Sector Analysis 3Q16

The Consumer Staples sector ranks first out of the ten sectors as detailed in our 3Q16 Sector Ratings for ETFs and Mutual Funds report. Last quarter, the Consumer Staples sector ranked third. It gets our Neutral rating, which is based on an aggregation of ratings of nine ETFs and 14 mutual funds in the Consumer Staples sector as of July 12, 2016.

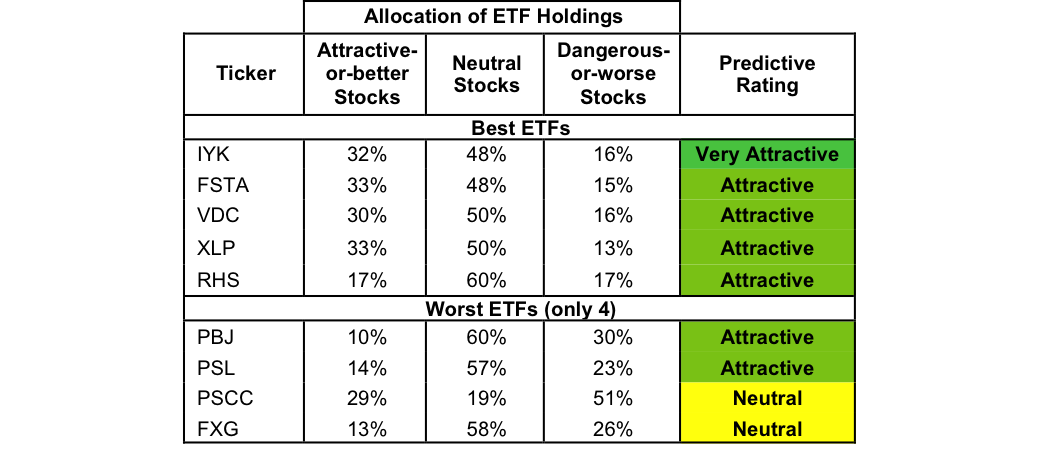

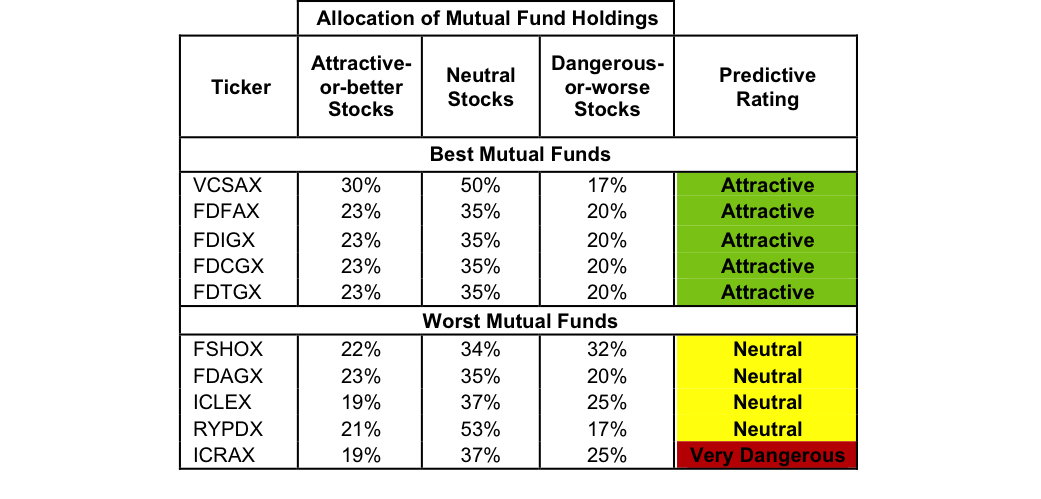

Figure 1 ranks from best to worst all nine Consumer Staples ETFs and Figure 2 shows the five best and worst rated Consumer Staples mutual funds. Not all Consumer Staples sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 15 to 114). This variation creates drastically different investment implications and, therefore, ratings.

Investors seeking exposure to the Consumer Staples sector should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Figure 1: ETFs with the Best and Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best and Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Fidelity Select Automotive Portfolio (FSAVX) is excluded from Figure 2 because its total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

iShares US Consumer Goods (NYSE:IYK) is the top rated Consumer Staples ETF and Vanguard Consumer Staples Index Fund (VCSAX) is the top rated Consumer Staples mutual fund. IYK earns a Very Attractive rating and VCSAX earns an Attractive rating.

First Trust Consumer Staples AlphaDEX (NYSE:FXG) is the worst rated Consumer Staples ETF and ICON Consumer Staples Fund (ICRAX) is the worst rated Consumer Staples mutual fund. FXG earns a Neutral rating and ICRAX earns a Very Dangerous rating.

