The elemental idea of Blockchain technology (cryptography hash functions and public key cryptography) have been around since the 1970s but it took the arrival of Bitcoin in 2009 to show a glimpse of its true socioeconomic potential. The arrival of Bitcoin after the global financial crises triggered frank discussions about the role of governments and corporations as middlemen in economic activities.

Blockchain technology provides decentralized trust in many practical use-cases beyond financial transactions. Ethereum heralded smart contracts which are essentially self-executing contracts that eliminates the need for intermediaries.

However, Ethereum is struggling with scaling challenges and now, there are many different Blockchains facilitating the development of DApps. This piece examines how Ethereum and its biggest competitors are faring in the grand war to bring Blockchain technology to the mass market.

Snapshot report on how different Blockchains are faring

Ethereum Facing Downward Pressure

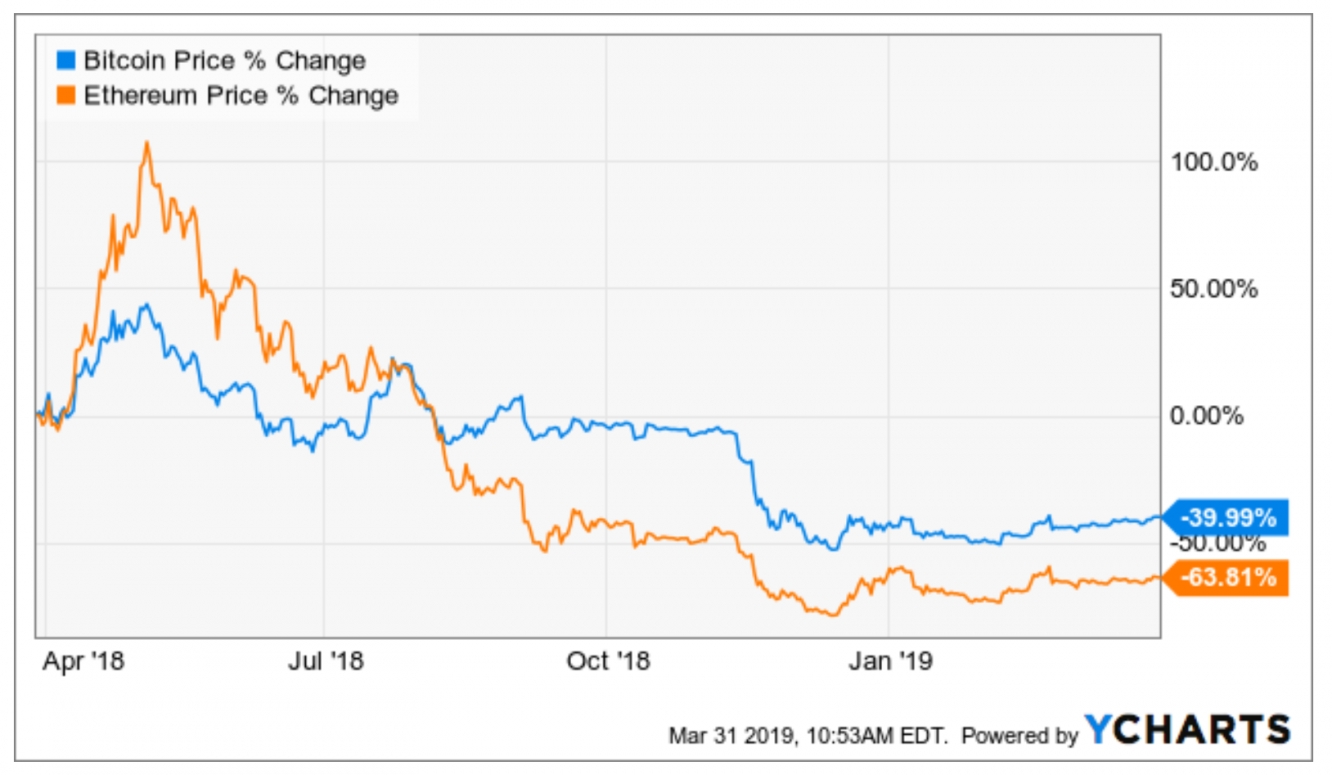

Ethereum, the second largest Blockchain project by market cap is valued around $14.95B and it trades around $141. Over the last one year, Ethereum has suffered a depressing price action that saw it plummeting from a $1400 high to a $90 low. Beyond the fact that the general cryptocurrency market is in a downtrend; Ethereum has been unable to maintain positive market sentiments as seen the chart below.

