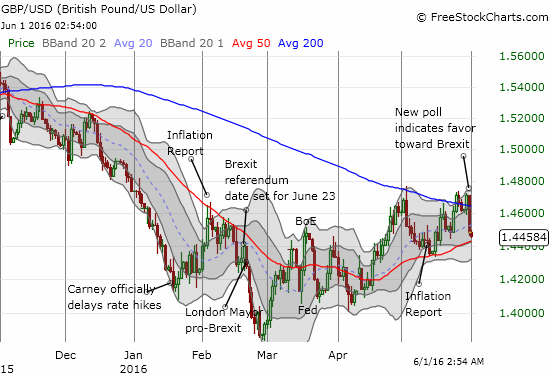

After London’s former mayor Boris Johnson first announced his support for Great Britain’s exit from the European Union (EU), aka “Brexit,” the British pound (Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB)) sold off for the rest of that week. Ever since then, the currency has trended higher albeit in very choppy form. On Monday, May 30, the pound finally suffered a fresh pro-Brexit blow. The latest polling suggested that most Britons believed an exit from the EU would have no impact on their or the country’s financial well-being.

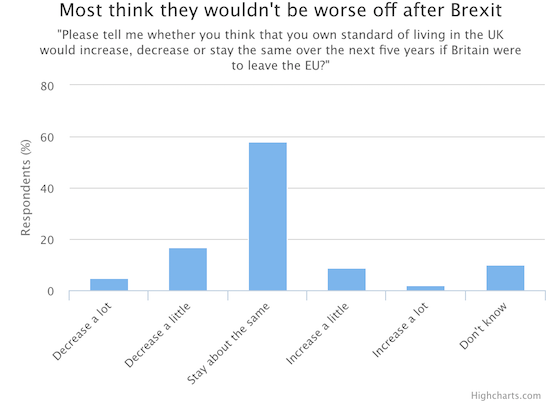

Britons express very little fear about the prospects of Brexit – much to the dismay of all the global and financial institutions that have spent considerable capital warning about the dangers of Brexit.

Source: The Telegraph

The British pound slips back under its 200-day moving average (DMA) against the U.S. dollar as Brexit fears take hold once again.

In the wake of the post-Boris sell-off, HSBC recommended a currency strategy for hedging against the risk of a larger sell-off in the pound if Brexit passes. HSBC recommended going long the Swiss franc (Guggenheim CurrencyShares Swiss Franc (NYSE:FXF)) because the traditional “safe haven” currency would presumably rally strongly on Brexit but stay relatively stable in the case Brexit fails. From CNBC:

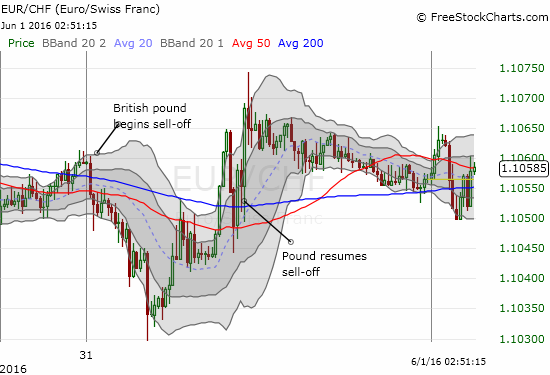

The reawakening of Brexit fears provided the first small test of HSBC’s theory. The immediate results looked good but very quickly the Swiss franc proved itself uninterested in hedging on-going weakness in the British pound.

This 15-minute chart shows how the Swiss franc initially strengthened in response to the reawakened Brexit fears. Yet, when the pound sold off again during U.S. trading hours, the franc failed to respond at all and closed about flat with its pre-fear level.

So this “mini-experiment” showed the Brexit hedge failed its first test. Still, it is very possible that a vote for Brexit may indeed generate fears large enough and enduring enough to sustain more strength out of the Swiss franc.

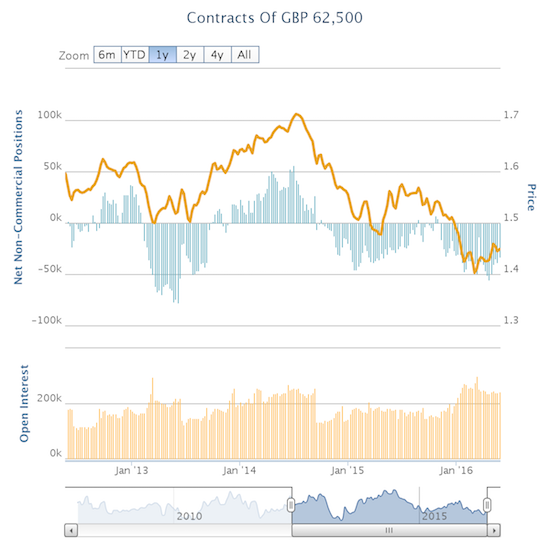

Ultimately, I think traders are better off exiting positions in the British pound before the vote happens. Speculators apparently have implemented just such a strategy as net shorts have gradually declined since April.

Speculators have spent the majority of the past two and a half years sitting on net bearish positions against the British pound. For the past month-plus, speculators steadily drew down these bearish bets.

Be careful out there!

Full disclosure: net short the pound and the euro