Given today’s move higher past 1.66%, the yield on the 10-Year U.S. Treasury has pierced through support. Having said this, yields may probe higher.

The Credit Suisse technical analyst team of David Sneddon, Christopher Hine, Pamela McCloskey, and Cilline Bain expects the yield on the 10-Year to head higher. In their latest U.S. Fixed Income Daily, they wrote the following:

10yr US yields had looked stretched and have now confirmed a base on the break above 1.66%. This allows for a backup in yields to 1.73% next. We would look for an initial hold here. Above targets firmer support at 1.80/82% – chart support and the 200-day MA. We would look for this to hold and to see a reversion lower again into the range. Only through 1.89/90% would a larger base be signaled.

Below 1.60/59% is needed to test the 1.54% September barrier. We expect this to hold and would look to fade any move here. Only below it would expose the bottom end of the range to 1.45/44% next.

The technical analyst team’s strategy shorted the 10-Year at 1.61% with Stop-Loss below 1.53% and a target for 1.79%.

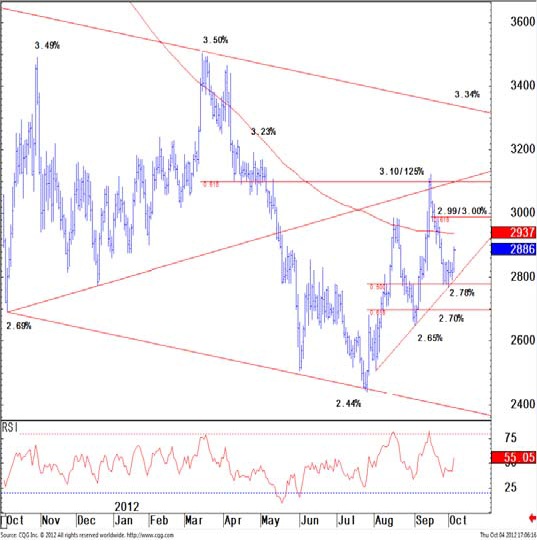

Like the 10-Year, the Long Bond has breached support and may continue to sell off which equates to higher yields:

The 30yr has resolved the former sideways range higher on the vault above 2.86%. The breakout has confirmed a base and opens up further weakness to 2.94/95% with a better support at the 61.8% retracement level at 2.99/3.00%, where we would look for buying to emerge. Only through here would allow a test of more important levels at 3.10/125% – the 61.8% retracement of the 2012 rally and trend/chart supports.

Immediate resistance remains at chart and retracement hurdles at 2.80/77%. Below here is needed to see strength extend to 2.70% ahead of a bigger test at the September 2.65% chart low, which we look to hold.

The Credit Suisse team of analyst reversed a long position to short at 2.86%. They are targeting the 30-Year U.S. Treasury for 2.98% with a Stop-Loss below 2.82%.

Disclaimer : The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Break Through Support Points To Higher Yields For Treasuries

Published 10/05/2012, 02:17 AM

Updated 07/09/2023, 06:31 AM

The Break Through Support Points To Higher Yields For Treasuries

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.