117 stocks of the 3000+ we cover are classified as Consumer Staples stocks.

Tenneco Inc. (NYSE:TEN: $45/share) is one of our favorite stocks held by FSAVX and earns a Very Attractive rating. Since 2009, Tenneco has grown after-tax profit (NOPAT) by 25% compounded annually. Tenneco has improved its return on invested capital (ROIC) over this same time, from 4% in 2009 to 11% over the last twelve months.

Despite the improving operations, TEN remains undervalued. At its current price of $45/share TEN has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means that the market expects TEN’s NOPAT to permanently decline by 10%. If Tenneco can grow NOPAT by just 5% compounded annually for the next five years, the stock is worth $72/share today – a 60% upside.

Seneca Foods Corp (NASDAQ:SENEA: $36/share) is one of our least favorite stocks held by Consumer Staples ETFs and mutual funds and earns a Dangerous rating. Since going public in 2006, SENEA’s NOPAT has actually declined by 0.2% compounded annually.

SENEA’s ROIC has declined from 7% in 2006 to a bottom-quintile 3% over the last twelve months. Despite the deteriorating profitability, SENEA remains overvalued. To justify its current price of $36/share, SENEA must grow NOPAT by 10% compounded annually for 15 years. This expectation seems optimistic given SENEA’s profit decline since 2006.

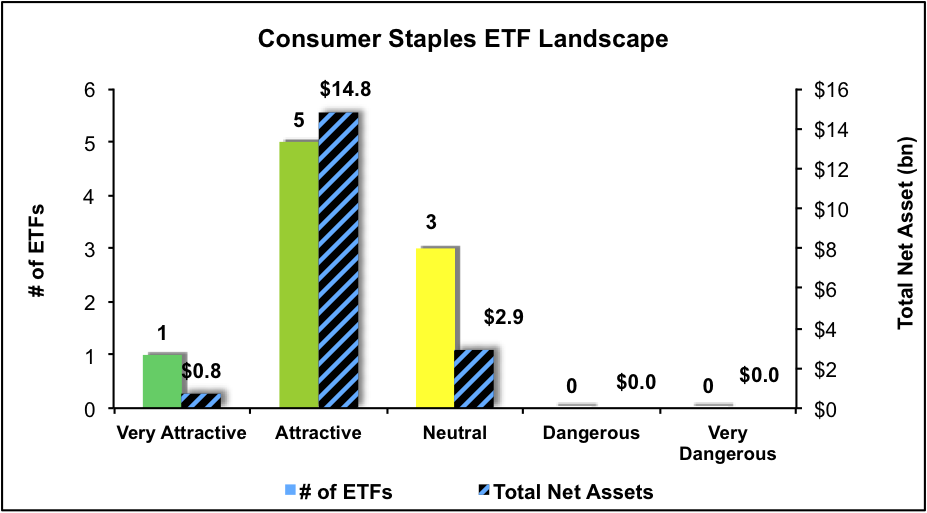

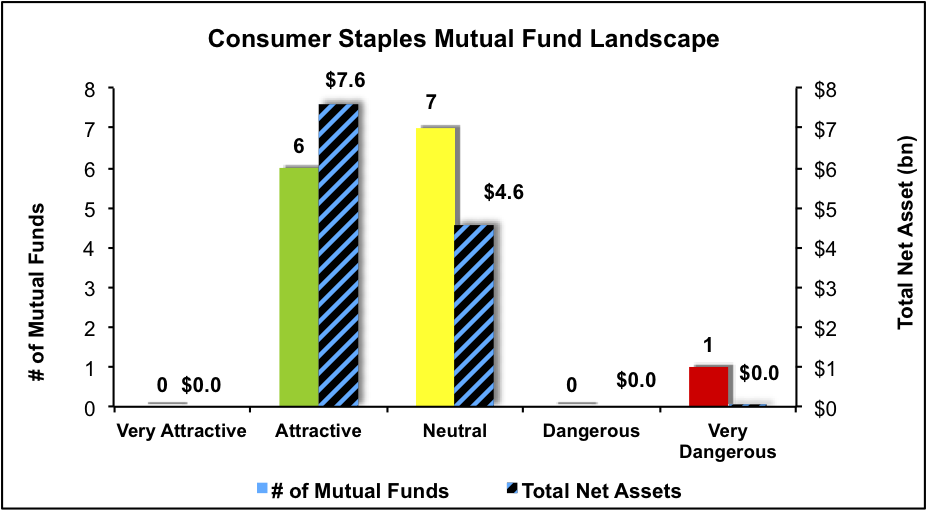

Figures 3 and 4 show the rating landscape of all Consumer Staples ETFs and mutual funds.

Figure 3: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 4: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

This article originally published here on July 12, 2016.

Disclosure: David Trainer and Kyle Martone receive no compensation to write about any specific stock, sector or theme.