Investing.com’s stocks of the week

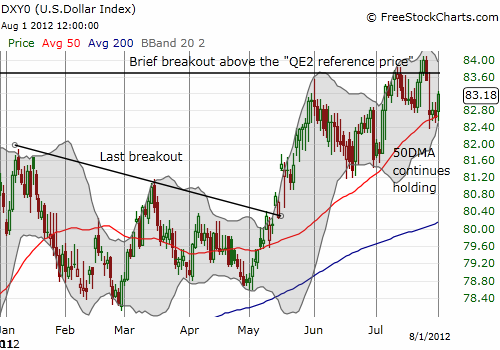

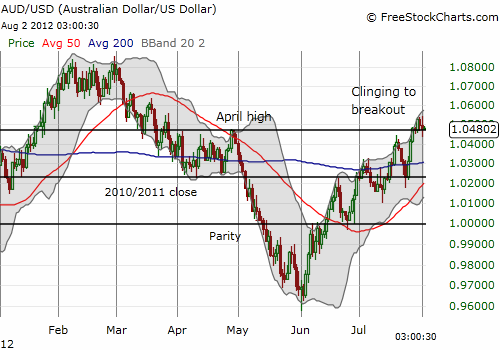

On July 30th, the Australian dollar made a clean breakout against the U.S. dollar (FXA). At that time, I stated I was finally ready to reposition for what could be an extended rally. My final milestone was Australian retail sales growth released on August 1st. Those numbers came out stronger than expected (1.0% versus 0.7% consensus), but the Federal Reserve provided the larger catalyst earlier in the day.

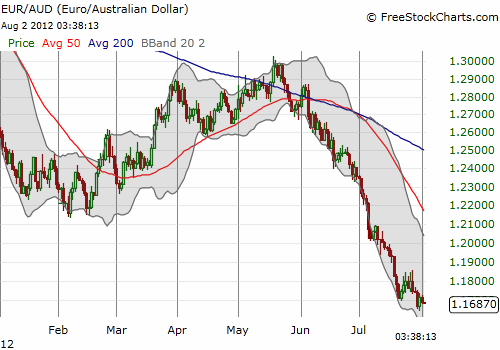

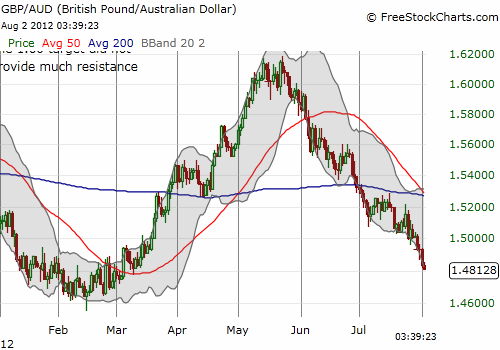

While the Australian dollar has made halting progress against the U.S. dollar, it has really beaten up the euro and the British pound.

GBP/AUD" title="A steep decline for GBP/AUD" width="500" height="350">

GBP/AUD" title="A steep decline for GBP/AUD" width="500" height="350">

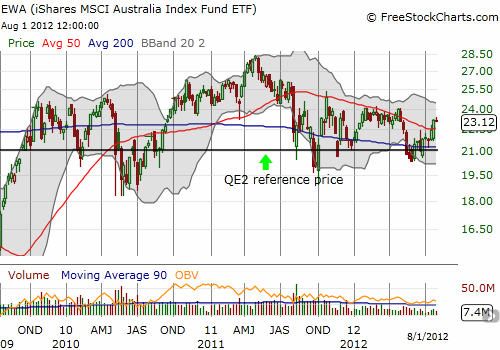

Australian stocks (in general) also show little sign of experiencing a fresh decline.

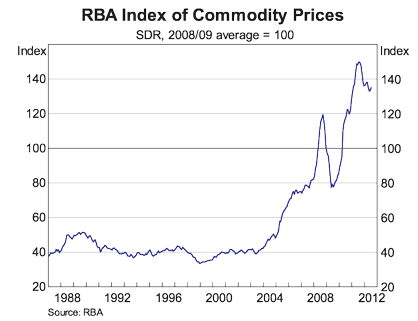

While the Reserve Bank of Australia (RBA) will likely repeat its conclusion that the Australian dollar is over-valued at its next monetary policy meeting on August 10th, it will be hard-pressed to drop interest rates further without a fresh move downward in commodity prices.

Commodity prices always loom large when considering prospects for the Australian dollar.

So, overall, I am now marginally bearish against the Australian dollar. As I look to trade more bullishly again, I am keenly interested in fading pops in EUR/AUD and GBP/AUD – something I have finally started doing very tentatively given the trends downward are already quite extended.

One looming wildcard could be the foreign reserve actions of the Swiss National Bank (SNB).

Be careful out there!

Full disclosure: Net short Australian dollar, long EWA, long EUR/CHF.