It’s Friday in the Wall Street Daily Nation!

That means the longwinded analysis is out. (Hallelujah!) And some carefully selected charts are in.

So without further ado, check out these snapshots on the most shocking truth about the economic recovery, the difference between a recession and a depression, and why the laws of the market always get enforced.

Recovery? What You Talkin’ About, Willis?

Ready for a shocker?

A Washington Post-ABC poll from December 19, 2013 shows that – get this – a staggering 79% of people still believe we’re in a recession.

So either they didn’t get the memo from the NBER that the recession officially ended in June 2009, or they’re clueless, right?

Maybe not…

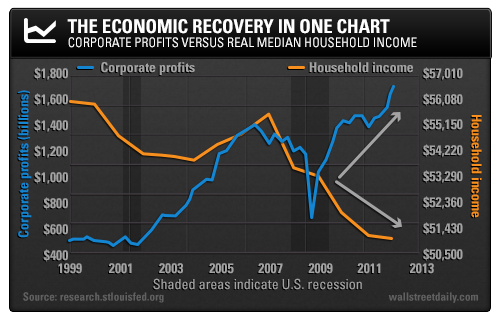

This chart of corporate profits versus median household incomes reveals two shockingly different economic realities.

While the average American corporation has enjoyed a massive rebound in net income, the average American has not.

Now, I’m not even remotely suggesting that corporations need to “share” the wealth a bit more. Don’t go there, people. I’m just making an observation and providing some perspective.

Speaking of perspective…

The Great Recession Wasn’t So Great After All

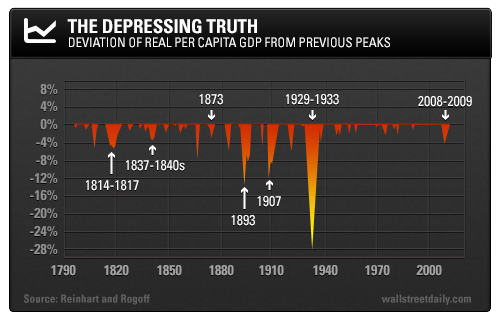

If I only had a dime for every person who swears that the Great Recession was nearly as bad as the Great Depression.

It wasn’t even close!

At least, not based on the analysis by Harvard professors, Carmen Reinhart and Kenneth Rogoff, in their paper, Recovery from Financial Crises: Evidence from 100 Episodes.

During the Great Recession, real GDP per capita fell only about 5% from its previous peak. During the Great Depression, it plummeted nearly 30%. (Yikes!)

Keep that in mind when your great-grandkids start asking you what it was like to live through the Great Recession. That is, if you can still remember anything at that age.

Forget Crack… Hype Kills

Boy, what a difference two months make!

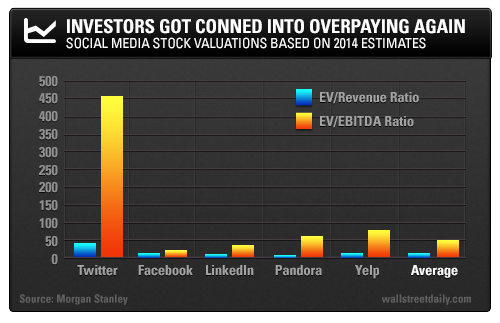

You’ll recall, heading into Twitter’s (TWTR) IPO in November 2013, every single analyst who issued a pre-IPO report rated it a “Buy.”

Fast-forward to today, though, and they’re all scrambling to downgrade the stock. What gives?

I’ll tell you… The hype wore off, and they actually started crunching some numbers.

And whether we value the company based on its sales or profitability, overwhelming evidence indicates that the stock is ridiculously overpriced.

any event, Business Insider’s Jay Yarow does make a valid point: “This doesn’t necessarily mean Twitter’s stock is going to crash. Some companies can defy the laws of valuation. (See: Amazon.)”

But if you’re willing to make that bet on Twitter with your hard-earned capital, a sucker must truly be born every minute. Because, eventually, the laws of the market always get enforced.

So it’s only a matter of time before Twitter – and for that matter, Amazon (AMZN) – gets crushed.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Biggest Con Of The Last 10 Years

Published 01/10/2014, 01:00 PM

Updated 05/14/2017, 06:45 AM

The Biggest Con Of The Last 10 Years

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.