The trading price of Bitcoin has declined by 39.99% in the last one year but the trading price of Ethereum has recorded almost 2X more losses with a decline of 63.81%. At the heart of Ethereum’s problem is its persistent scalability challenge. The Ethereum Network has proposed different solutions such as Proof of State, Sharding, and Layer2; yet, none of them looks to be the “perfect” solution that would restore positive market sentiments.

However, SKALE Labs Inc seem to have found a way to help Ethereum overcome its scalability challenged. The team launched the SKALE DevNet earlier this year and the launch of its Mainnet is projected to happen sometime in Q3 2019. Using SKALE, developers can launch applications on sidechains without necessarily relying on the main chain for validations.

SKALE is essentially a Layer 2 Blockchain scalability network that provides Ethereum DApps with a platform to run low-cost smart contracts at fast speeds. As expected, SKALE is a decentralized open-source project, it is secured with a Byzantine fault-tolerant system and Ethereum DApps can run in layer 2 at 1000x speeds.

EOS Is Gaining Market Share

EOS is considered the Ethereum-killer, and with good reason. The brains behind EOS have intelligently sidestepped some of the pitfalls that are limiting Ethereum. For instance, EOS uses a Delegated-Proof-of-Stake that makes it somewhat “centralized” but free from consensus bottlenecks. EOS allows up to 100,000 tx/s and it doesn’t require developers to learn new programming languages.

