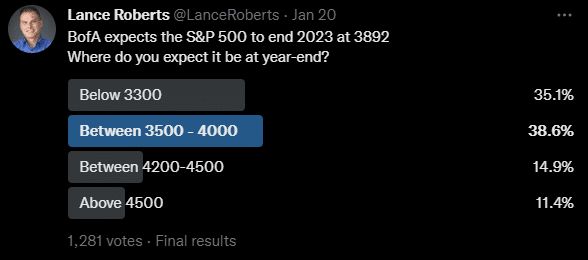

From a contrarian investing view, everyone remains bearish despite a market that corrected all of last year. I polled my Twitter followers recently to take their pulse on the market.

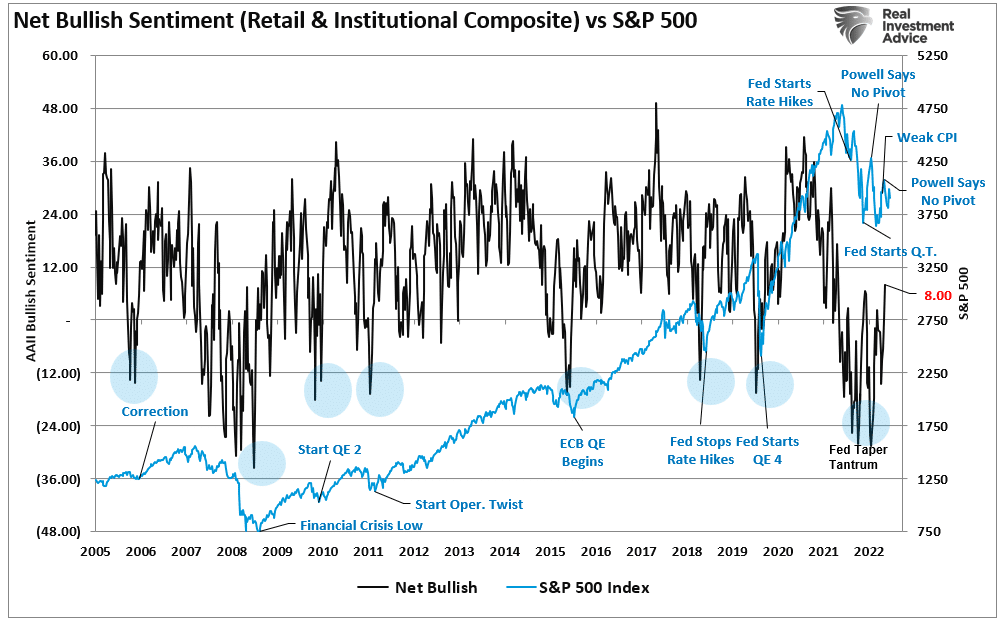

Of the 1280 votes cast in the poll, roughly 73% of respondents anticipate the market to be lower throughout 2023. That view also corresponds with our sentiment gauge of professional and retail investor sentiment, which, while improved from the October lows, remains depressed.

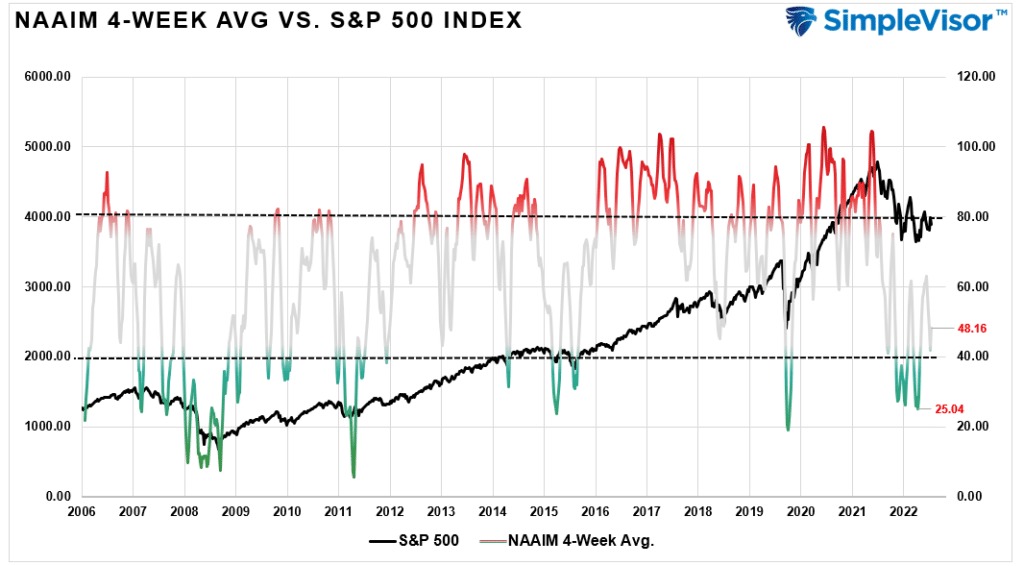

More importantly, investor allocations, particularly among professional investors, remain extremely light, suggesting a much higher level of caution. The following is the 4-week moving average of the National Association of Investment Managers bullish index. While the reading of 25.04 in October coincided with the market low, the current reading of 48.16 remains bearish.

