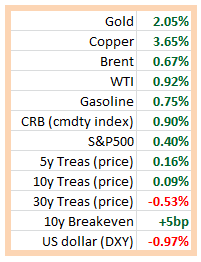

Friday's poor employment report has given us a good window into how financial markets react to prospects of a monetary expansion. The weakness in the US labor conditions has significantly increased the probability that the FOMC will lean toward an outright asset purchase program. Friday's market reaction to this possible move by the Fed is shown in the table below.

Typically weak labor markets are an indication of decreased demand and should not result in price increases in industrial commodities or energy. Yet Friday's moves in copper and oil are clearly the result of QE expectations (see this discussion). Some analysts continue to argue that Friday's gasoline price increase is due to the Hurricane Isaac hampering the refining capacity in Louisiana. That is a difficult argument to make in the face of the CRB commodity index as a whole rising 90bp for the day.

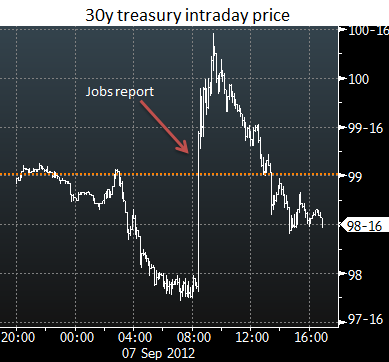

In a classic response to a potential monetary expansion, the dollar had a sharp decline of nearly a percent (see this discussion). And as expected treasuries rallied after the jobs report increased the probability of the Fed's incremental buying. But later in the day a more troubling trend was established. The Treasury curve steepened, with the 30-year bond and other longer dated Treasuries steadily selling off for the rest of the day.

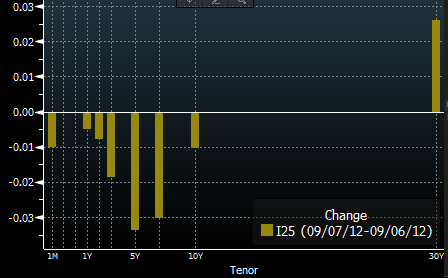

Steepening Treasury Curve

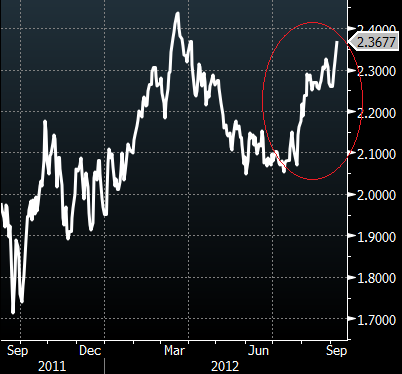

Why did the Treasury curve steepen in spite of clear expectations of the Fed's new securities buying program? The answer has to do with market participants beginning to price in materially higher longer term inflation. While shorter term inflation expectations remain relatively benign (though rising), the 10-year expectation for example (derived from inflation linked treasury prices) rose to 2.37% on Friday (chart below). The same expectations of elevated inflation in the future also drove up the price of gold.

Rising long-term inflation expectations intraday had pushed real yields for longer dated Treasuries deeper into negative territory (see this post), forcing a selloff in the 30-year bond, even as the shorter dated Treasuries were up on the day. In fact the 10-year inflation expectation (and gold price) has been on the rise (chart below) since the market began anticipating additional easing from the Fed and the ECB.

An aggressive monetary easing program at this juncture could be a dangerous move for the FOMC. Structural changes in the US labor market since the Great Recession make the Fed's quest to materially bring down the unemployment rate rather fruitless (see discussion). And as an "unintended consequence," the central bank could boost inflation expectations - particularly the headline number that includes food and energy.

With the US consumer sentiment already shaken (see this discussion), it wouldn't take much for spending to begin declining. Gasoline and food prices may not be a major part of the overall consumer spending in the US, but rapid increases can play an important psychological role in inhibiting spending, thus negating the very reason for the expansionary policy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Anticipation Of Aggressive Monetary Expansion By The Fed Woke Up

Published 09/09/2012, 03:01 AM

Updated 07/09/2023, 06:31 AM

The Anticipation Of Aggressive Monetary Expansion By The Fed Woke Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.