up to 18,870 as measured by the blue arrows with a time frame in January of 2015 or so. You will only see a chart like this at Rambus Chartology and nowhere else because no one is looking for this pattern. The bears were all over the bullish rising wedge before it broke out to the upside. Its now been about 6 months and nothing is broken.

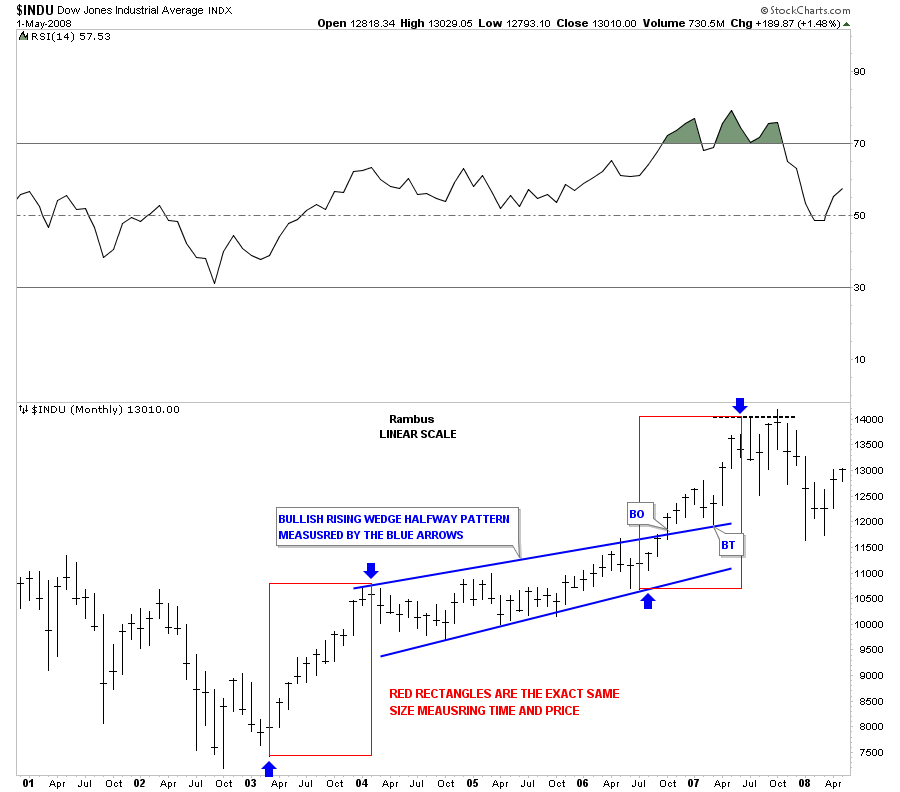

This next chart is a closeup look at the 2002 to 2007 price action that measured out the bullish rising wedge as a halfway pattern.

