For many years now, metals traders and enthusiasts have been patiently waiting for the move in Silver that we feel its eventually going to happen.

There is almost a ritual process in the metals market that takes place when a crisis happens. We’ve written about this in a past article and we’ve highlighted how we believe Silver is one of the absolute best opportunities if/once it breaks out. It goes something like this…

A. Silver is often an overlooked “little cousin” to other precious metals like Gold and Platinum. Many traders would rather trade/acquire Gold vs. Silver.

B. When a crisis begins to happen, both Gold and Silver tend to collapse an initially as the shock to the markets translates into sales of precious metals to improve cash/margin requirements.

C. As the crisis continues to unfold, Gold will typically begin a sustained upside price move over many months where Silver may move very little to the upside. This creates a massive peak in the Gold to Silver ratio.

D. Then, suddenly Silver starts to rally upward faster than Gold and the Gold to Silver ratio begins to collapse. Gold continues to move higher throughout this process, but Silver is already rallying much stronger than Gold.

This is the breakout move in Silver that we believe may be happening right now and may continue for many months or years into the future. Allow us to explain this setup in more detail.

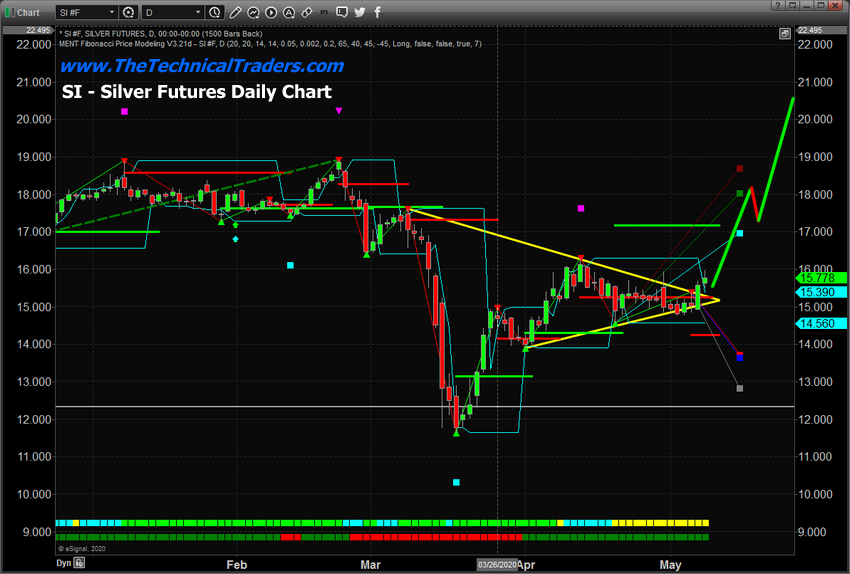

SILVER DAILY CHART

First, we believe an extended FLAG formation in Silver has recently completed and we believe this price wedge type of pattern will prompt a renewed upside price trend in Silver prices over the longer-term given a number of factors that many skilled traders have failed to appreciate. Technically, a price advance from current levels to levels above $21 will prompt a big shift in thinking for Silver traders. These new highs will suggest Silver has finally broken above the previous $20 price highs and could be skyrocketing higher as it did in 2010~12.

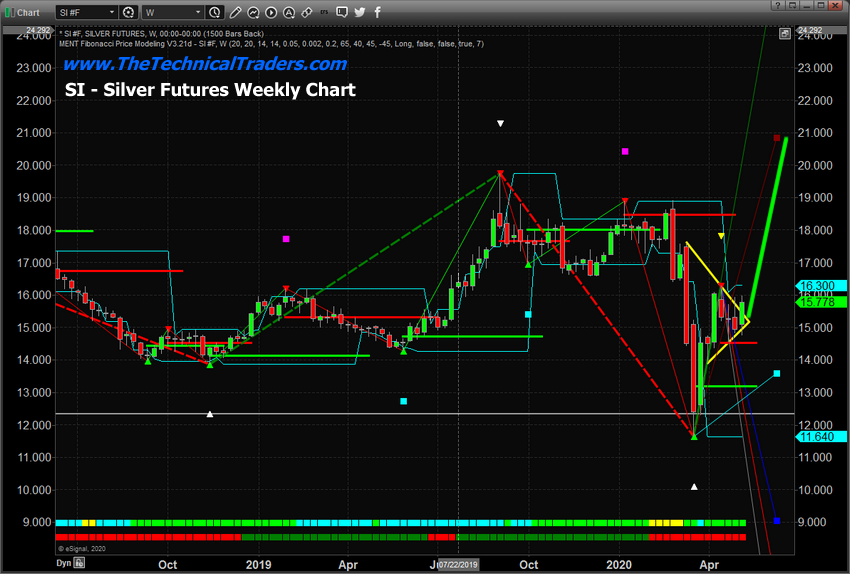

SILVER WEEKLY CHART

This Weekly Silver chart shows exactly why we believe this Flag Breakout could prompt a major upside price rally in both Gold and Silver. The downside price rotation that took place after the February 2020 global COVID-19 virus event prompted a vast rethinking of value and risk. While Gold found support fairly early, suggesting skilled traders were moving away from risk and into safe-havens, Silver has stalled below $16.50 recently. We believe this ”second-class” status for Silver is about to end in a very big way. Follow along.

