The Bank of Canada left interest rates at 1.00% and kept its tightening bias unchanged, i.e. "over time, some modest withdrawal of monetary policy stimulus will likely be required, consistent with achieving the 2 per cent inflation target. The timing and degree of any such withdrawal will be weighed carefully against global and domestic developments, including the evolution of imbalances in the household sector."

The BoC acknowledged that "momentum appears slightly softer than previously anticipated." But the central bank viewed the weak Q3 performance as partly resulting from "transitory disruptions in the energy sector," expecting a rebound. The BoC acknowledged the moderation in credit growth but remained vigilant by saying that "its too early to determine whether the moderation will be sustained." As in its October forecasts, the BoC expects inflation to return to 2% next year.

Bottom line:

The BoC stuck to its guns yet again, viewing the Q3 slowdown as "transitory," and downplaying the moderation in credit growth. The guidance is unchanged and the bias remains. We do not share the central bank's current economic assessment.

Weakness in Q3 was much more broad-based than just energy as reflected in the overall decline in corporate profits. In non-energy manufacturing, earnings were down for the third consecutive quarter with a sharp erosion in margins. This isn't a harbinger of a strong labour market. Indeed, we are somewhat surprised that the central bank didn't acknowledge that the private sector has actually created no jobs over the past six months. Unless we see a sharp reversal of that concerning trend in the upcoming employment reports, we would expect a major change of assessment in next January's Monetary Policy Report.

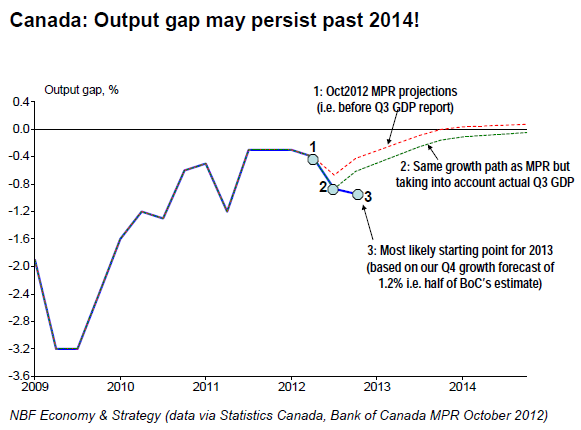

With Q3 growth coming in well below the Bank of Canada's 1% estimate and the downward revision to the prior quarter, the output gap is already larger than what the BoC expected in its October MPR. Given our expectations for Q4 (half of the BoC's 2.5% projection), the "current small degree of slack" is likely to get larger. We continue to see no reason for any rate hikes before 2014.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The BOC Is Sticking To Its Guns For Now

Published 12/05/2012, 06:37 AM

Updated 05/14/2017, 06:45 AM

The BOC Is Sticking To Its Guns For Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.