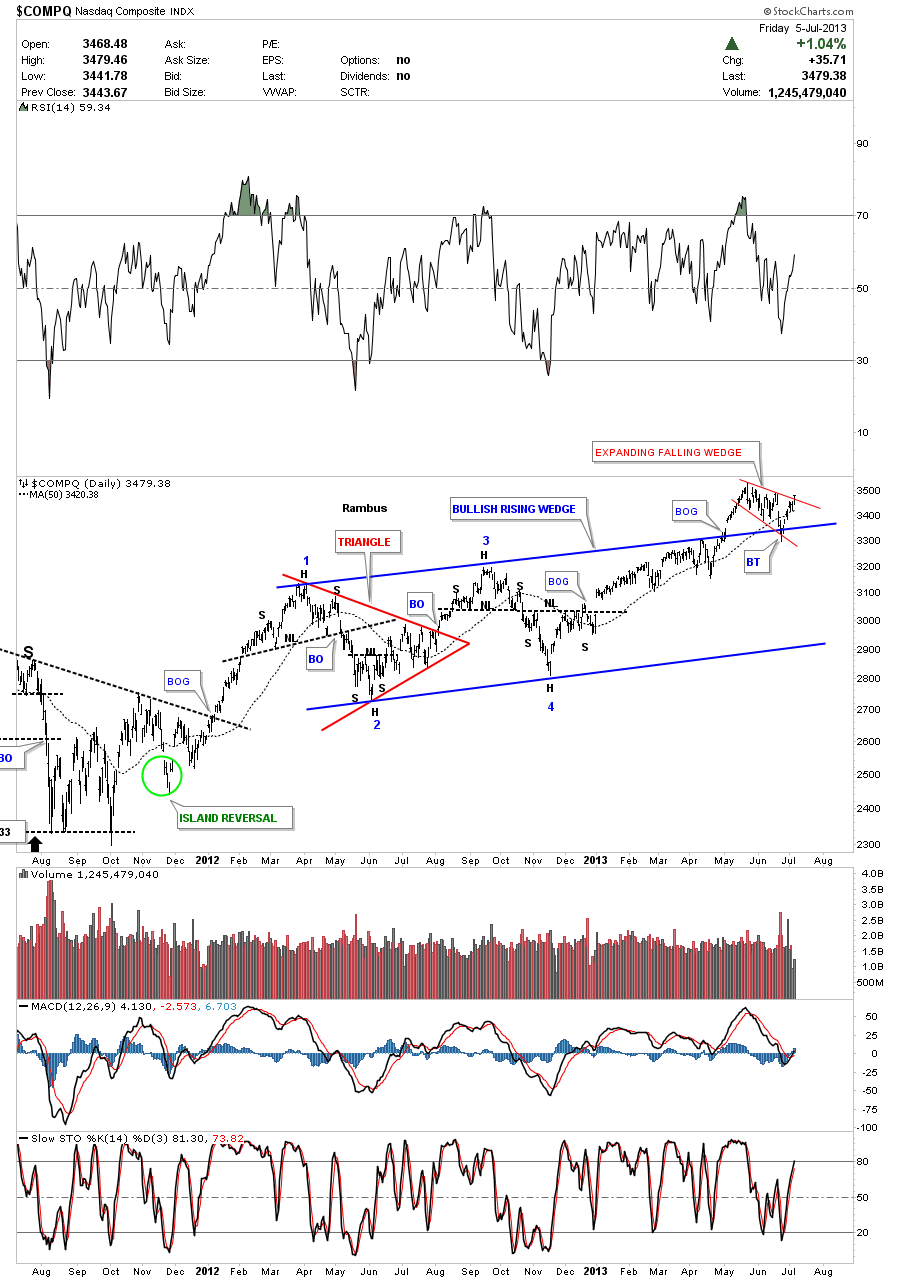

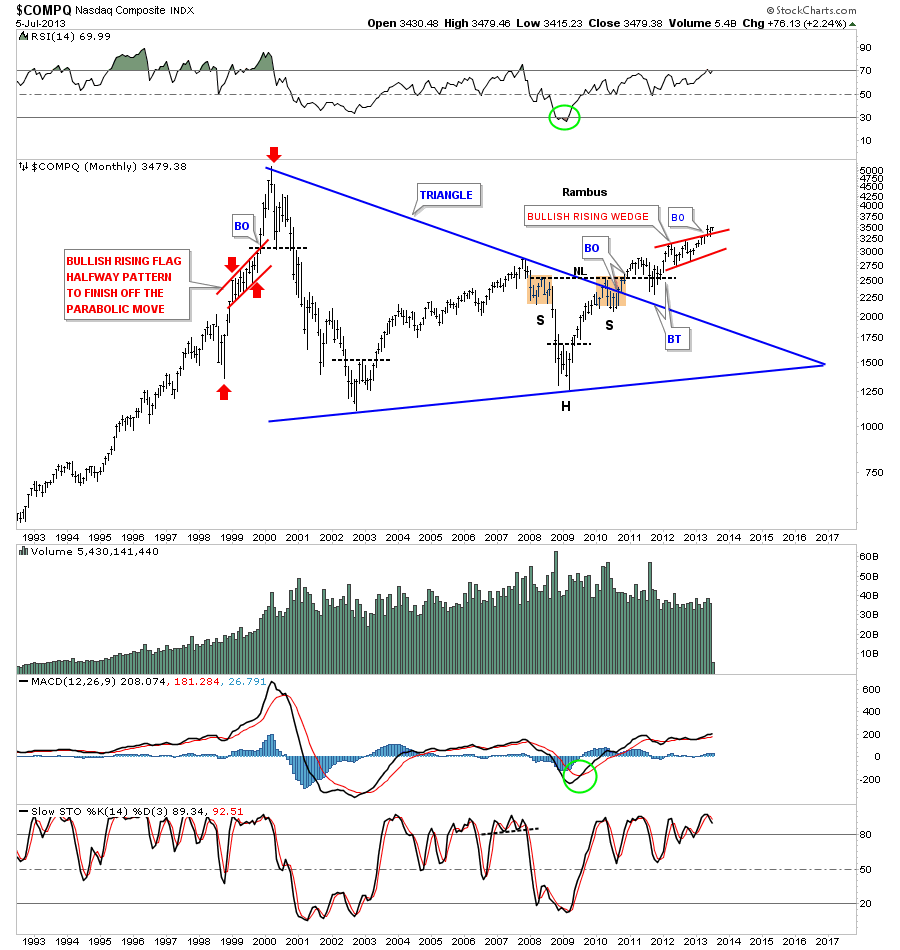

The next chart is the COMPQ that also shows a bullish rising wedge that has broken out and has been in backtest mode for the last month or so. It looks like it is trying to breakout from the red bullish expanding falling wedge that is sitting on the top rail of the blue bullish rising wedge which is normally a bullish setup.

The COMPQ monthly.

