The U.S. automobile sales boom has been one of the most important economic growth engines since the Great Recession. The boom kicked off with the federal government’s “cash for clunkers” rebate program and was fueled by cheap auto loans and leases, which were a result of the Federal Reserve’s ultra-low interest rates in the past decade. American consumers borrowed almost a half-trillion dollars to buy new cars in the past decade, which helped to pull struggling U.S. automakers out of the deep existential slump that they were in earlier this decade. Unfortunately, rising interest rates are putting an end to this debt-driven auto boom, which can be seen in rising auto loan delinquencies, a spike in auto industry layoffs, and sharply falling U.S. vehicle sales.

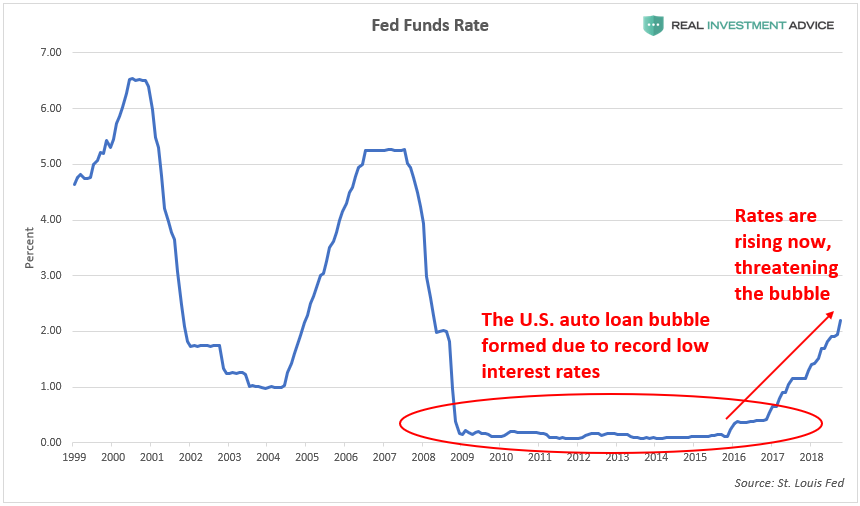

As the chart below shows, U.S. interest rates were at record low levels for a record length of time in the past decade. Those low interest rates made it much cheaper to lease and finance new automobiles. For the last three years, interest rates have been rising, which makes it more expensive to finance and lease new automobiles. On top of higher financing costs, the average price of a new car has soared 29% since 2009 to a little over $36,000. As a result of both higher financing costs and automobile prices, the average car payment is now a hefty $550 per month!

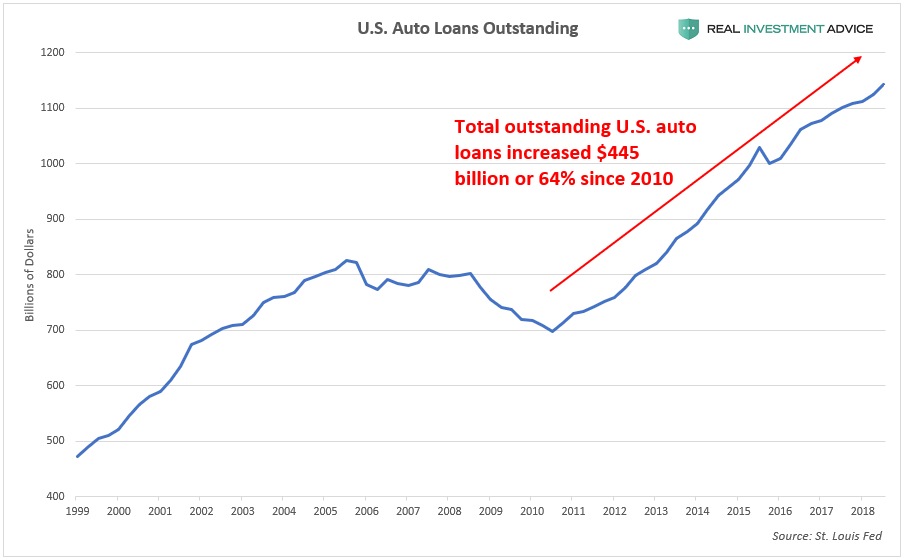

Since 2010, total outstanding U.S. auto loans increased by $445 billion or 64% to over $1.1 trillion as Americans took advantage of record low interest rates to finance automobile purchases:

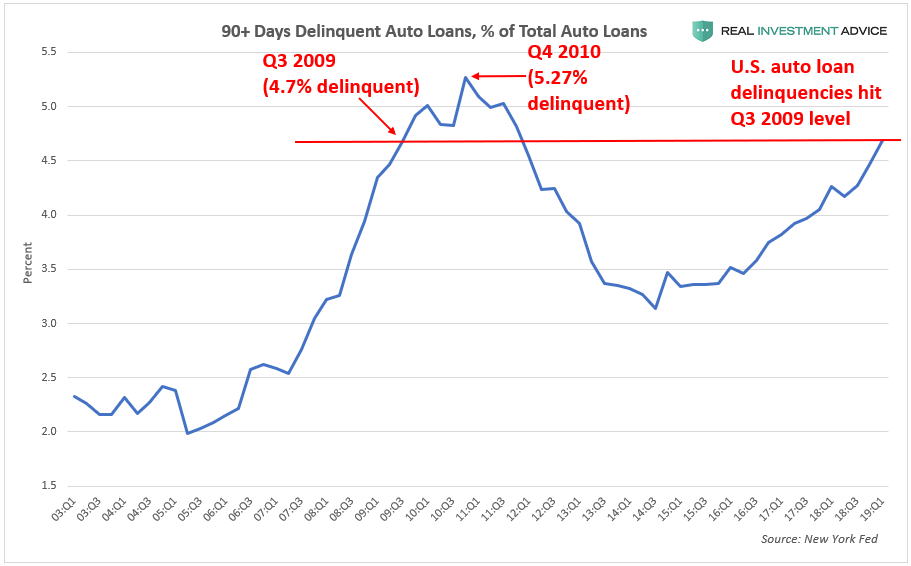

As a result of the auto loan boom/bubble in the past decade (in which loans were made to increasingly marginal borrowers) and very high car payments, U.S. auto loan delinquencies have recently hit Q3 2009 levels:

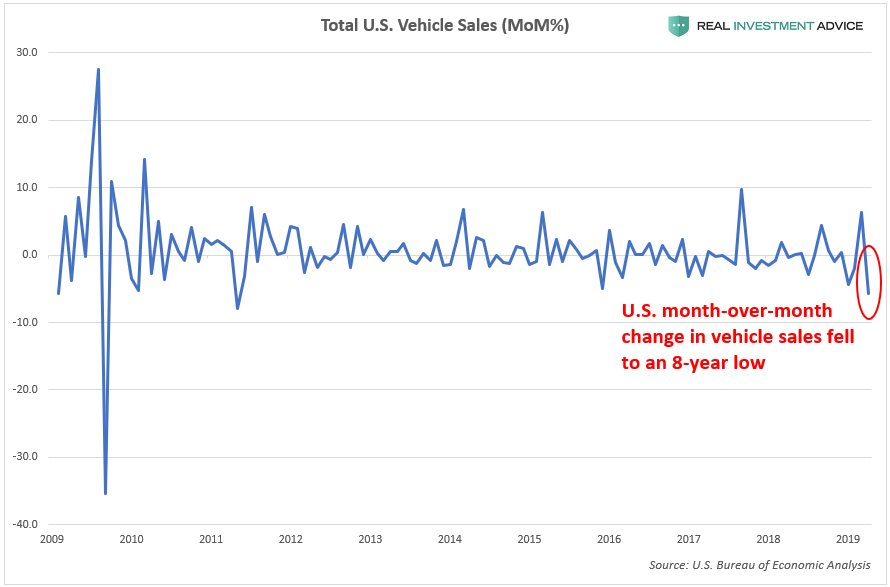

Soaring payments and market saturation are finally hitting U.S. vehicle sales:

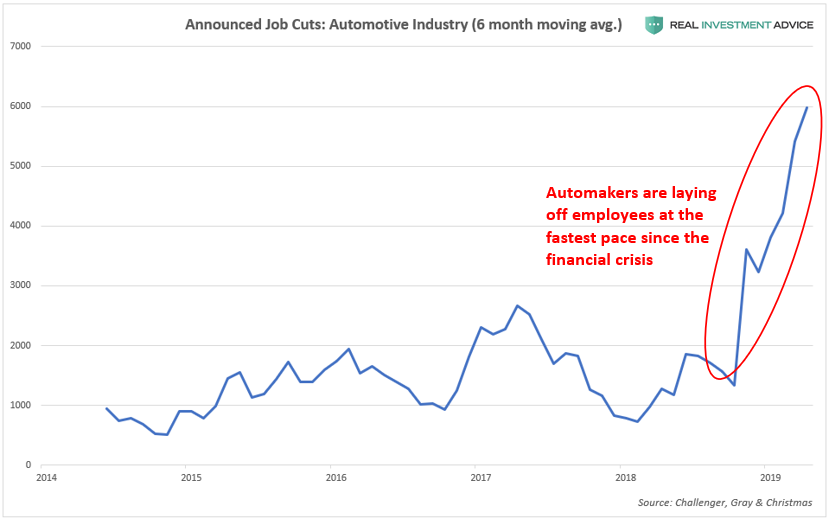

Seeing the writing on the wall, automakers are now laying off employees at the fastest pace since the financial crisis:

The nascent auto industry bust and layoffs are not a surprise to me because I’ve been warning for several years about the U.S. auto loan bubble and how it was artificially boosting auto sales, and will end in a terrible bust. For example, in March 2017, I criticized President Trump in a Forbes piece called “Don’t Mistake A Bubble For Sustainable, Organic Economic Growth” for naively cheering the auto jobs boom without realizing that it was driven by a bubble in auto loans.

To summarize, the U.S. auto sales boom was largely driven by cheap credit rather than organic demand. When central banks like the Fed hold interest rates at ultra-low levels, they create economic booms by pulling demand forward. Similarly, the U.S. housing bubble of the mid-2000s inflated thanks to the ultra-cheap mortgages available at that time.

Unfortunately, these kinds of economic booms always end in a bust. The current U.S. auto bust is just getting started – expect to see even more layoffs, rising auto loan delinquencies, plunging sales, and sinking automaker stock prices.