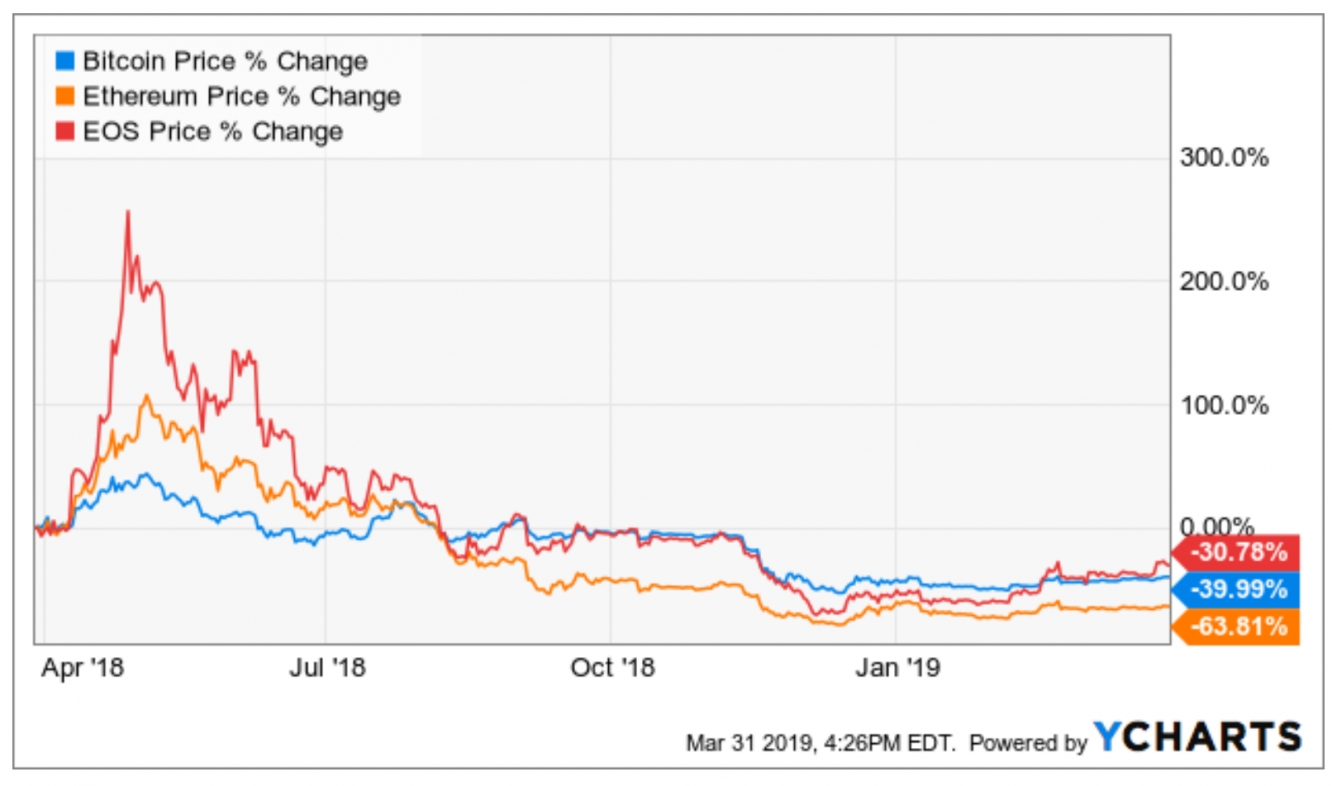

In the chart above, EOS has recorded a slightly lower price fall relative to Bitcoin. More so, the percentage decline in Ethereum twice as much as the percentage decline in EOS within the same period. EOS is rapidly stealing market share from Ethereum and innovative solutions such as LiquidApps might eventually help EOS get a lead over Ethereum. LiquidApps is designed to fix the problems with the scarcity of RAM and CPU on EOS.

EOS is attractive in the development of DApps for the mass market because it offers zero tx costs and it doesn’t have a scalability challenge. However, developers can’t run their DApps unless they own and use RAM on the Blockchain. The cost of RAM on EOS Blockchain has been rising steadily in the last couple of months; hence, developers are not quite enthusiastic about launching their DApps on the platform.

LiquidApps provides a win-win situation for all stakeholders by introducing a vRAM system as an alternative storage solution for EOS developers. Its DApp Network and it DApp Service Providers also provides a network effect on the EOS mainnet to provide developers with access extra storage capacity, secure communication services, and other critical utilities that could make the development of dApps substantially easier and more affordable.

Stellar Is The Distant Cousin No One Talks About

Stellar says it’s on a mission to deliver a blockchain-powered platform for moving money across borders cheaply. Critics opine that it is a knockoff of Ripple except that it has s $3M funding from Stripe to bankroll its operations. Some people don’t like that fact that Stellar Lumens can’t be mined, there is some disquiet about the transparency of its undistributed supply, and its Ripple-style consensus is not entirely reassuring.