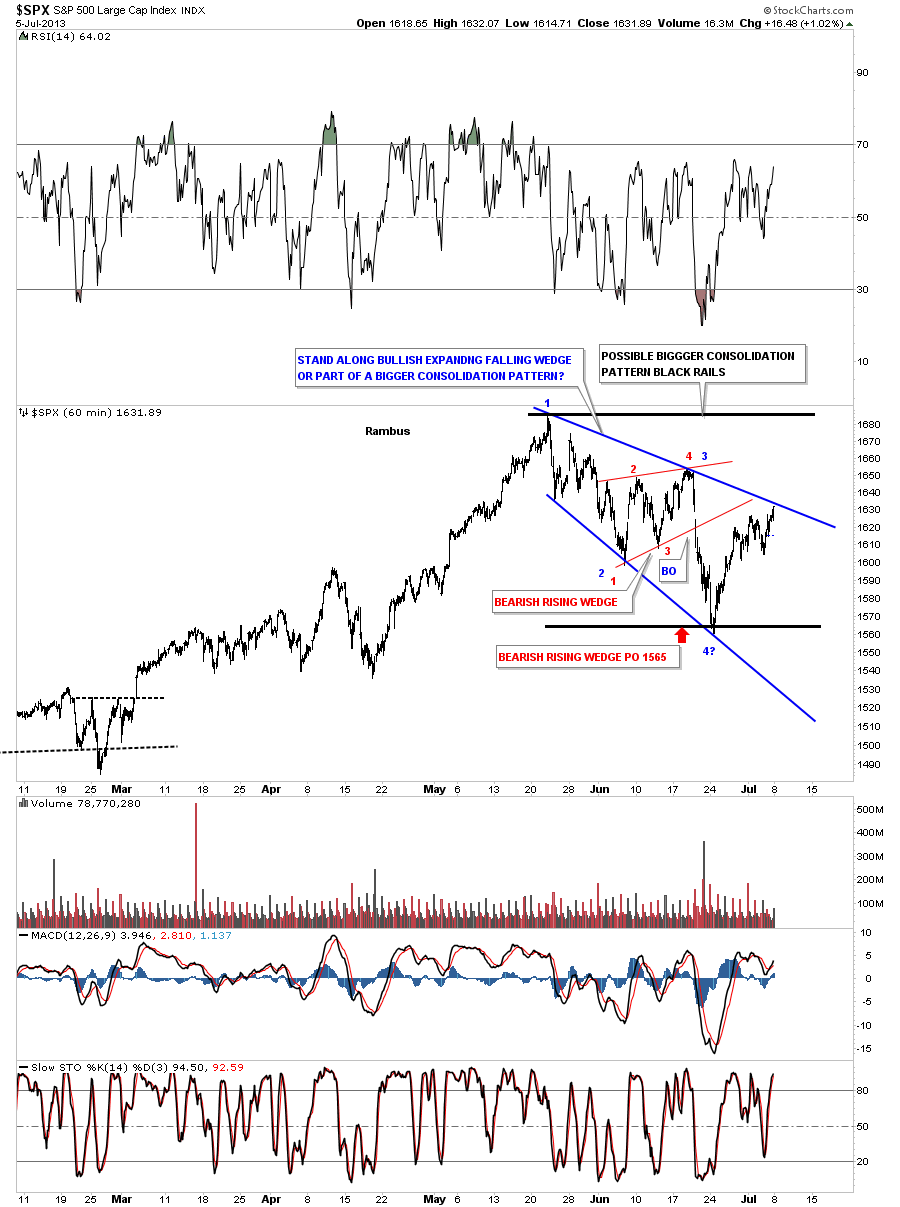

Below is a 60 minute chart for the SPX I showed you several weeks ago as it was still forming its consolidation pattern. As you can see it closed just below the top rail last Friday.

