Let’s catch up on some of the major exchange traded funds that cover US markets. The first one, the “Diamonds”, has been following a descending channel for about a year and a half. We are near the highest reaches of that channel, so fortune favors the bears. It took a mere 2.5 weeks to traverse from the bottom to the top.

Another clean representation of the industrials sector is found with XLI, whose horizontal appears to be providing very solid resistance. This is very, very overbought right now and should fall hard.

The only chart that scares me is the “cubes” because they bounced very cleanly off major support. As I’ve said before, however, the fact this support is so major is what makes it important, because a failure of this trendline which be a huge B.F.D. and cause for ursine celebration.

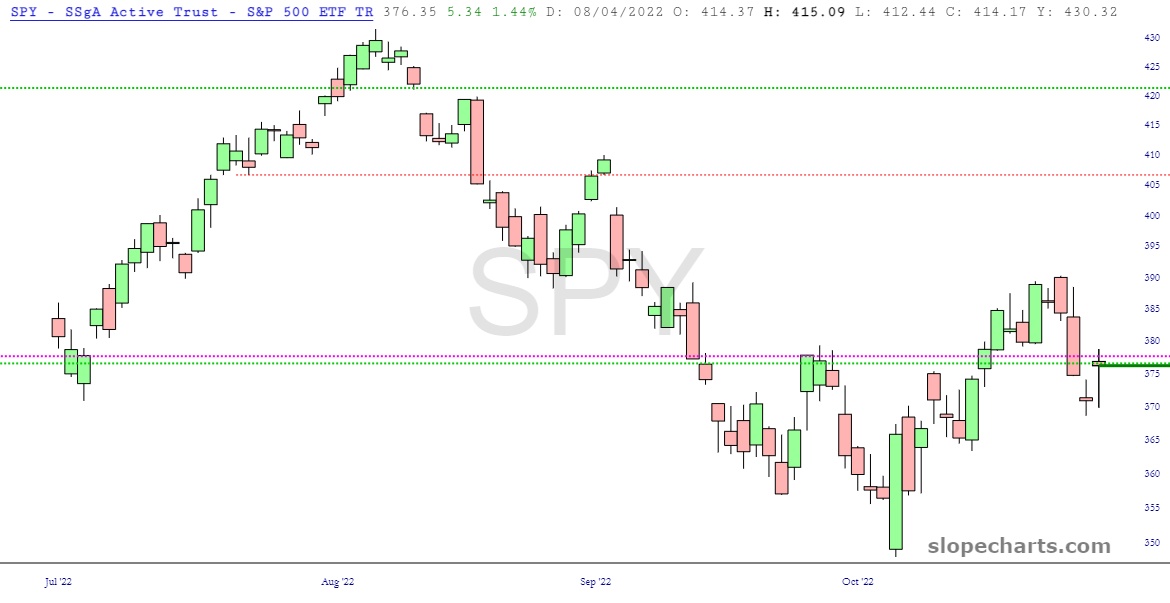

The SPYders from Thursday and Friday illustrate how uncertain the market is, as both of them are dojis. We are EXACTLY at the level of not just one major Fibonacci, but two of them, which is extraordinary.

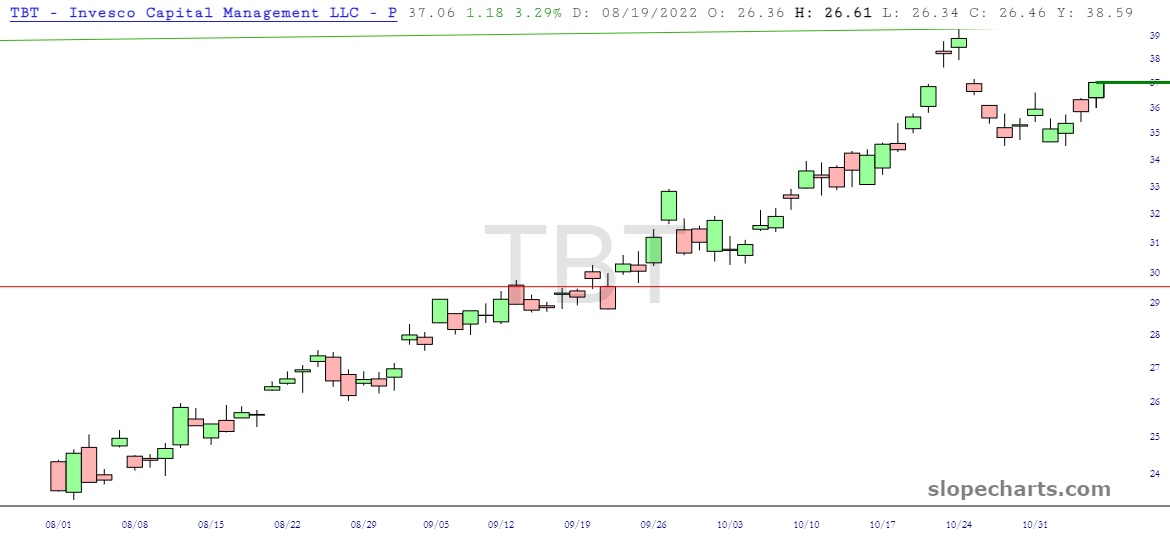

Lastly is the ultrashort on bonds, which clearly illustrates that not only have interest rates roared higher, but they have every intention of continuing to roar. That’s going to smash the economy and the government like no time in history.