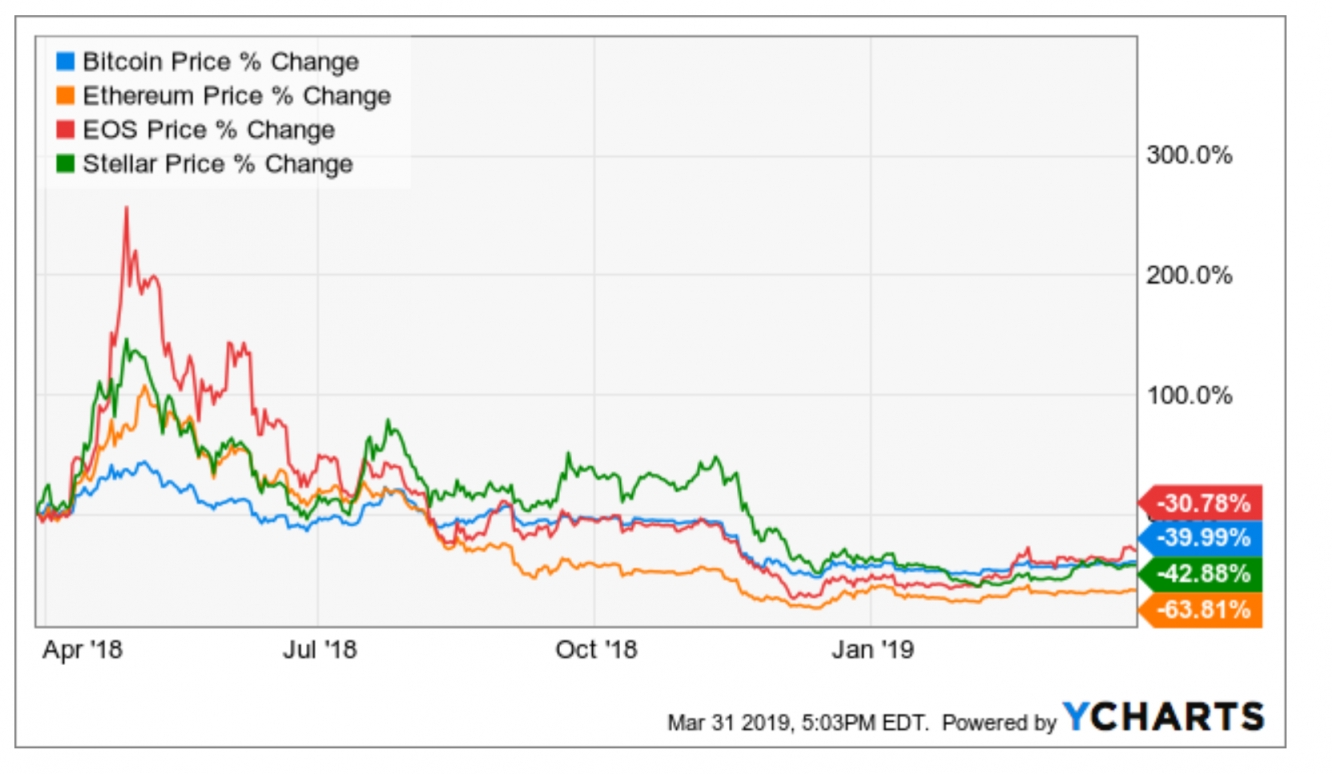

The chart above shows the performance of Stellar Lumens in the last one year. Stellar is down 42.88% to record bigger losses than Bitcoin and a slightly lower loss than Ethereum. Nonetheless, its trading price around $0.107 suggests that it might still enjoy a speedy rally when the crypto market returns to bullish ways.

However, Stellar is quietly making progress and it appears to be the top DApps Blockchain that doesn’t’ seem to have a scalability problem. Last year, IBM (NYSE:IBM) regarded Stellar as a “wonderful, scalable, publicly accessible digital asset registry”. Last month IBM launched IBM Blockchain World Wire to accelerate cross-border foreign exchange payments and remittances though Stellar.

Neo Seems To Be On The Fast Track To Obscurity

If you had bought NEO at any point in the last one year; the odds are that you’ve taken your losses in good stride or hoping that the platform will deliver an incredible turnaround. From the onset, Neo positioned itself as a blockchain platform for automating the digital managements of assets through smart contracts. Neo was probably the most vocal evangelist of the Smart Economy focused on Digital Assets, Digital Identity, and Smart Contracts.