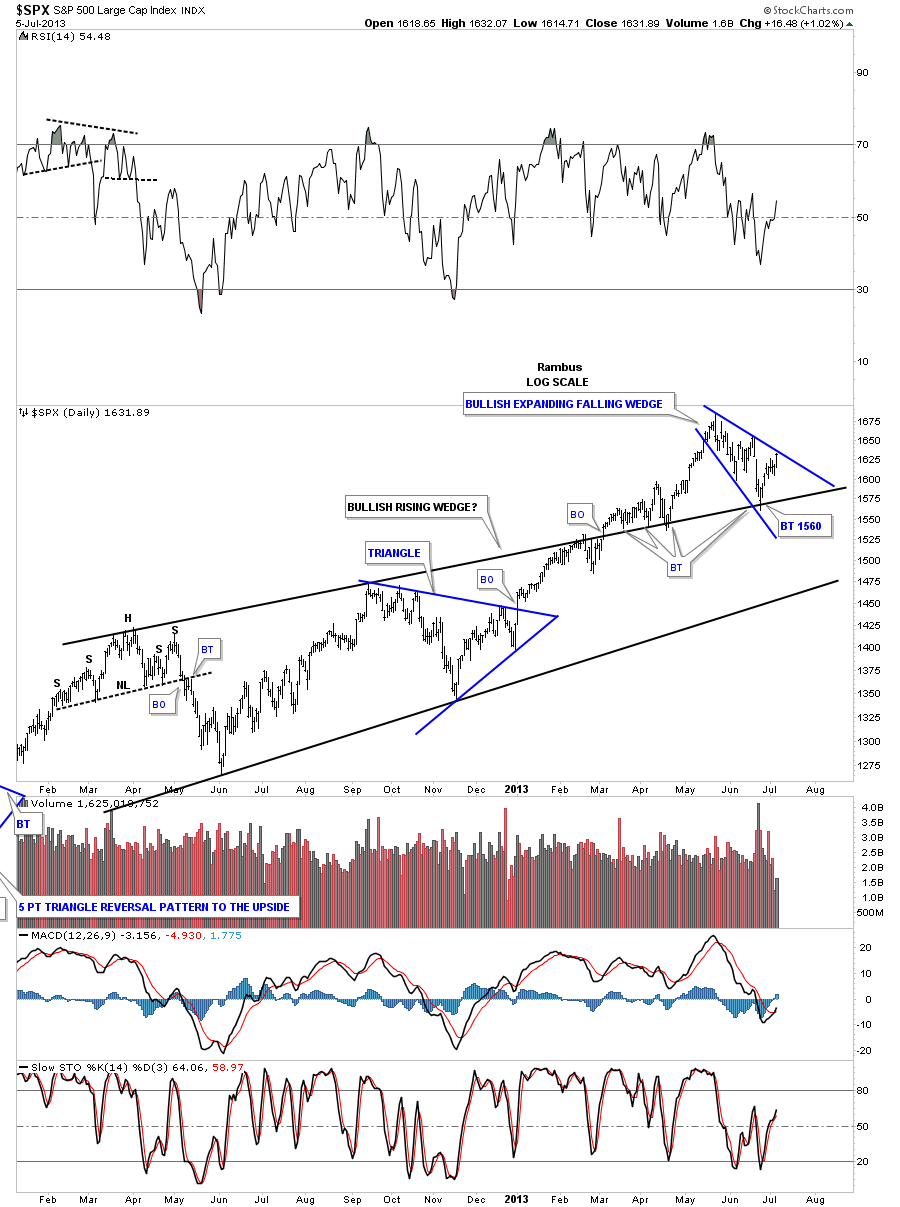

The daily chart shows the bullish rising wedge with the bullish expanding falling wedge as the backtest. If you recall I was looking at 1560 as a potential low on this bar chart. Now it just needs to breakout through the top rail to enter the next leg up.

