Most investors are focused on a handful of sectors. Hence, following all stock market sectors is a success formula for outperforming fellow investors, as it allows us to identify the winning sector(s) in the broad array of markets.

The most known stock market sectors are the ones represented by the 9 sector ETFs (Energy Select Sector SPDR (NYSE:XLE), Financial Select Sector SPDR (NYSE:XLF), Industrial Select Sector SPDR (NYSE:XLI), Materials Select Sector SPDR (NYSE:XLB), Technology Select Sector SPDR (NYSE:XLK), Consumer Staples Select Sector SPDR (NYSE:XLP), Utilities Select Sector SPDR (NYSE:XLU), Consumer Discretionary Select Sector SPDR (NYSE:XLY), SPDR S&P Retail (NYSE:XRT)). However, those sectors really represent the highest level stock market sectors.

There are many more sectors on a ‘lower level’. By analyzing at a lower level, the probability of finding an outperforming sector increases exponentially.

We follow more than 50 sectors in the U.S. stock market, and we selected the most promising stock market sectors as 2017 kicks off. We use sector ETFs for this type of analysis; hence we feature one chart per sector.

As discussed before, the ongoing market sector rotation favors value stocks over growth stocks. Not coincidentally, all attractive sectors we identified are part of the ‘value stocks’ segment. Moreover, we believe the stock market outlook for 2017 is bullish, which is a key consideration before taking any position in stocks.

Note that our favorite stock market sectors are much more precise than the views you get on mainstream media outlets. For instance, MarketWatch published a piece featuring the best stock market sectors in 2016, but clearly, their view was too generic and seemed only partly accurate.

The 5 best stock market sectors for 2017

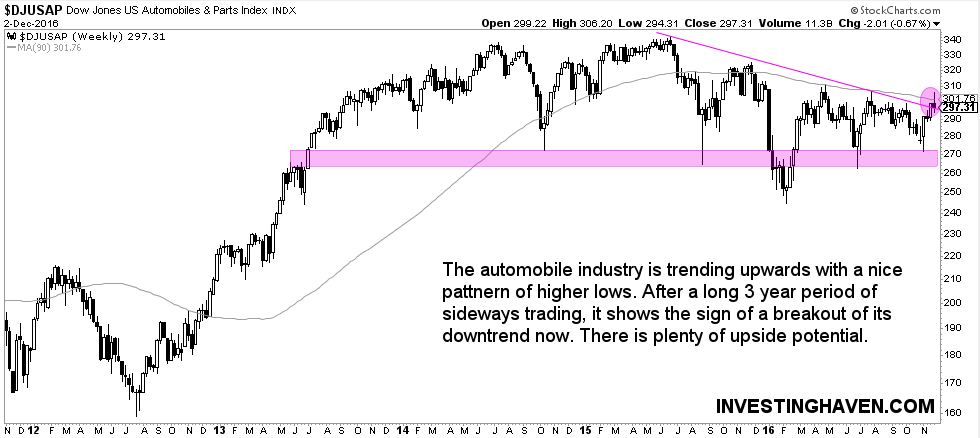

The automobile industry looks very attractive at this point. After a long consolidation period, it seems this sector is breaking out from its 18-month downtrend (see purple circle on the first chart). If the automobiles sector, represented by the Dow Jones Automobiles & Parts Index, trades above 300 points for at least 3 weeks, we can expect investments in this sector to be profitable in 2017.

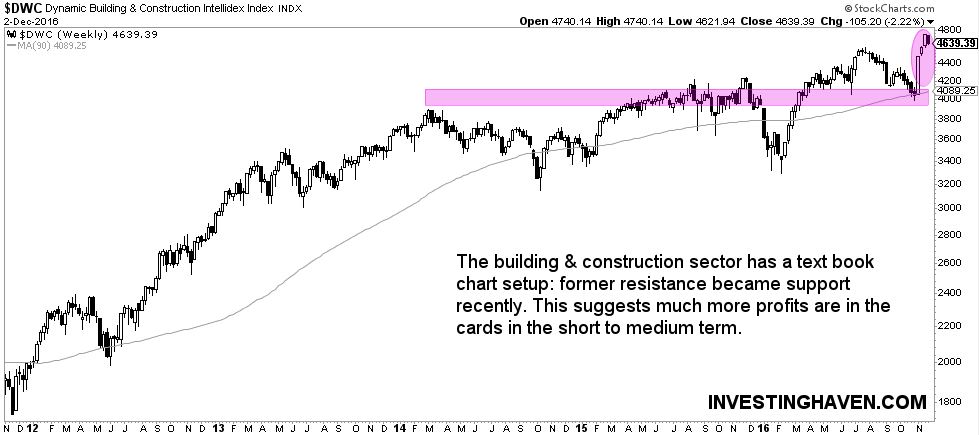

Another stock market sector with lots of potential for profits in 2017 is building and construction. On the one hand, rising interest rates support this sector. On the other hand, this sector remained in a consolidation phase for way too long, suggesting the time is ripe for it to move from lagging to leading.

The chart of the Dynamic Building and Construction Index for this sector has a text book chart setup: former resistance became support in October.

Third, industrial machinery is in a very good spot for continued profits (via the Dow Jones Industrial Machinery Index). Interestingly, it has a similar chart evolution as the building and construction sector (above), but it is more volatile. Consequently, the profit potential is higher if this sector is bulish.

Fourth, the toys sector is seeing long-term upward momentum. Its chart, represented by the Dow Jones Toys Index makes that point.

This seems a good entry point in this market sector as DJUSTY has retraced some 13 percent in recent weeks. Moreover, the long-term moving average is close, and it has provided decent and reliable support in recent years.

The fifth stock market sector we identified with lots of upside potential in 2017 is the water sector (via First Trust ISE Water Fund (NYSE:FIW)). Similar to the building and construction sector (2nd chart), recently, former resistance became support.

Bonus chart

As a bonus, we feature the regional banking sector, represented by the SPDR S&P Regional Banking ETF (NYSE:KRE). We are a bit cautious at this point as this sector got ahead of itself. We would become more confident about entering a position if KRE would retrace a bit, towards the 48 level.

Moreover, interest rates are strongly correlated to the banking industry, so investors should make sure that rates are in a good spot to continue rising before taking a position in KRE.

The challenge for investors is to select the out-peforming stocks within the leading sectors. That is the recipe for investment success.