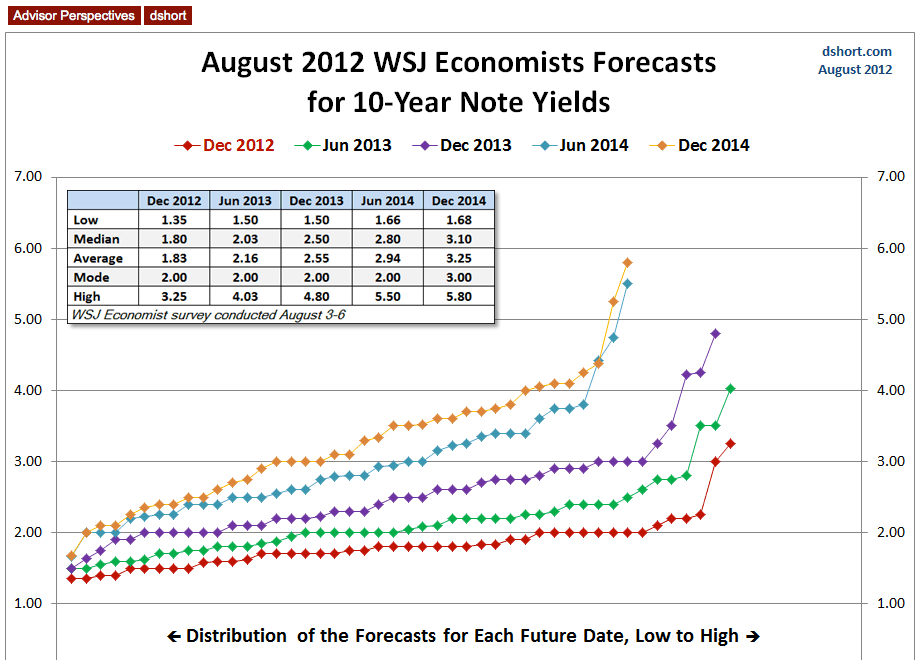

Earlier this month the Wall Street Journal posted the results of its August Survey of economists conducted August 3-6 (xls file). Let's take another look at its estimates for 10-year yields. The various Federal Reserve strategies in recent years (ZIRP, QE1, QE2 and Operation Twist) have focused on lowering interest rates, for which the 10-year note yield is an interesting 'tell'.

The 51 economists solicited for the latest survey were asked for their estimates for 10-year yields at six month intervals from June 2012 to December 2014. Not all of them participated and responses dwindled a bit for the further-out dates. The second chart below captures the range of responses for each of the six timeframes. But before we look at that chart, let's refresh our memory on the recent history of the 10-Year Treasury Constant Maturity Rate and weekly data, through last week's close.

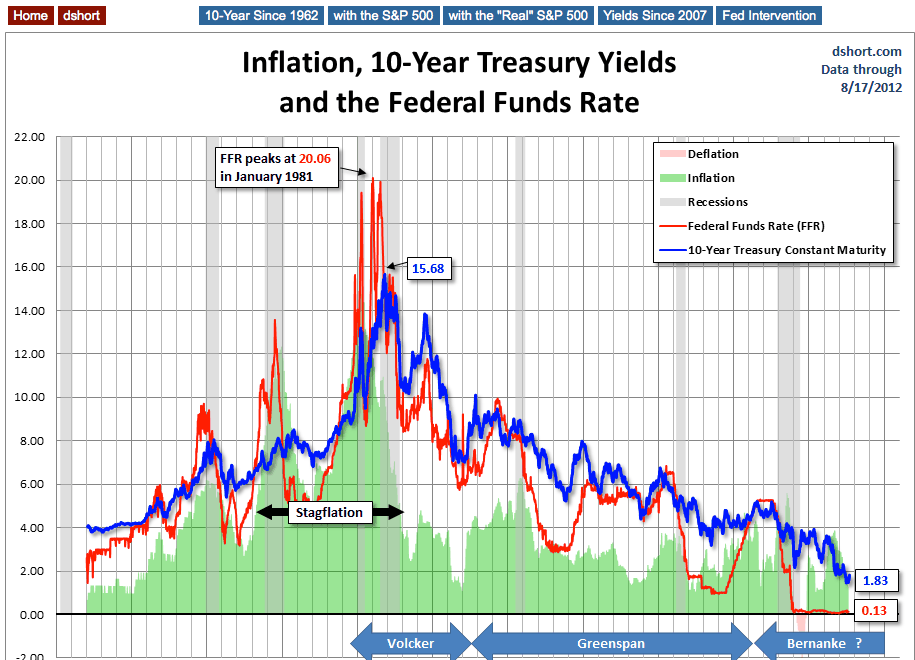

Secular Rally Since 1981

As the snapshot above clearly illustrates, the 10-year note has been in a secular rally, as signified by falling yields, since the weekly yield peaked at 15.68 in October 1981. I've included recessions, inflation (based on the CPI) and the Fed Funds Rate to help us understand the role of the Federal Reserve in managing the long-term behavior of this asset class.

Are we nearing a reversal of this trend? The economists who participated in the survey, for the most part, certainly think so.