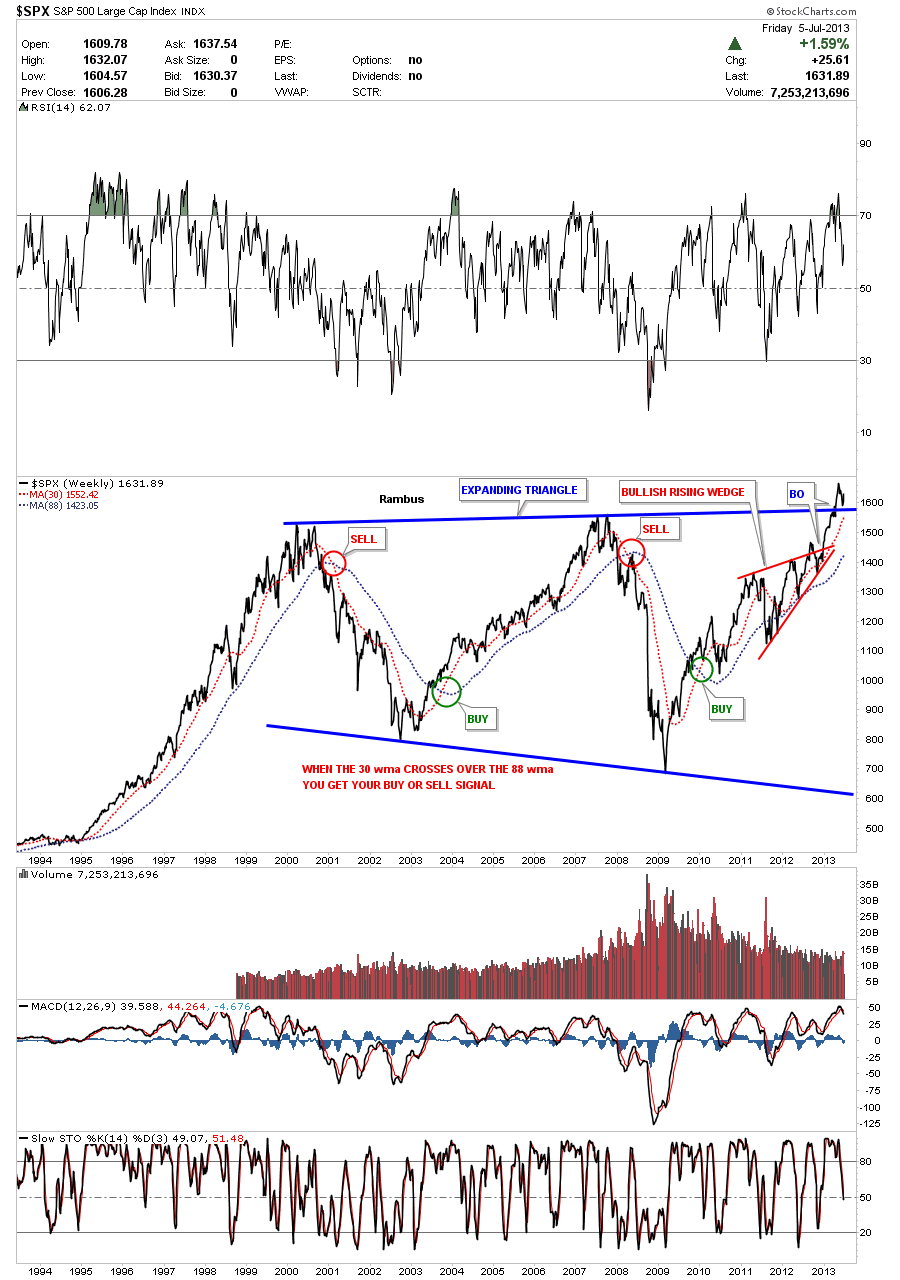

This next chart for the SPX is a weekly line chart that shows the breakout of the 13 year expanding flat top triangle. The backtest here comes in at 1580 or so which has already been tested. Again, as long as the top blue rail holds support nothing is broken and we have to follow the price action where ever it leads us.

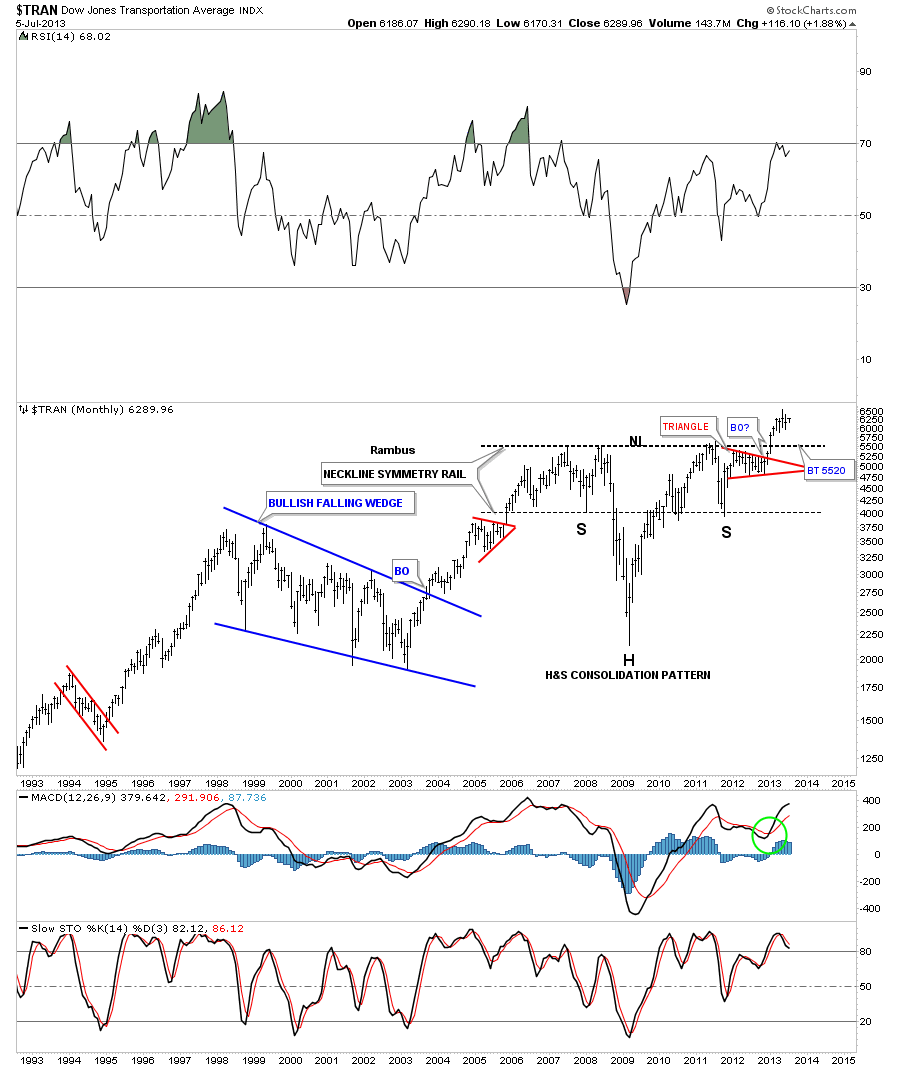

The next chart shows a beautiful H&S consolidation pattern for the transportation index that broke out 6 months or so ago. Nothing is broke here either.

