The Federal Reserve once again flicked its fat finger and sent the dominoes falling this week. A quarter-point hike and a faster pace to come, we’re told.

As we’d expect, the stock market yawned. Yellen certainly didn’t hide any surprises.

Although America’s benchmark interest rate rose by a quarter point last week - presumably calling all other interest rates to follow - most folks won’t notice much. Fixed-rate loans aren’t going anywhere. And payments on variable loans will rise by a few bucks.

But numbers are one thing... the brain is another.

The psychological effect of the interest rate hike is undoubtedly Yellen’s sharpest fang.

Take, for instance, mortgage applications.

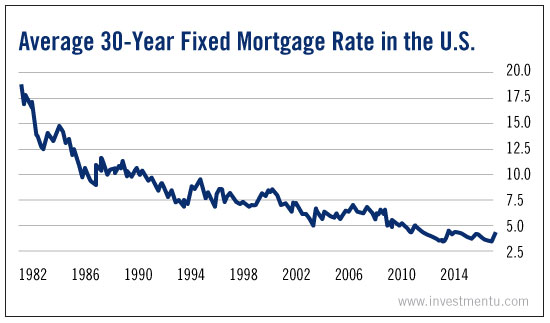

The cost of the typical 30-year mortgage isn’t up all that much in recent months. Earlier this year, the best mortgages came with a record-low rate of about 3.5%. Today, meh, just 4.15%.

Rates are still a couple hundred basis points below where they were a decade ago... and are far, far below their all-time highs.

To be sure, the recent rise in rates hasn’t had a big impact on monthly mortgage payments. The check a new homeowner would cut each month on a typical $200,000 house has risen by less than 100 bucks.

Even so, the psychological effect of the rapid surge in rates over the last month has been chilling.

The number of folks applying for a mortgage fell by 4% last week.

They dropped by 7% the week prior.

And they plunged by 9.4% the week before that.

The people selling those loans are having a tough Christmas, to be sure. But if you’re a homeowner, the numbers should show you that, while your stocks may not have fallen thanks to Yellen this week, there’s a good chance the value of the roof over your head did.

It’s too soon to tell how much rising rates have affected real estate prices. But there’s no doubt the combined effect of higher mortgage payments and less demand for those mortgages has given buyers a bit of an edge over sellers.

One number to watch is the total value of homeowner’s equity across the country. Thanks to rising home prices and (somewhat) smarter lending, the figure has surged from $6 trillion in 2009 to some $13 trillion today.

It’s a key figure, as it shows some of the pliability of the market. The more equity a person has in his home, the more likely it is he’ll be able to sell it and buy a bigger home. But, on the other hand, the higher his equity, the lower he can go with his selling price and still stay above water.

In other words, prices have room to fall. And when demand softens - even for only psychological reasons - that often means they will.

A good place to watch the action as it happens is in the real estate investment trust (REIT) sector. These unique companies pool shareholder money and invest in real estate. The leverage afforded by mortgages is a key part of their business models.

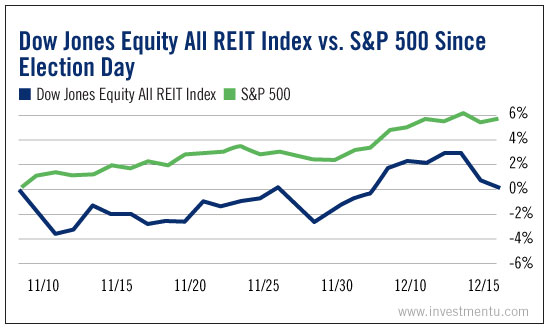

And as rates move higher... their shares have moved lower.

For example, the popular Dow Jones Equity All REIT has been virtually flat since Trump’s election win that sent rates surging. And in the few days since Yellen’s move, the index has fallen sharply. Meanwhile, the S&P has risen by more than 5% in just over a month.

As rates continue to climb - or at least as Yellen hints at future hikes - the sector will face more headwinds.

If your portfolio is overexposed to real estate, consider some end-of-year rebalancing.

Just because the markets didn’t dip on Yellen’s news last week, that doesn’t mean investors walked away unscathed.

The dominoes are falling.