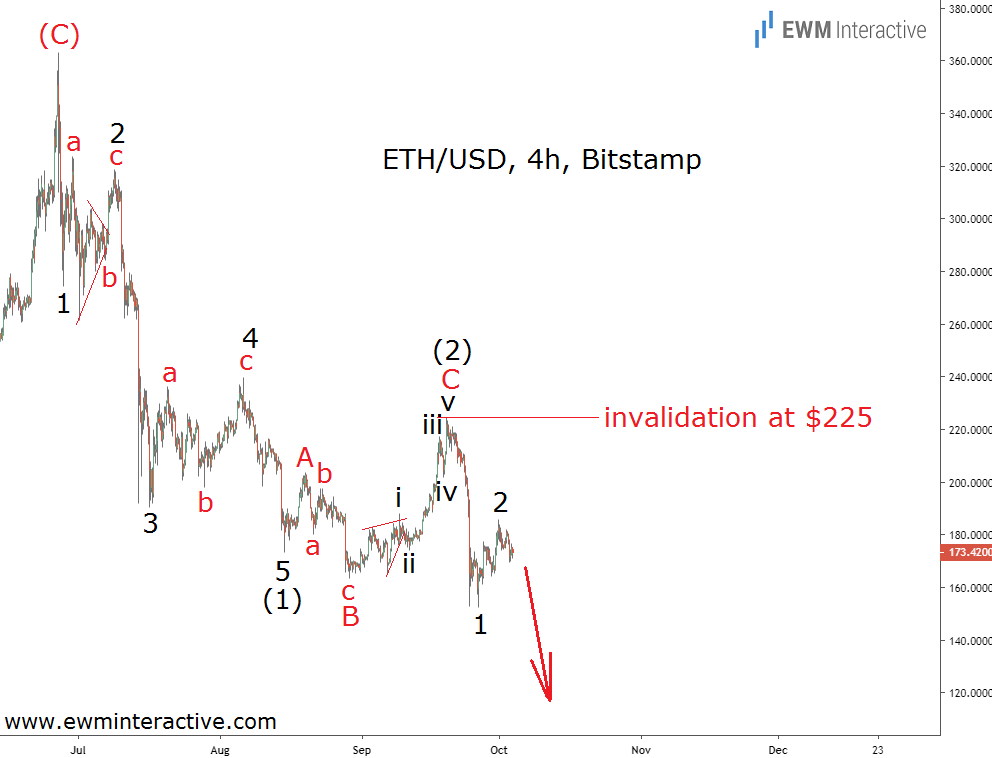

We last wrote about Ethereum on August 9th. The second largest cryptocurrency had plunged by 42% in less than two months and was hovering around $210. Unfortunately, our Elliott Wave analysis of the decline from $363 pointed to more weakness ahead. See the chart below to refresh your memory.

This chart was included in our last article on ETH/USD. We thought Ethereum “made a decision the bulls won’t like“, because the drop from $363 looked like an almost complete five-wave impulse. In the short-term, this was good news because a corrective recovery was supposed to soon occur. On the other hand, the theory states that impulses point in the direction of the larger trend, so the overall outlook was not that encouraging.

Hope can be Dangerous for Ethereum Bulls

Once wave 5 completed wave (1) a three-wave rally in wave (2) had to be expected before the downtrend resumes in wave (3). Nearly two months later now, we know for sure the bulls didn’t like what happened next. Ethereum is currently trading near $173.

Wave 5 concluded wave (1) at $173.35 on August 15th. Wave (2) chose to develop as an A-B-C- expanding flat correction, making a new low to $163.62 in wave B. Then, wave C of (2) climbed to the vicinity of $225 to complete the entire 5-3 wave cycle.

By September 19th, it was time for the bears to return. A week later, Ethereum was barely holding above $152, losing a third of its value in the process. Thanks to the Elliott Wave principle, none of this came as a big surprise.

Ethereum started 2019 at $131 so it is still at a decent annual gain of 32% as the fourth quarter begins. The problem is it remains under pressure as long as $225 holds. If this analysis is correct, wave 3 of (3) is going to drag ETH/USD to new lows from now on.