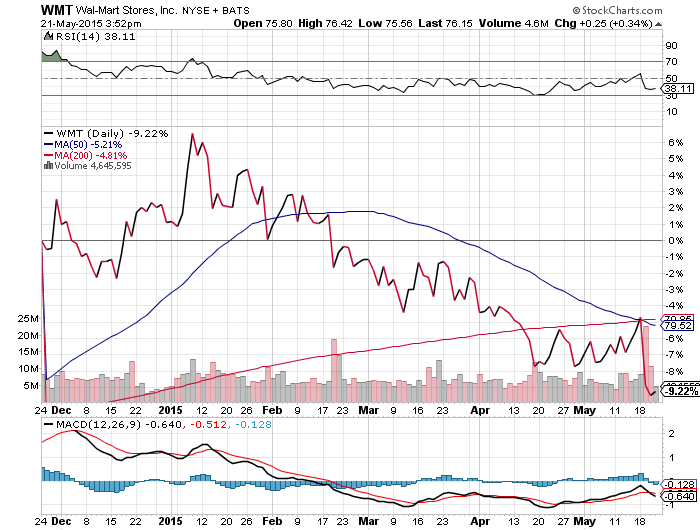

The volatility of individual stocks never ceases to amaze me. Just today David and I were cycling through some large prominent names such as Intel Corp. (NASDAQ:INTC), International Business Machines (NYSE:IBM), Wal-Mart Stores (NYSE:WMT), Microsoft Corp. (NASDAQ:MSFT), Exxon Mobil (NYSE:XOM), etc. The shocking conclusion we came to is that even large stalwart stocks that you wouldn’t think could fluctuate by 10%-20% in a month, or even a week, often times do.

Not only that, but they do so quite regularly in response to earnings reports, guidance announcements, or even unfounded trading momentum. Sometimes it’s simply a matter of more anonymous sellers than unidentifiable buyers. When you have been following and researching ETF’s as long as we have, sometimes it’s easy to forget how tricky individual stock investing can be.

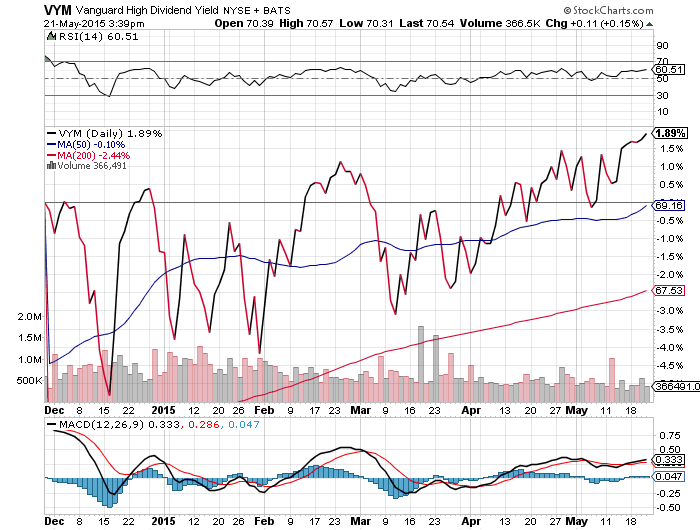

When examining a popular ETF such as the Vanguard High Dividend Yield Index (NYSE:VYM), 8 of the top 10 holdings have fluctuated, or made high-to-low changes, of roughly 10% or more just so far in 2015. It’s phenomenal to view single company charts, then examine VYM and identify the volatility, or beta, has been roughly half the average of its top 10 constituents, or about 5%.

I bring this to our audience’s attention because VYM is a relatively large holding within our Strategic Income Portfolio, so we commonly look under the hood to identify any overly erratic price movements. By far the most interesting observation (depending on which ETF you are analyzing) is that if you examine just the top ten holdings, you’re really only ascertaining a small cross section of the entire basket.

While one or all of the aforementioned stocks might underperform and drag on the entire ETF, the other 90% of the fund might be concurrently outperforming. This is why we believe so wholeheartedly in the simple virtue of low-cost diversification; as a means of smoothing out individual stock volatility.

In my opinion it’s often times an overlooked advantage of ETF investing that continues to deserve attention. As an exercise, view the largest ETF holdings in your portfolio, and then view the price performance of their top ten holdings. I think you would be shocked at what you discover, which is why building a well-diversified portfolio in this type of market environment should be a requirement for all investors alike.