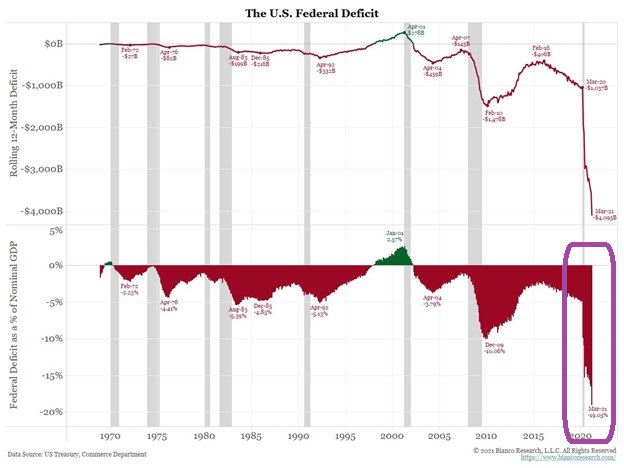

The federal government continues to hand out borrowed money to stimulate the economy. It is running monstrous deficits to do so.

One consequence of spending too much borrowed money? Inflation.

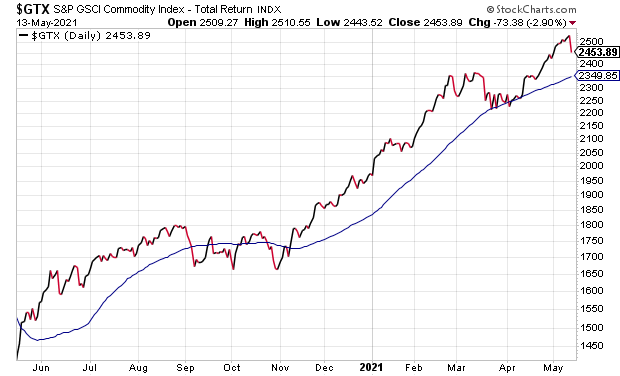

Copper, lumber, oil, gas, livestock, agriculture—you name it. Stuff costs a whole lot more than the year before.

Sticker shock is happening around every corner. At the grocery store. At the gas pump. Even at the hair salon.

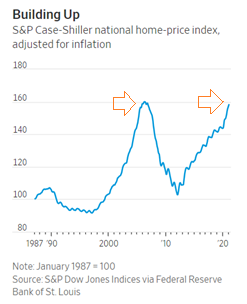

On the other hand, many folks are taking the rising costs in stride. Why? Their investment accounts have never been higher and their home values have never been higher.

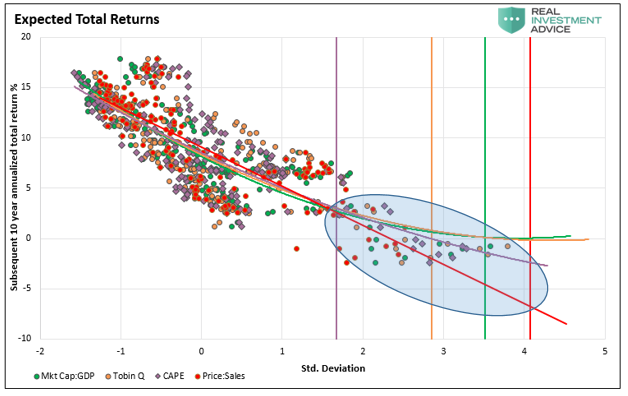

Ignoring hyper-valuation in asset prices will likely come back to haunt, however. Subsequent 10-year stock returns based on historically reliable metrics (e.g., CAPE price-to-earnings, price-to-sales, market cap-to-GDP, etc.) will be poor for hold-n-hopers.

How poor? An average of four metrics clocks in at -0.75% over the next decade. And that’s not even accounting for inflation!

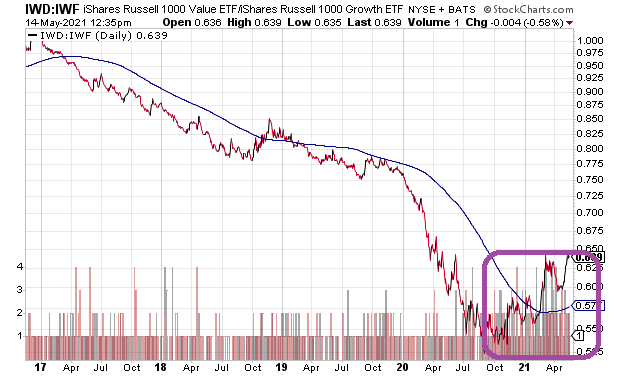

Some investors are becoming wary of price agnostic growth stocks. They are beginning to shift to underappreciated stocks with more favorable price-to-earnings, price-to-sales and/or price-to-book valuations.

Consider the iShares Russell 1000 Value ETF/iShares Russell 1000 Growth ETF ratio. Since Q4 of 2020, “value investing” has outperformed “growth investing.”