The Fed is starting to get into serious trouble.

The US bond market is moving in the wrong way fast. And while these moves don’t indicate that a crisis will hit today… if the Fed doesn’t get this situation under control soon things could get ugly.

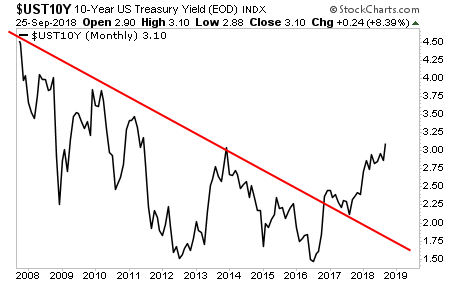

The yield on the 10-year Treasury bond, the single most important bond in the world, has broken a multi-decade downtrend. If this does not reverse soon it means the 30+ year bull market in bonds is over.

————————————————-

Who said getting rich from trading was hard?

Since inception in 2015, this trading system has produced average annual gains of 41%.

And it’s doing this with just one trade once per week. In fact we just closed a 15% gain last week. And we only held it 24 hours!

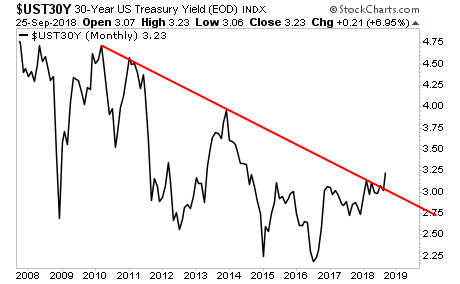

Even worse, a similar pattern is emerging in the 30-year US Treasury.

Again, this is a massive deal. And while 99% of investors are focusing on stocks… it is bonds that are flashing a major warning. The whole situation is getting eerily similar to late 2007. And now, like then, the vast majority of investors have no clue how to invest during the coming crisis . Which is why smart investors who put capital to work here stand to make fortunes.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.