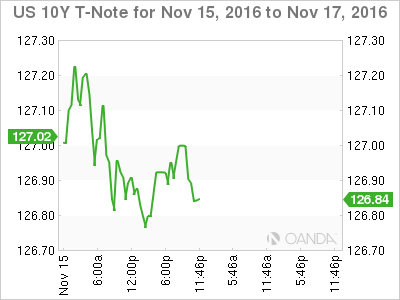

The U.S. 10-Year Treasury sell-off took a respite overnight despite the strong US retail sales data reinforcing December’s elevated rate hike probabilities.

The market was quick to notice of comments from usually dovish leaning Fed, Tarullo, who mentioned that rate hikes were ‘more on the table’ than before, while speaking on finance and the economy, confirming the unified outlook from all the recent Fed speak.

With market positioning and Fed guidance supported by the strong Retail Sales print overnight, we can safely call December a done deal as the Fed Policy Bell weather 2-Year Bond climbed above 1%.

Given the pace of the recent Bond sell off coupled with value hunters buying into the current yield appeal” in the 10 years at 2.25%, we should expect some near-term consolidation. Morse as we have seen so often in the past, campaign promises do not necessarily, translate into policy.

The RBA minutes provide very little incentive and with no new information forthcoming – therefore look for RBA policy to remain sidelined. The RBA continues to view the economy positively as a whole but is rightfully concerned about any escalation of a trade war between China and the US, which would play negatively for the domestic economy.

The IMF was equally confident on Australia’s economic outlook but did express concerns about the rebirth of the capricious global populism movement to economic slowdown in China

The overnight price action on the Aussie confirms that traders are sensing a turning point but are struggling for direction. The market is mired in a tug of war between higher US yields and spirited risk on appetite. Despite the broader USD appeal, post-US retail sales, the Aussie dollar was supported on dips to the .7510, and once again we find ourselves back in no man’s land smack in the middle of the current near-term range at .7550.

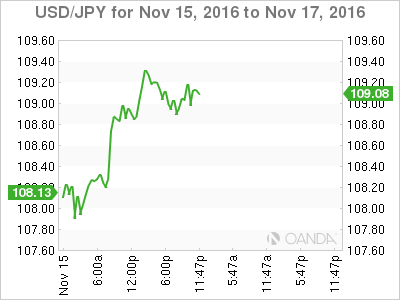

Japanese Yen

Despite the stronger than expected domestic GDP print amidst all the news about JGB’s breaching the” lofty” 0% level in 10-Year JGB’s, the Dollar-Yen show is all about the US bond yields amidst the broader USD uptrend. Despite the US bond market taking a breather overnight, trades focused on the robust US Retail Sales Print and chomped through 108.50 and ¥109 levels virtually uncontested with the currency now perched for a run at the key psychological ¥110 level.

However, like the US bond market, it is a likely time for the USD/JPY to take a breather and consolidate, especially ahead of Dr Yellen’s key testimony scheduled for tomorrow.

I expect base camp to be established in the 108.50-109.50 zone, before the market makes its assault on the key ¥110 level, heading into weeks’ end. Of course, this is assuming there are no surprises from Dr Yellen tomorrow.

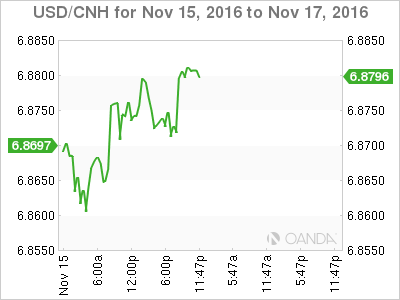

Chinese Yuan

It remains a very much USD driven storyline on the backdrop of higher global bonds and broader USD appeal.

Using yesterday’s market for clues into trader current sentiment, the PBoC fix came in considerably lower than the market expected at 6.8495 vs. 6.8625. After the initial move, traders were quick to fill the gap and drive the pair higher. With little intervention on offer from the PBoC and USD sentiment looking higher, dealers are nervously testing the upper levels on CNY and offshore CNH. There’s certainly a greater degree of trepidation at theses levels, but with no state-owned banks in sight (offering USD) and few traders willing to fade the current move, the path appears paved for a test of 6.90 +USDCNH heading into year-end.

Emerging Market Asia A much need pause in the carnage will provide investors with an opportunity to reassess strategy amidst very oversold conditions.