Americans quickly transitioned from gobbling up turkeys to gobbling up the deals at their favorite retail stores.

According to the National Retail Federation, 139 million unique shoppers hit up the malls during the holiday weekend. That’s up 6% from last year.

The anecdotal reports coming in are promising, too. Stores like Macy’s (M) and Toys”R”Us reported that people weren’t restricting their purchases to sale items alone.

In other words, bargains be damned… Americans appear to be in the shopping mood. Period. So it’s only natural that, as investors, we start looking for opportunities in retail stocks.

After all, many retailers book upwards of 40% of sales and profits during the holiday season. So it’s make or break time for retail businesses – and, in turn, their stocks.

Whatever you do, though, don’t even think about playing the brewing opportunity in retail by investing in big box electronics retailer, Best Buy (BBY).

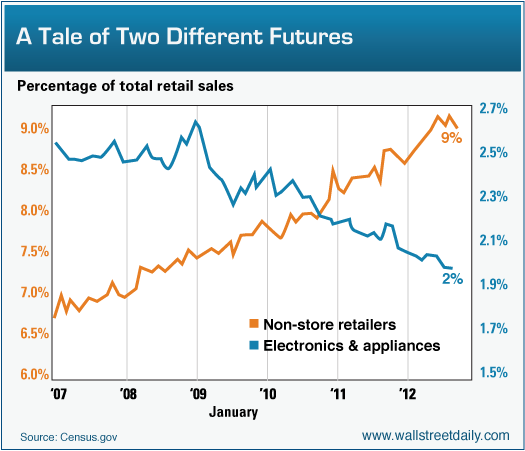

Like its former competitor, Circuit City, the company’s doomed for the trash heap. Here’s why… in one simple chart.

It’s All About the Internet, Stupid

I’m a gadget guy, and an avid football fan. So I never turn down an opportunity to browse Best Buy’s stores for the newest toy or super-sized, high-definition television.

Notice I said “browse,” though. I never buy anything at Best Buy anymore because I can almost always get better deals online. Therein lies the company’s fatal flaw.

It’s a traditional, brick-and-mortar retail store in a day and age when more and more Americans are doing more and more shopping online. And the transition away from in-store purchases is most pronounced in the electronics industry.

Take a look:

Since the beginning of 2009, the total share of retail sales for electronics and appliances stores has been declining. Meanwhile, the total share of sales for non-store retailers (i.e. – online merchants) keeps climbing.

Therefore, Best Buy’s stock slump (down 45.8% this year) isn’t an isolated occurrence related to poor management, bad marketing, or any other individualized factor. It’s symptomatic of the entire industry’s downturn.

Put simply, big box retail is on a crash course with obsolescence, thanks to stiff competition from online players like Amazon (AMZN). And there’s nothing the Best Buys of the world can do about it.

Part of the reason they can’t compete is the heavy burden of traditional brick-and-mortar infrastructure. In the last six months, Best Buy invested $316 million in property and equipment.

Meanwhile, the only money Amazon spent on “property” was for intellectual property.

And traditional retailers can’t adapt fast enough to survive…

Amazon demonstrated the viability of an online-only sales model over a decade ago. Yet Best Buy still only generates about 5% of total sales online today. Sorry, but if Best Buy didn’t transition to an online model yet, it’s way too late.

Even if we ignore Best Buy’s fatal flaw, its other fundamentals hardly warrant consideration…

Same-store sales – a key retail metric – dropped 4.3% over the last six months. The company’s saddled with $2 billion in debt, prompting the rating agencies to put it on watch for a potential debt downgrade. That’s never an encouraging development.

Plus, management recently suspended its share buyback program to preserve capital. So, logically, the next thing on the chopping block is the company’s dividend.

At $0.68 per year, it represents a $229 million outlay for a company with only $309 million in cash in the bank. Newsflash: Shareholders don’t tend to respond positively to dividend cuts or suspensions. (Think RadioShack (RSH).)

Bottom line: More and more retail spending is migrating online. And there’s nothing Best Buy can do to stop it. That alone tells us an investment in Best Buy is doomed. And when we take the time to review the company’s fundamentals, we find even more reasons to avoid it.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Bear Case For Best Buy In One Simple Chart

Published 11/28/2012, 06:27 AM

Updated 05/14/2017, 06:45 AM

The Bear Case For Best Buy In One Simple Chart

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.