Here’s the second installment of our review of ETFs that can be used to replicate the Global Market Index, a passive, unmanaged benchmark that’s comprised of the major asset classes. In the previous edition, we looked at broadly defined U.S. equity funds. This time the focus is on the short list of investment-grade U.S. bond funds that cover the waterfront in this corner of the capital markets.

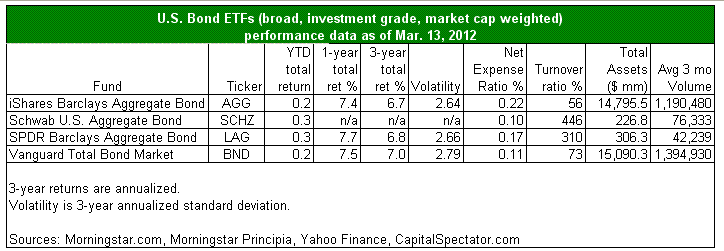

The first point to note is that the short list really is short. That’s partly because there’s only a handful of ETFs that cover the broad spectrum of investment-grade bonds in the U.S. in one fell swoop. We’re talking here of Treasuries, government agencies, corporates, and a small amount of international dollar-denominated bonds (inflation-protected Treasuries and munis are excluded, however). We’re also limiting the choices to market-cap weighted benchmarks exclusively in the ETF space. That leaves us with four choices, as shown in the table below:

All four ETFs track the Barclays Aggregate Bond Index, which means that the benchmark factor isn’t an issue here. Instead, trading liquidity and expense ratio come into play. As a result, our first choice is Vanguard Total Bond Market (BND). The combination of the highest daily trading liquidity and low expense ratio within the group make this an easy choice. It doesn’t hurt that BND has slightly outperformed it competition over the last three years, in no small part due to a lower expense ratio vs. the other two ETFs with several years of history.

The newer Schwab U.S. Aggregate Bond ETF (SCHZ) boasts a slightly lower expense ratio vs. BND, but SCHZ's light trading volume is a caveat. Of course, if the intended purchases are relatively small and you plan on buying and holding for the long haul, the lesser trading volume in SCHZ may not be a stumbling block. Then again, SCHZ’s expense ratio is a mere one basis point lower than BND's, a rather insignificant discount for relatively small investment sums. In fact, a routine amount of rebalancing could easily wipe away SCHZ’s advantage in expense ratio through the higher trading costs associated with lower trading volumes.

In the grand scheme of choosing ETFs, however, the above issues amount to nitpicking. All four of the ETFs above are solid choices for capturing the broad profile of the U.S. bond market. There are differences, but compared with ETF choices in other asset classes, the distinctions will be minor for most investors who are using these funds as part of a broad, multi-asset class asset allocation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Beta Investment Report | US Bond ETFs (Broad)

Published 03/15/2012, 02:13 AM

Updated 07/09/2023, 06:31 AM

The Beta Investment Report | US Bond ETFs (Broad)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.