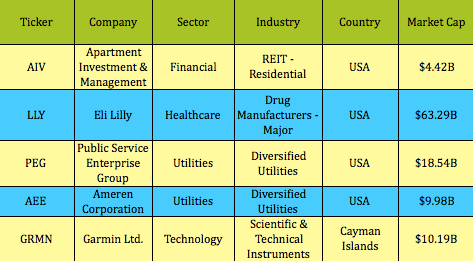

We thought we’d take a different approach in this article, and look at high dividend stocks within the S&P 500 that are performing well in 2014, vs. those that are oversold and/or undervalued. Not surprisingly, 3 out of 5 of these top dividend stocks are from the Utilities and Healthcare sectors, which are the 2 top sectors year to date.

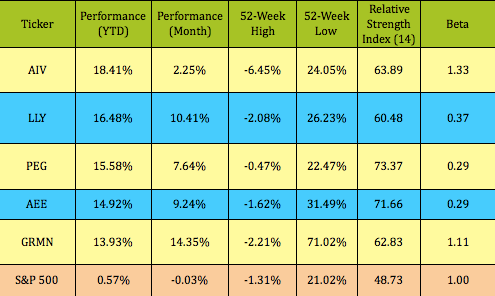

Performance through 3/17/14: A Financial stock, Apartment Investment & Management, (AIV), is the top performer of this group so far in 2014, but, interestingly, made most of its gains in January and February, and is only up around 2% in March.

Garmin, (GRMN), a tech stock, has made all of its net gains over the past month.

The more defensive Utilities stocks, Public Service Enterprise Group, (PEG) and Ameren Corporation, (AEE), show a more balanced performance, both rising in January and February, in addition to the past trading month.

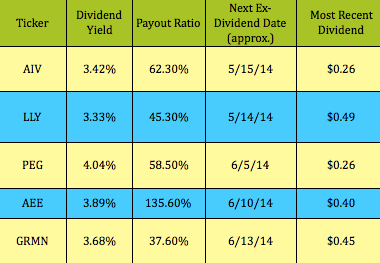

Dividends: With its 4%-plus yield, we’ve added Public Enterprise Group, (PEG), to the Utilities section of our High Dividend Stocks By Sector Tables. You’ll also find Lilly, (LLY), in the Healthcare section of the tables.

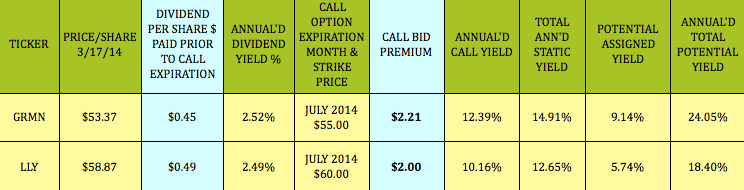

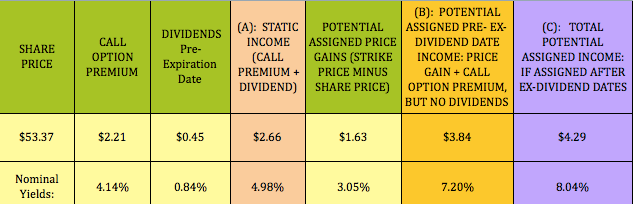

Options: 2 of these dividend paying stocks also have fairly high options yields – Garmin and Eli Lilly and Company, (LLY). We’ve listed July Covered Call trades for both stocks below. Both stocks have ex-dividend dates for their next quarterly dividends, prior to the July call expiration, so you can effectively increase your overall yield substantially, via the combo of the dividend and option yields.

Garmin’s call option payout is nearly 5 times its dividend, and Lilly’s call option pays 4 times its dividend.

You can find more details on these and over 30 other trades in our free Covered Calls Table.

Both trades have call options which are enough above the stock’s share/price, to amply replace the dividend income, via price gains, if your shares get assigned prior to the ex-dividend date.

Here are the major income scenarios for the Garmin trade:

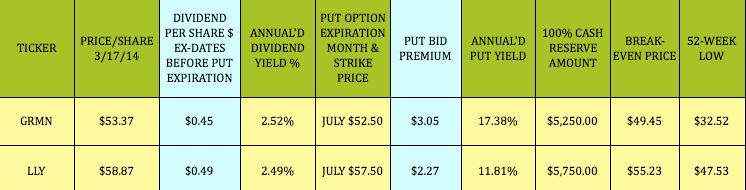

Cash Secured Puts: Our Cash Secured Puts Table also lists July put trades for Garmin and Lilly, (along with over 30 other trades). These put option trades both have strike prices which are below these stocks’ current price/share, thereby achieving a lower breakeven:

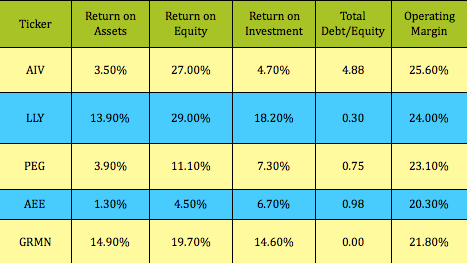

Financials:

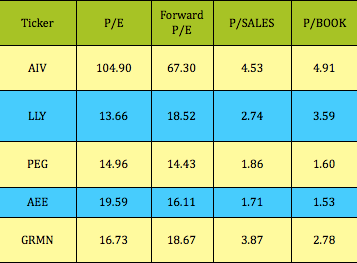

Valuations:

Disclosure: Author held no positions as of yet in any of the stocks mentioned in this article at the time of this writing.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.