Let me be one of a few thousand commenting on Apple’s (AAPL) earnings as they affect primary technology ETFs where the weighting in the company is extraordinarily high. Depending on any given day where price action may dictate weightings, the company’s weighting on the SPDR Technology Select Sector (XLK) and the Powershares Nasdaq 100 ETF (QQQ) is somewhere between 15-18%. Therefore, anything positive or negative occurring with the stock will greatly dictate the performance of several technology weighted ETFs.

Apple shares had seen quite a bit of profit-taking over the past few weeks. This was occasioned in our opinion by too many people buying expensive short-term call options on the stock. Many of these options probably expired worthless on options expiration the previous Friday.

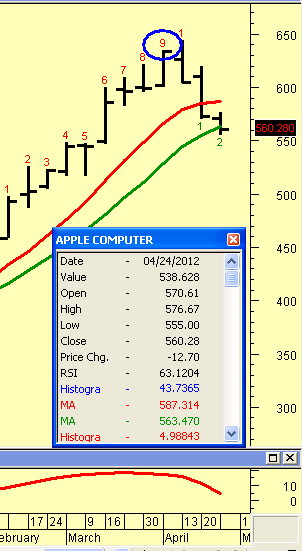

Technically, there was a significant DeMark weekly sequential 9 count registered as the stock had gotten substantially overbought. As is often the case, such a reading, especially with the security in question being much overbought, can cause a reaction the other way. Such was the case with Apple shares

Fundamentally, there were news items regarding ebook publishing disputes. Suggestions were also making the rounds that wireless carriers were showing a decline in new plan sign-ups perhaps negatively affecting sales of Apple products.

Finally there were concerns the upcoming earnings report would show some disappointment. But based on the company’s report Tuesday night it appears all these concerns were misplaced and the stock roared higher on a blockbuster earnings report.

All things considered, it’s primarily a one stock market.

Disclosure: Long XLK and QQQ.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Apple Effect On Technology ETFs: XLK And QQQ

Published 04/30/2012, 02:26 AM

Updated 05/14/2017, 06:45 AM

The Apple Effect On Technology ETFs: XLK And QQQ

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.