Break out the bubbly, because it’s Friday in the Wall Street Daily Nation!

For the newbies in the group, once a week I embrace the adage that a picture is worth a thousand words. And I select a handful of graphics to convey important economic or investment insights.

This week, I’m dishing on the most shocking GDP report in the world, the uncanny correlation between the stock market and joblessness, and the one statistic that points to another banner year for dividend stocks.

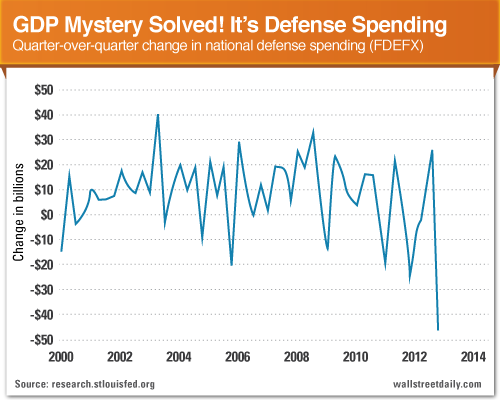

The Mysterious GDP Miss

Boy, do I look stupid. Or do I?

It was only last week that I told you to expect an uptick in economic growth in the United States in 2013. And then Wednesday, the Commerce Department shocked the world, revealing that the economy contracted 0.1% in the fourth quarter – instead of growing 1.1%, as was widely expected.

But fear not. The unexpected drop can be blamed on a massive decline in military spending related to the drawdowns in Iraq and Afghanistan.

As you can see, spending plummeted $40 billion quarter-over-quarter.

The good news? The rest of the economy is humming along just fine.

For instance, personal consumption increased 2.2%. Durable goods spiked 13.9%. Equipment and software increased 12.4%. And real residential fixed investment jumped 15.3%. (Anyone still doubting that the real estate recovery is legit? Didn’t think so.)

The list of positive contributors goes on. So fear not. The U.S. economy isn’t on the precipice of another recession.

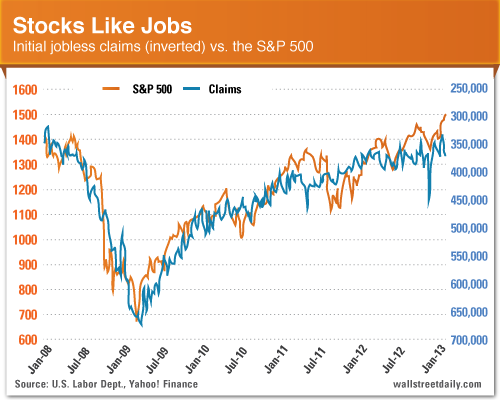

Stocks Follow Earnings… and Jobs!

It was certainly a January to remember. The S&P 500 kicked off the year with a strong rally, rising almost 3%. That’s the fastest start to the year since 1997.

Don’t kill the messenger. But a pullback could be on the horizon in the short term.

Am I saying that because I think stocks have risen too far, too fast? Nope. It’s because this week’s initial jobless claims jumped 38,000, to 368,000.

As I’ve noted before, an uncanny inverse correlation exists between initial jobless claims and stocks. As claims go down, stocks go up. And vice versa.

So if next week’s report includes another uptick in claims, don’t be surprised if stocks take a breather. Since the long-term trend remains bullish, though, we should treat any pullback as a buying opportunity.

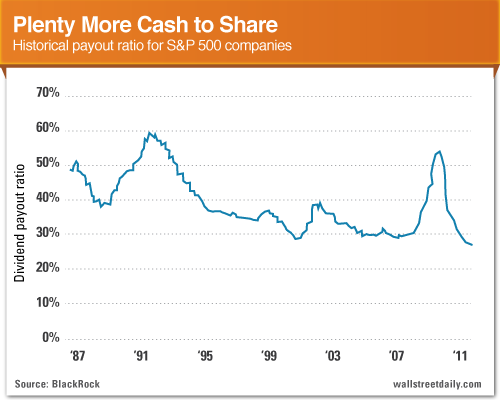

Mo’ Money, Please!

After a record-setting year of payouts, you’d think companies couldn’t afford to keep doling out more and more dividends. But you’d be wrong!

The dividend payout ratio of 28% for S&P 500 companies remains freakishly below the long-term average. In fact, it’s resting at a 30-year low.

The end result? We should expect another year of record dividend payments. And I’m not the only one who thinks so.

Standard & Poor’s Howard Silverblatt does, too. What’s more, he expects companies in all industry sectors to spread the wealth. Giddy up!

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Bullish Case For Dividend Stocks In One Chart

Published 02/01/2013, 03:18 PM

Updated 05/14/2017, 06:45 AM

The Bullish Case For Dividend Stocks In One Chart

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.