Overview

Most of the G7 traded on a roller coaster yesterday; we saw EUR/USD depreciating by 80 pips within an hour and recovering within the next few hours while at the same period the cable rose from 1.289 to 1.297 in a range of 80 pips as well.

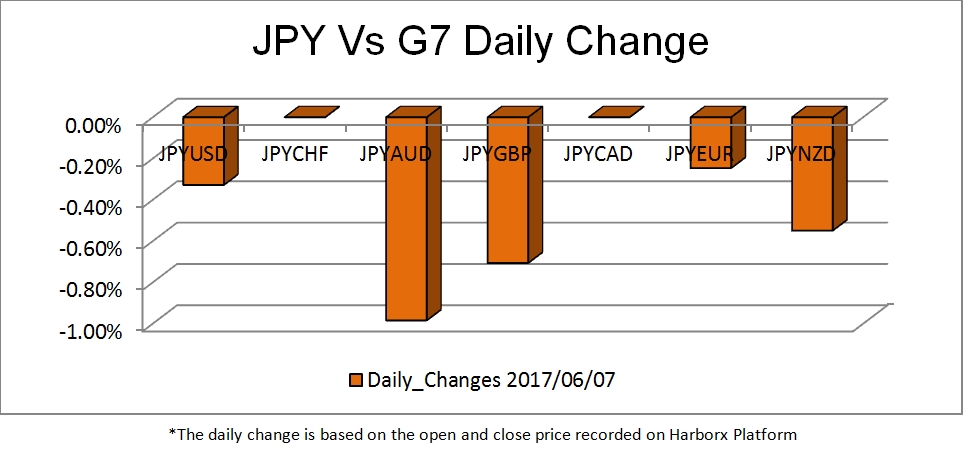

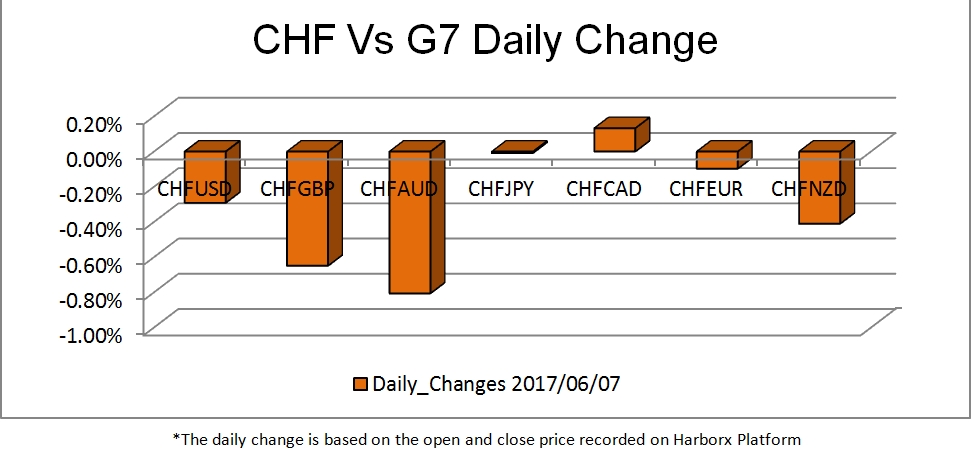

In the meantime, since traders paid attention to more risky currencies, safe haven instruments lost some of their strength closing the day lower against the US dollar; such as gold, CHF and JPY. More specifically, the yen fell against all of its major counterparties, gold dropped 1.28% against the greenback and the Swiss franc depreciated against all of the G7 except the Canadian dollar.