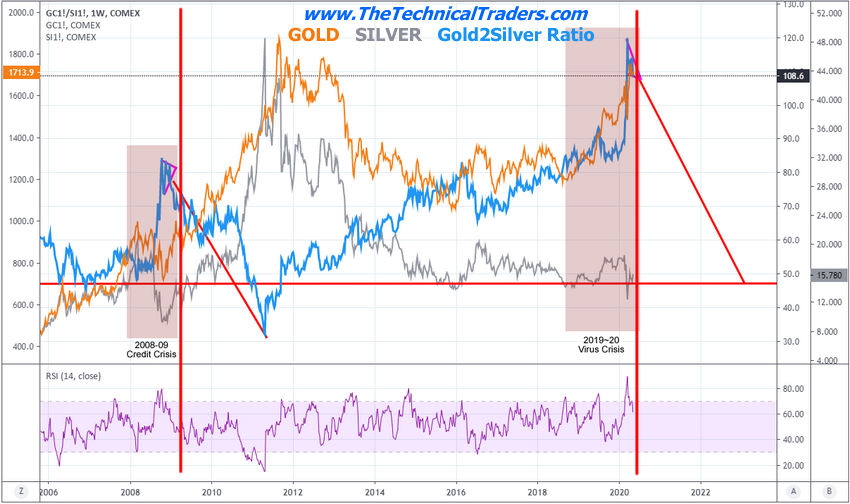

GOLD TO SILVER RATIO WEEKLY CHART

The Flag formation setup on the Daily and Weekly Silver charts is almost like the Starting Line of an incredible upward price event. The COVID-19 price collapse did what it was supposed to do, deflate expectations related to future market valuations and shift investor consideration of Metals for a short period of time. As risks accelerated and equity trades were put at risk, metals sold off as traders liquidated metals positions to cover risk exposure in Equities or another market. Now that the risk event has taken place and metals are transitioning back towards a safe-haven solution again, a new process begins – the upside advance in Gold and Silver which takes the Gold To Silver Ratio back down below 65~75.

Looking back at the 2008~09 Credit Crisis and the current COVID-19 crisis event, we can see Gold is already trading at levels which are very high compared to the peak levels in 2011 (almost 4 years after the 2008 Credit Crisis). We can also see that the Gold: Silver Ratio has reached the 120 level on this chart – which is incredibly nearly 41% higher than the peak levels in 2008. Comparatively, the Gold:Silver Ratio collapsed 60% from 2008 to 2011 while Gold skyrocketed from $720 to $1870 (259%). A similar move from current Gold price levels would suggest Gold could rally well above $4,500 over the next 2+ years.

Now, how does this relate to Silver? In 2008, Silver was trading near $9.75 just before the peak in the Gold:Silver Ratio was reached. By 2011, Silver had reached levels above $48.25 – an incredible 495% price increase. This suggests Silver could rally from current levels, near $15.75 to levels above $78 (or higher) if our analysis is correct. What are we expecting to happen next?

If our research is correct, we will see an upside price move in Silver to levels above $21 to $23 over the next three to five+ weeks. At the same time, Gold will likely rally to levels near $1999~$2100. This simultaneous price rally in both Gold and Silver should prompt the Gold:Silver ratio to stay rather elevated. But the next move in Silver, above $25~$30, should push the Gold:Silver Ratio below 100 from current high levels – which would collapse the RSI level showing us the longer-term price rally in Gold and Silver has confirmed.

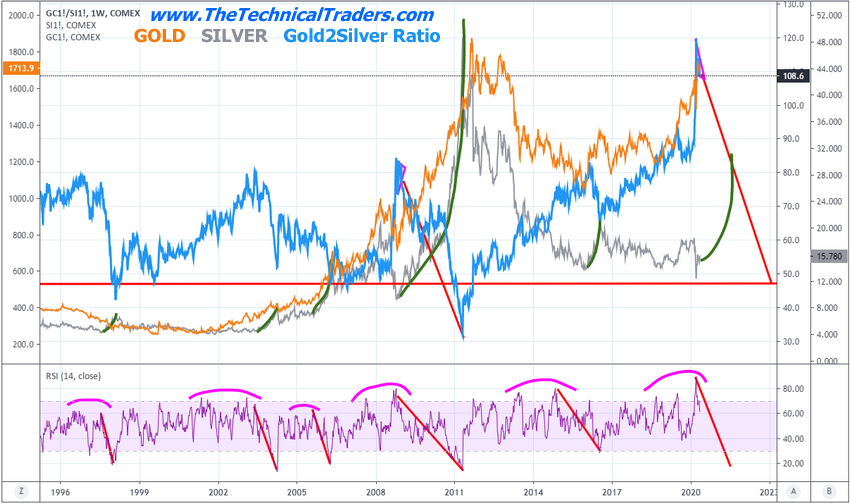

Every time the Gold:Silver Ratio collapses substantially, more than 35 to 40 RSI points after the Gold:Silver Ratio reached new high levels, this indicates a price rally in Gold and Silver is beginning. You can see how often this setup qualifies and confirms over the past 30+ years on the chart below. We’ve highlighted the uptrends in Silver in GREEN.

LONG-TERM HISTORICAL GOLD TO SILVER RATIO WEEKLY CHART

Concluding Thoughts:

We believe the current FLAG formation breakout in Silver is the beginning of a much larger upside price trend that is just beginning. Over the next few weeks and months, we believe Silver will begin an upside price advance that could last 12 to 24+ months and present an incredible opportunity for technical traders who follow price action.