Summary:

- The sterling broke below last week’s lows as CPI and its core measure in U.K. released Tuesday both disappointed investors. It will be interesting to see whether or not the downtrend could continue on its 4 hour chart.

- S. July retail sales increased 0.6% month over month and which was released Tuesday and better than expected. Therefore, the buck bounced back strongly to a new high from last week.

- FOMC is set to release its minutes of monetary policy meeting in July at 0200AM Thursday Beijing Time and markets will pay attention to it closely.

The dollar extended rallies Tuesday (15 August) above highs printed last week to 94.015. U.S. July retail sales published last night and showed an increase of 0.6% in MoM against previous figure 0.3% and consensus forecast of 0.4%. The better-than-expected report gave a strong boost to the dollar against a basket of six major currencies. However, it fell back slightly in New York session as it is holding below daily resistances and which seems hard to be taken over for now. But, the upcoming FOMC July meeting minutes could dictate the direction of the greenback.

Technical

The dollar index (DXY) extended rallies for second day and hit H4-period EMA169. Its diverging short term moving averages went back above its long term moving averages, with strong bullish momentum. Wait and see whether or not the index could flirt with its daily EMA30 resistance again in today and tomorrow trading sessions.

As to non-U.S. currencies, the euro lost ground to H4-period EMA144 and held above it. With modestly strong short-term decline momentum, the single currency will embrace the upcoming EU revised GDP YoY. The sterling pressured by the worse-than-expected CPI and printed a new low from last week for a potential extension of the downtrend. The Australian dollar extended declines for second day towards 0.78 handle yesterday, with downside supports at 0.78—0.7778 area.

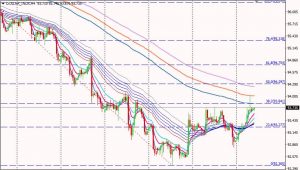

(AUD/USD H4 chart)

Now let’s take a look at precious metals. Gold slipped below H4-period EMA60 and consolidated below the level in a choppy session. Its short term moving averages moved deep into its long term moving averages which flattened after contraction. It is highly unlikely to cross below its long term moving averages in one-off action. However, this does not mean could not happen. Key level needs to watch on the day lies on 1276.5. Pay attention to market impacts from FOMC July minutes.

Disclaimer: The views and opinions expressed in this article are those of the authors and for the purpose of reference only, and shall not be relied upon by investors in making any trading decisions.