As I type this, the CBOE Interest Rate 10-Year (TNX) is hovering around 1.75, five basis points below yesterday's 1.80 close according to Treasury data. The mean (average) of economists' estimates grows from 1.83 at year's end to 3.25 in December 2014. At the high end of the range, one economist sees the 10-year yield above 5.80 by the end of 2014.

The Japanese Yields Exemplar

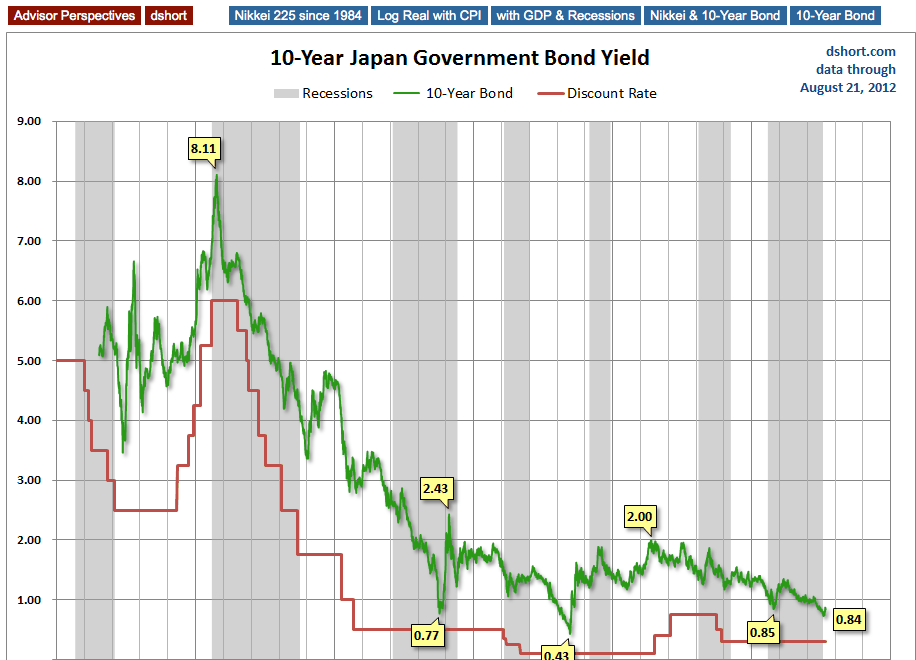

Could yields surprise in the other direction? That is to say, continue falling? We saw the 10-year yield hit an all-time closing low of 1.43 on July 25.

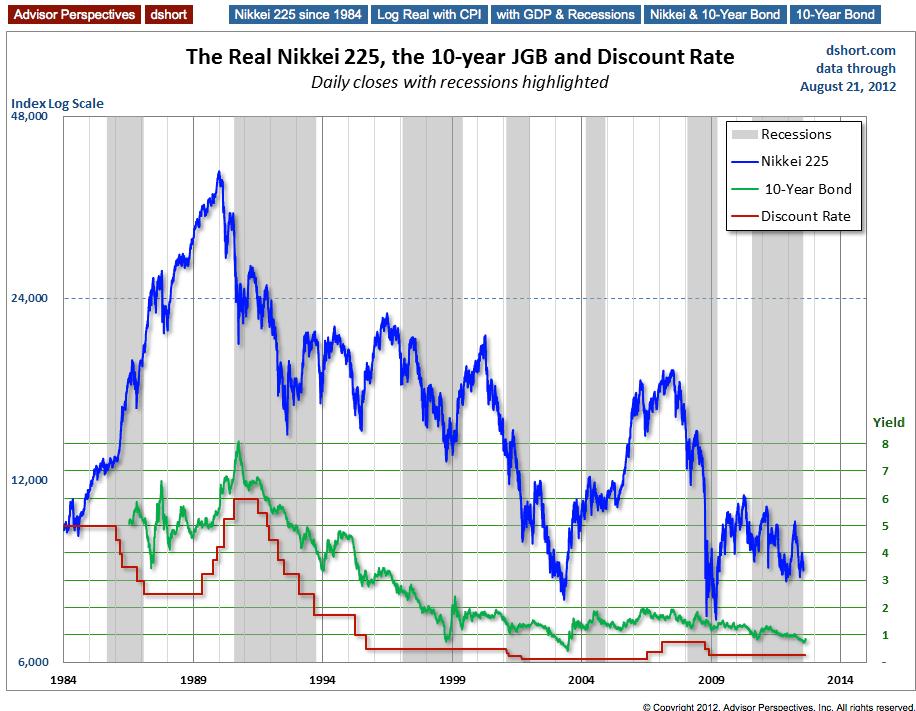

Government bond yields in safe-haven countries have been plunging of late. The lesson from Japan is that the trend toward lower yields can last a very long time. Here is an overlay of the Nikkei and the 10-year bond along with Japan's official discount rate.

And here is a closer look at the 10-year yield over time.

The U.S. is not Japan. But the experience of the Land of the Rising Sun (and falling yields) suggests caution in assuming that a sustained reversal in U.S. Treasury yields is imminent.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Big Spread: 10-Year Yield Forecasts

Published 08/22/2012, 03:59 PM

Updated 07/09/2023, 06:31 AM

The Big Spread: 10-Year Yield Forecasts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.