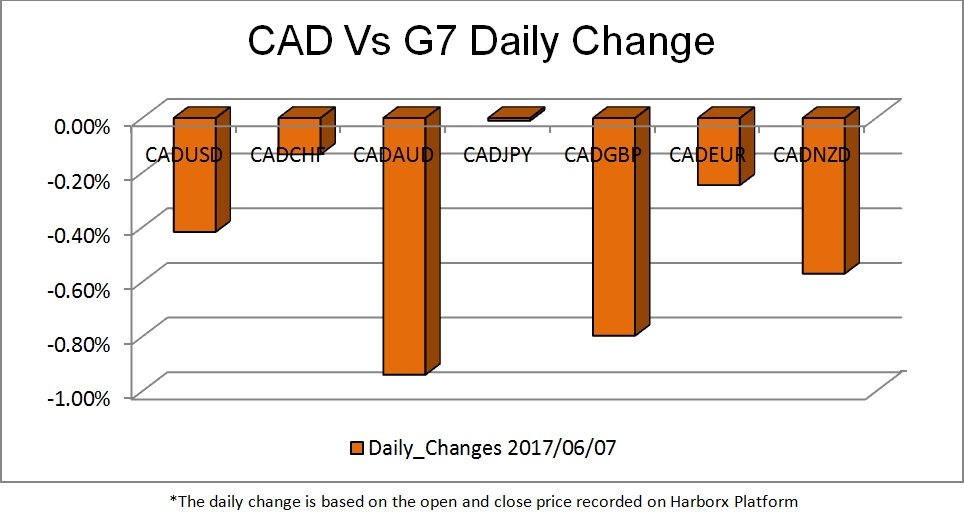

Canadian dollar sunk yesterday after the announcement of the negative figure of April Building Permits which was published at -0.2% against expectations of 2.4%. Moreover, the weekly crude oil inventories in oil were 3.295M against expectations of shortages of -3.464M which pushed the loonie even lower. The Canadian dollar depreciated 0.95% against the Aussie which surged yesterday, 0.8% against the pound and 0.57% against the Kiwi.

USD/CAD is trading around the psychological price level of 1.35 at the time of writing and its upside penetration would signal an early sign of reversal on the short term, which for sure needs to be verified by more signals but we would take it as the first alarm. It is worth mentioning that the daily trend is still an uptrend and the pair is near the bottom of it which is critical for longer timeframes as well.

Today is a big day for the euro and the pound. The European Central Bank will announce the rate decision at 11:45am GMT while this will be followed by a Press Conference at 12:30pm GMT. Moreover, today is the General Election Day in the UK where the Conservative party leads in the polls.

ECB is expected to keep its policy rates unchanged with the deposit rate at -0.4% and the interest rate at 0%. Traders expect the President’s speech and ECB’s forecasts for growth and inflation. A draft of the ECB projections was released yesterday indicating that ECB is likely to cut its inflation forecasts and thus putting downside pressure to the euro. Despite the fact that the inflation rate is still far below ECB’s target, it had a significant improvement since the last year and it is currently at acceptable levels.

Mario Draghi, ECB President, acknowledged the improved economic conditions but he is still concerned about the appreciation of the euro which does not support ECB’s plans. If ECB indeed cuts the inflation forecast then the euro could fall as low as 1.12 against the US dollar and upon penetration of this level it may reach 1.116 as well. On the other side, if the president announces that the bank has positive view about the GDP growth and the overall economic risks then the euro is expected to surge back to 1.13 and even above it.

In the meantime, the British vote for the General Election today, which starts at 7am and closes 10pm local time. The Conservative party was leading the polls against the Labour party from the beginning, however the last 2 days the gap between them has narrowed. The pound is driven by the good poll releases since Conservative’s win is deemed to be positive for the pound while the Labour’s win brings uncertainty which could harm the currency. The stronger the majority of the Conservatives, the more pound is expected to appreciate while a slim majority is likely to keep the cable between the range of 1.28 and 1.305. An unexpected win of the Labour could drive the pair as low as 1.26.

Technical View

EUR/USD

The world’s most traded currency created a double top formation at around the level of 1.1284 on the hourly chart and since then it did not reach up to this level again. By default, double top patterns are reversal patterns; however the pair went as low as its previous bottom and did not manage to break this level. EUR/USD is currently trading between the levels of 1.1284 and the psychological support of 1.12. Since the pair is on a short term range, ADX is on neutral levels indicating no clear direction and both MACD and RSI are near their equilibrium levels.

It is likely that the pair will reach again the lower band of the rectangle at around 1.12; if it manages to break it then we will see it lower to the next valid support of 1.1165. On the other hand, if the pair finds support on 1.12, then we expect it to rise again up to 1.1284 and upon penetration the next valid resistance to be reached is 1.135.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.