As Bob Farrell’s Rule Number 9 states:

“When all the experts and forecasts agree – something else is going to happen.

As a contrarian investor, excesses are built by everyone betting on the same side of the trade. When the market peaked in January 2022, everyone was exceedingly bullish, and no one was looking for a 20% decline. Sam Stovall, the investment strategist for Standard & Poor’s, once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

Today, everyone remains bearish, suggesting the possibility of the market doing something no one expects.

The Art of Contrarianism

As we have often discussed, one of the investors’ most significant challenges is going “against” the prevailing market “herd bias.” However, historically speaking, contrarian investing often proves to provide an advantage. One of the most famous contrarian investors is Howard Marks, who once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

As noted, a majority of investors remain bearish. There are certainly ample reasons to BE bearish:

- The Fed is remaining aggressive on monetary policy.

- Central banks are reducing liquidity to markets.

- Inflation remains problematic.

- Earnings remain elevated.

- The economy is slowing.

- Consumers are running out of savings.

We certainly agree with the more dismal outlook and continue to suggest that investors should be more cautious in their portfolio allocations. However, this is also the point where investors make the most mistakes. Emotions make them want to avoid the risk of loss.

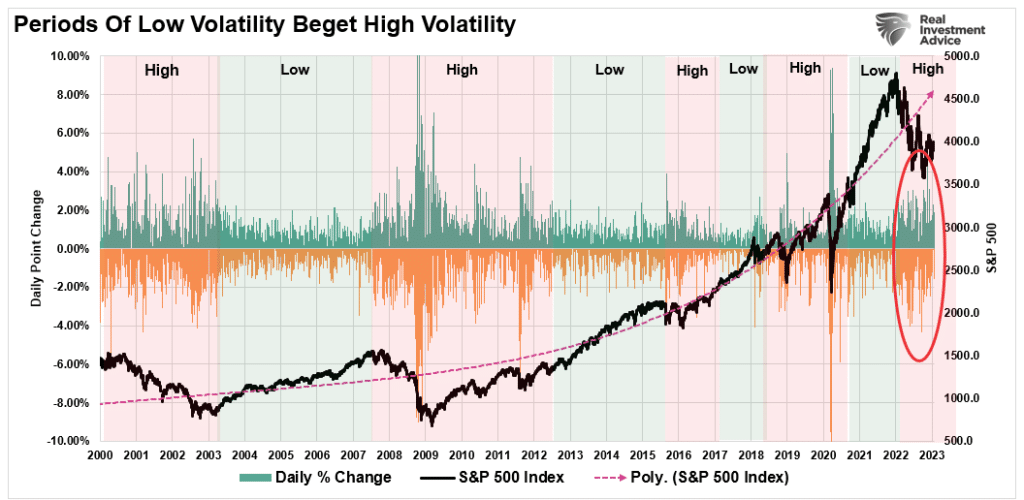

Given that many investors have never witnessed a “bear market,” the current bearing sentiment is unsurprising. The increased price volatility, and subsequent decline in prices, created a substantially higher level of instability. That instability creates “fear” and drives investors to the behavioral bias of “loss aversion.”

That increased volatility weighs on investor sentiment leading to poor investment decision-making and, ultimately, poor outcomes.

However, if the most fundamental premise of investing is to “buy when everyone is fearful,” investors may again be missing the contrarian opportunity.

With the market negatively positioned, the contrarian trade is an expectation of the unexpected.

- What if the markets have discounted an economic slowdown?

- What if earnings remain stronger than currently expected?

- Could the Fed reverse monetary policy?

- Have valuations declined enough?

The fundamentally bearish arguments of valuations, earnings, a Fed policy mistake, and a recession are certainly viable outcomes.

However, given that “everyone” is already expecting those outcomes, what happens if something else occurs?

Navigating a Contrarian Trade

As Bob Farrell’s Rule Number-9 states:

“When all the experts and forecasts agree – something else is going to happen.

As a contrarian investor, excesses get built when everyone is on the same side of the trade.

Everyone is so bearish the markets could respond in a manner no one expects.

There are plenty of reasons to be very concerned about the market over the next few months. Given the market leads the economy, we must respect the market’s action today for potentially what it is telling us about tomorrow. Therefore, there are some actions we can take to navigate for whatever path the market chooses.

- Move slowly. There is no rush to make dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

- If you are overweight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Again, after significant declines, individuals feel like they “must” do something. Think logically about where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers. These positions were dragging on performance as the market rose, and they led on the way down.

- Add to sectors, or positions, that are performing with or outperforming the broader market if you need risk exposure.

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

- Be prepared to sell into the rally and reduce overall portfolio risk. You will sell many positions at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake.

- If none of this makes sense to you, please consider hiring someone to manage your portfolio. It will be worth the additional expense over the long term.

Just remember:

“In good times, skepticism means recognizing the things that are too good to be true; that’s something everyone knows. But in bad times, it requires sensing when things are too bad to be true. People have a hard time doing that.

The things that terrify other people will probably terrify you too, but to be successful, an investor has to be a stalwart. After all, most of the time the world doesn’t end, and if you invest when everyone else thinks it will, you’re apt to get some bargains.“

Follow your process.