The crypto market is showing a moderate decline, heading into the end of the week, which has the potential for intensifying. Bitcoin's sideways price action remains in place, which is both good and bad news. A decrease in trading volumes to $15 billion indicates that the current levels are not interesting for most players to buy or sell, but still holds the price above $9,000. On the other hand, a long lull almost always ends in a surge of volatility.

A high correlation between Bitcoin and the stock market is on everyone’s lips. The traditional market was in the red on Thursday morning and risks pulling down the crypto market as well. Although Bitcoin has been trading around the lower bound of $9K for a long time, this does not mean that there are no changes in other digital currencies. In particular, it is worth paying attention to stable cryptocurrencies that are seeing a steady increase in demand.

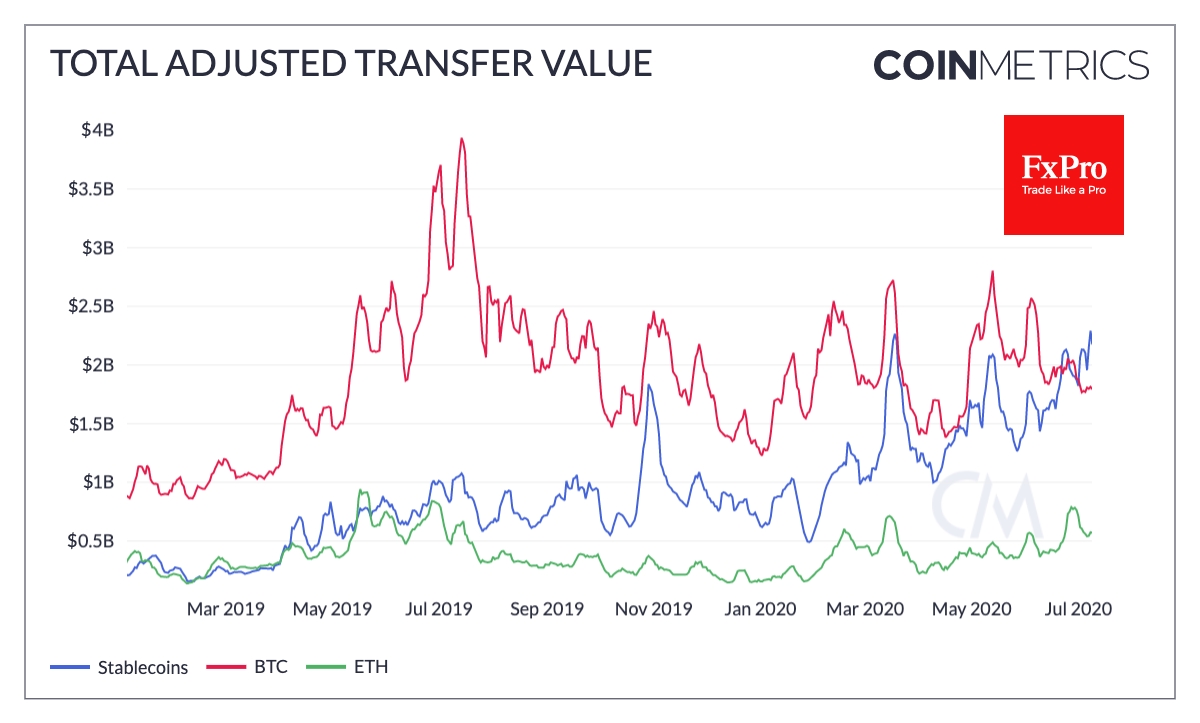

Coin Metrics’ data shows that the volume of transmitted value via stablecoins exceeded $2 bln in June, while the same indicator for Bitcoin fell below $1.8 bln. Growing demand for stablecoins is a logical response of the market due to the need for cheap and fast transfers across country borders.

FTX’s low capitalization altcoins index has shown 144% growth since the beginning of 2020, twice as much as Bitcoin. Demand for small coins demonstrates that crypto market participants still hope to find the next “unicorn”. Probably, this demand has retail roots, as institutional interest is concentrated on the most liquid instruments.

Among altcoins, Ethereum should be singled out, after showing more than a two-fold increase in the number of active wallets since the beginning of the year, several times more than Bitcoin. In this case, this growth may be influenced by DeFi (decentralized financial applications), as well as the work of other altcoins (including stablecoins) based on the Ethereum platform. Since the beginning of the year, the ETH price has increased by 79%, which also reflects market participants’ confidence in the platform's ecosystem.

From all this, we can conclude that there are many projects trying to challenge Bitcoin. However, the world's biggest cryptocurrency by market cap has coped with such challenges more than once, often remaining “in the saddle”. Recently, crypto miners were supposed to massively shut down their ASIC’s after halving. However, in mid-July 2020, Bitcoin is still “keeping an eye” on $10K, miners are increasing their production capacity, and the nearest Bitcoin competitor needs to attract more than $140 billion in market cap to pose a serious threat.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Altcoins Trying To Challenge Bitcoin Again

Published 07/16/2020, 10:11 AM

Updated 03/21/2024, 07:45 AM

The Altcoins Trying To Challenge Bitcoin Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.