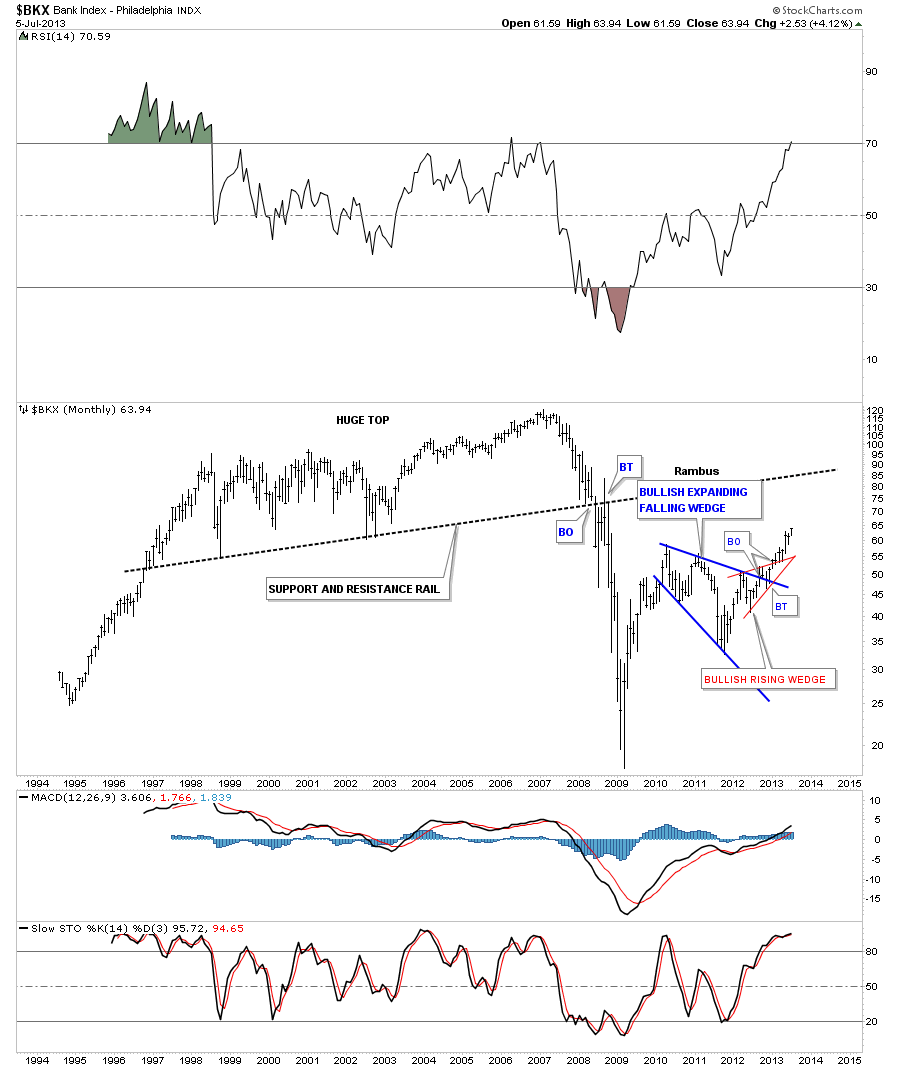

Next I want to update you on some of the indexes that I’ve been showing you once a month or so that are still in a bullish mode. The BKX, banking indexes, is still moving as expected after breaking out from the blue bullish expanding falling wedge followed by the red red bullish rising wedge. Note the 11 year support and resistance rail that gave anyone watching this index a huge clue that when the price action broke below the S&R rail a top was in place. You never know for sure how the move down would unfold but with such a big top in place you knew it couldn’t be good.

