Investing.com’s stocks of the week

To understand the financial markets, you need to understand the hierarchy of asset classes. That hierarchy is as follows:

Globally, the stock market is about $69 trillion in size, trading about $191 billion in shares per day. The bond markets are well north of $140 trillion, and trade about $700 billion in volume per day. The bond market is the SMART money and reacts to major policy changes before stocks.

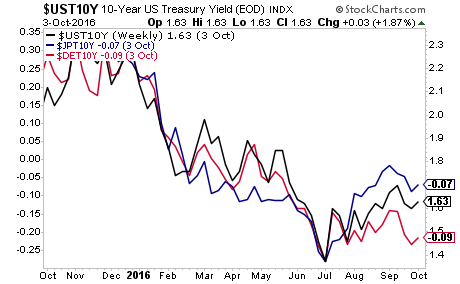

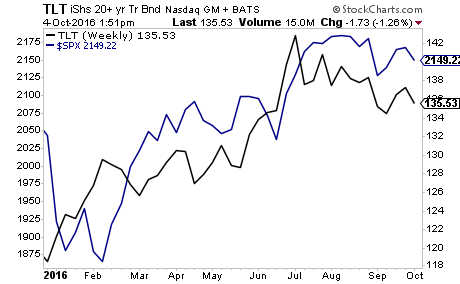

On that note, the bond market has realized QE is ending in Europe and Japan. In July the bond markets signaled that something BIG is coming to the markets. The yields on 10-Year Treasuries, 10-Year JGBs and 10-Year Bunds rocketed higher.

This is a MASSIVE problem for the markets. Stocks have started tracking bonds this year. And with bonds now selling off, stocks are on BORROWED TIME.

You’ve been warned. Globally over $555 TRILLION in derivatives trades based on interest rates. If the bond market really starts to go then we’re facing a Crisis that will be exponentially larger than 2008.