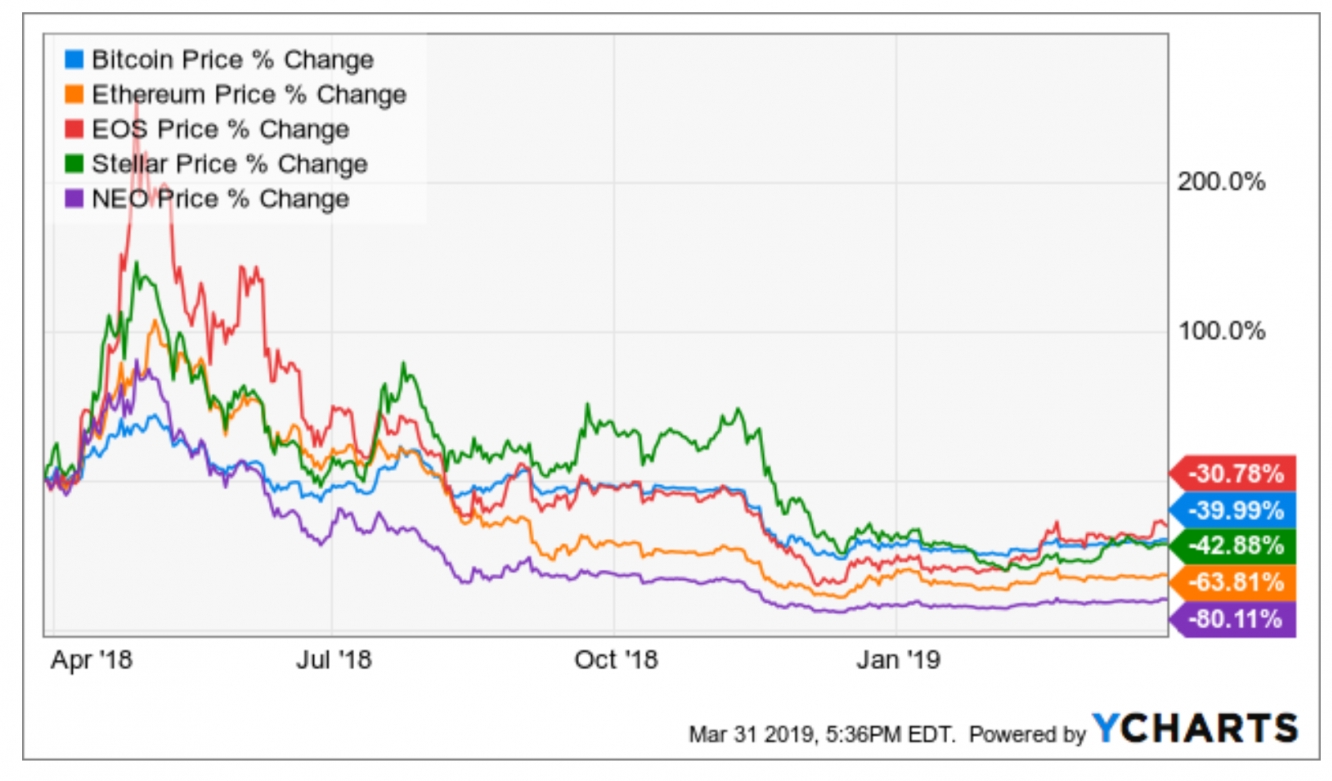

However, in the last one year, NEO has fared the worst out of the major blockchain platforms trying to bring DApps to the mass market. As seen in the chart above, NEO’s trading price has declined by more than 80% -- a significantly larger loss than the decline in the price of Bitcoin.

On the technical development side, NEO currently lay claim to have 1000tps and it says it is on track to deliver 100kps by 2020.

Trinity, NEO’s equivalent of the Lightning network made its debit with the promise of real-time settlement, privacy protection, scalability and low transaction fees. The off-chain scalability offered by Trinity could potentially facilitate the development of DApps on NEO over the long term.

Final Words On The Blockchain Battles

Ethereum unveiled the incredible potential of DApps but until is finds a definitive way to fix its scalability challenges; it probably won’t be able to usher Blockchain technology into the era of mass-market acceptability. Yet, it would be interesting to see how far SKALE can go to help Ethereum unlock scalability.

EOS seem to be strategically positioned to facilitate the mainstream adoption of DApps, and developments such as LiquidApps might help it strength its lead. Nonetheless, news about a recent Bithumb hack in which $13M worth of EOS was stolen could exert short-term downward pressure on EOS.

For Stellar, the future is uncertain, but it is somewhat too early to give up on its future potential especially because it seems to have found a niche in financial services. The fact that Stellar is focusing on facilitating the adoption of Blockchain in developing economies suggests that it might enjoy a niche advantage in frontier markets.