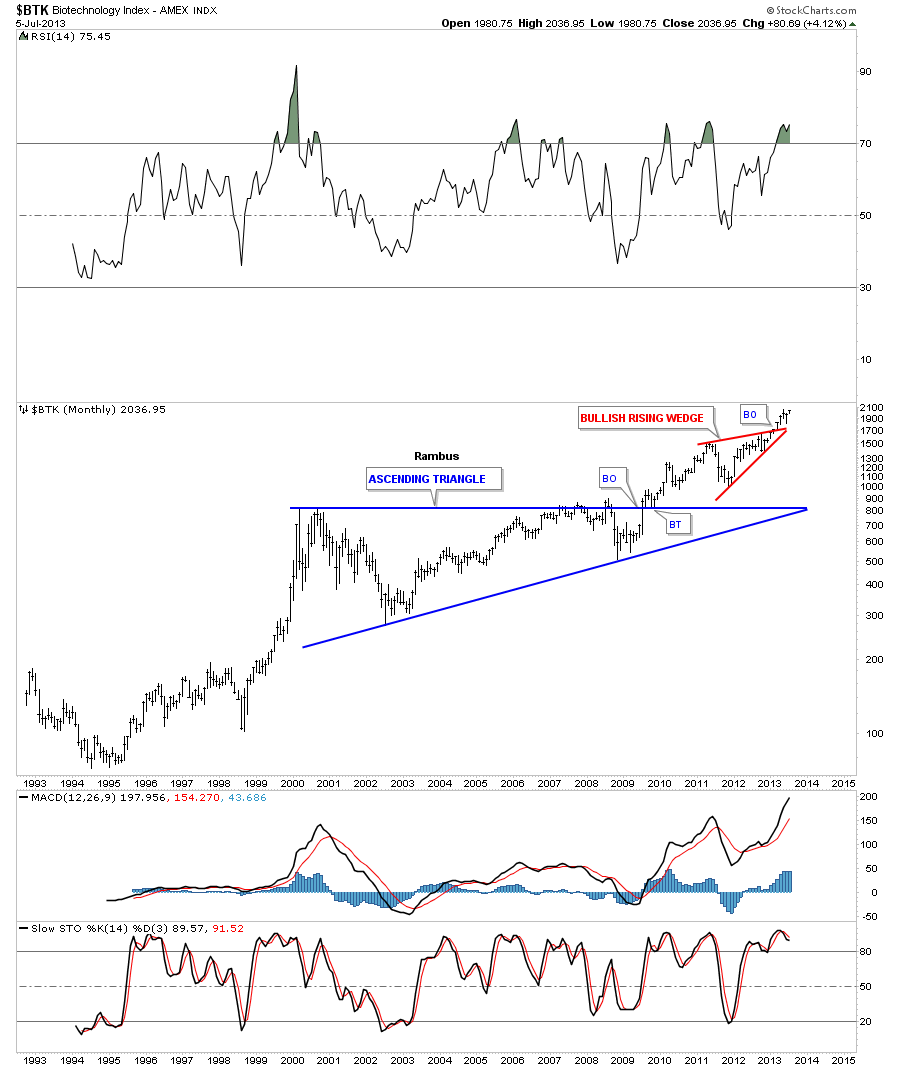

The BTK, biotech index. is still trading above its red bullish rising wedge I showed you when it broke out. Are you beginning to see a theme here with all the bullish rising wedges in play?

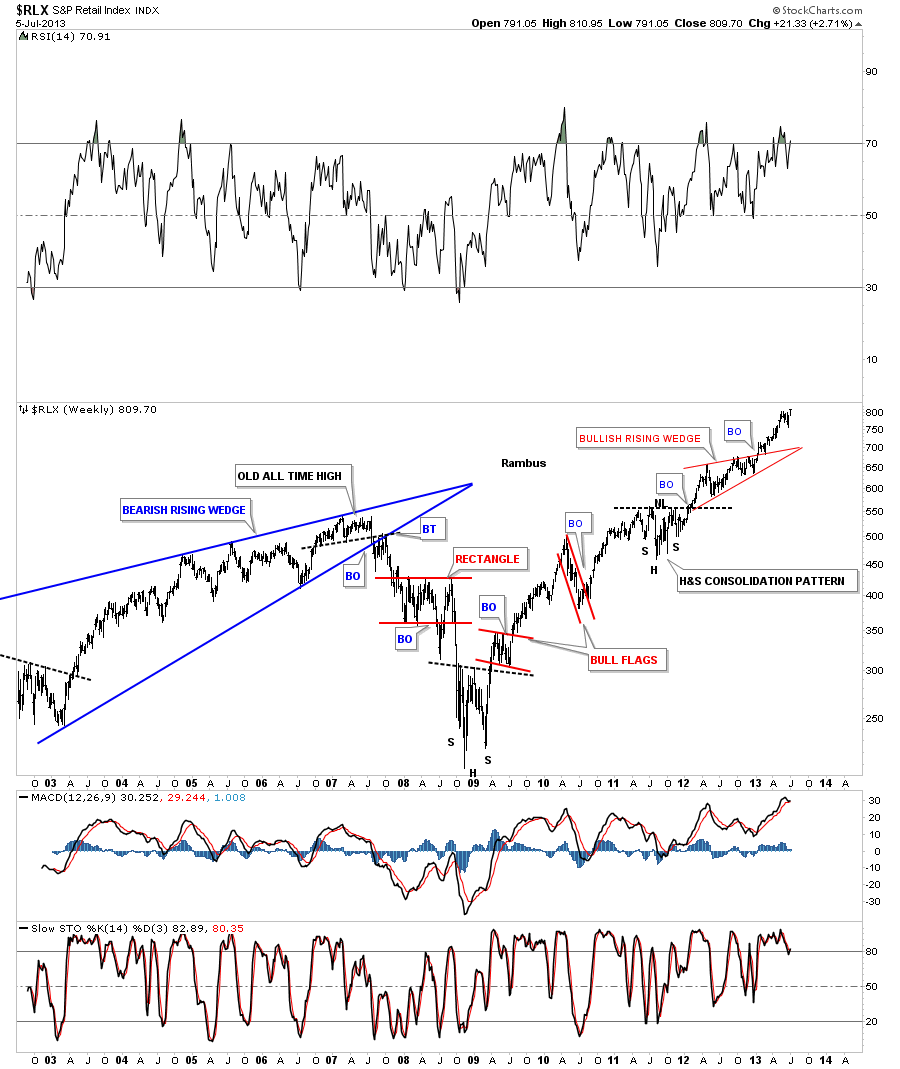

The RLX, retail index, is hitting new all time highs by the looks of this weekly chart. I would think this would have to be bullish for the stock markets. Also another bullish rising wedge that are built in fast moving markets.

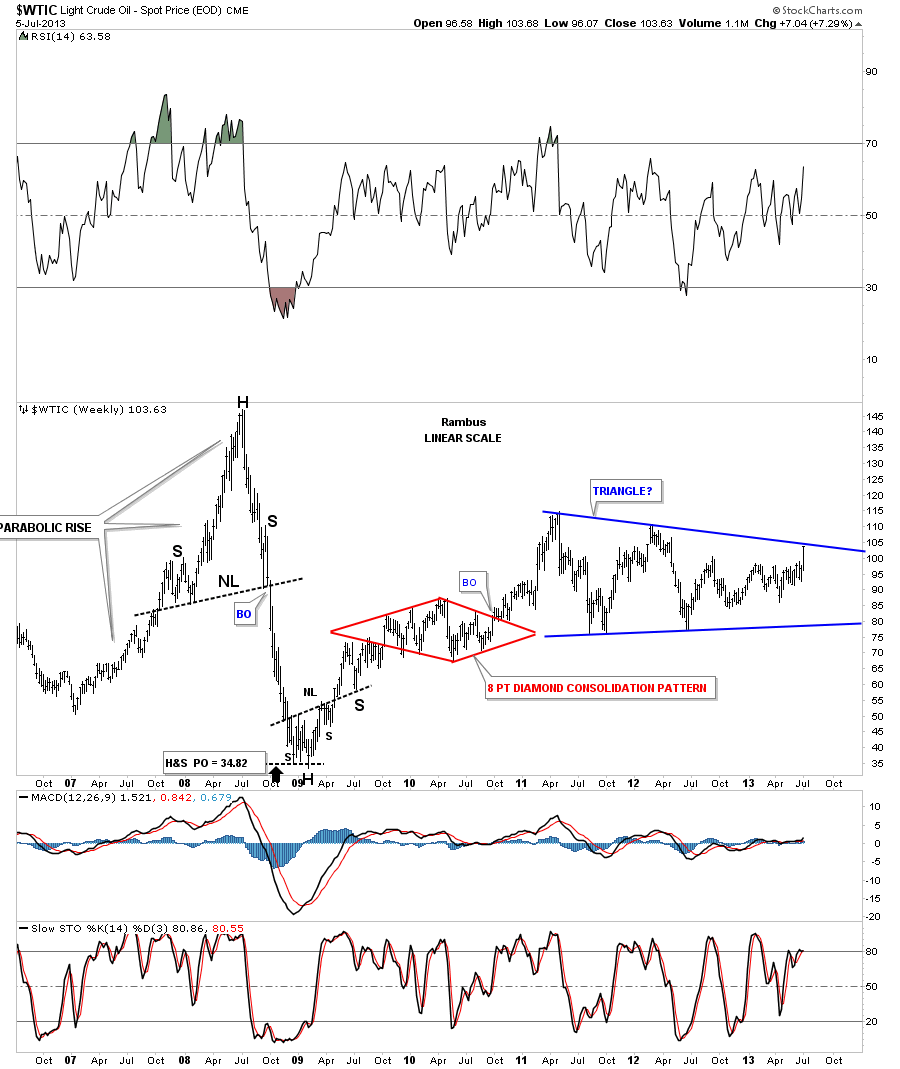

Oil is at a critical juncture right here. It’s testing the top rail of the bigger triangle pattern. The moment of truth is now for oil.

Its getting late and I need to get this posted. I hope everyone had a fun filled 4th of July. I know I did. All the best…Rambus

Disclaimer

IMPORTANT RISK DISCLOSURE This site has been prepared solely for information purposes, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any particular trading strategy. The information presented in this site is for general information purposes only. Although every attempt has been made to assure accuracy, we assume no responsibility for errors or omissions. Examples are provided for illustrative purposes only and should not be construed as investment advice or strategy. The information presented herein has not been designed to meet the rigorous standards set by the Commodity Futures Trading Commission for disclosure statements concerning the risks involved in trading futures or options on futures.

That disclosure statement must be provided to you by your broker. The materials in this site do not attempt to describe the risks to investors that may be associated with the way trading is conducted in any particular options market or in any market for an underlying or related interest. In the preparation of this site, every effort has been made to offer the most current, correct and clearly expressed information possible. Nonetheless, inadvertent errors can occur and applicable laws, rules, and regulations often change.Further, the information contained herein is intended to afford general guidelines on matters of interest, and to serve solely as an introduction to our financial services. Accordingly, the information in this site is not intended to serve as legal, accounting, or tax advice.

Users are encouraged to consult with professional advisors for advice concerning specific matters before making any decision impacting on these matters. This site disclaims any responsibility for losses incurred for market positions taken by members or clients in their individual cases, or for any misunderstanding on the part of any users of this website. This site shall not be liable for any indirect incidental, special or consequential damages, and in no event will this site be held liable for any of the products or services offered through this website. By accessing or otherwise using this website, you are deemed to have read, understood and accepted this disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Bullish Rising Wedge

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.