The Original Piotroski Scoring System

The first four criteria of the Piotroski Score count towards profitability.

1. Positive net income compared to last year

2. Positive operating cash flow in the current year

3. Higher return on assets (ROA) in the current period compared to the ROA in the previous year

4. Cash flow from operations greater than Net Income

Points 5-7 of the Piotroski Score, looks at the health of the balance sheet in terms of debt and the number of shares outstanding.

5. Lower ratio of long term debt to in the current period compared value in the previous year

6. Higher current ratio this year compared to the previous year

7. No new shares were issued in the last year

The last two factors of the Piotroski Score looks at operating efficiency.

8. A higher gross margin compared to the previous year

9. A higher asset turnover ratio compared to the previous year

Boiling Down the Piotroski Score

But I wanted to see if I could simplify this list and boil it down to the most profitable combination which I described in a previous Piotroski backtesting post.

Ultimately, the original 9 points can be boiled down to just three criteria.

By looking at these three criteria alone, you would never guess that it was based off the Piotroski score.

The 3 Most Profitable Criteria of the Piotroski Score that Beats the Market

This is as simple as it gets. No need for complex black box algorithms. No need to sign up for newsletters that claim market beating performance for just $1,000 a year.

Simple ideas are often passed by because it looks too… easy.

#1: Positive net income compared to last year

#2: Higher current ratio this year compared to the previous year

#3: A higher asset turnover ratio compared to the previous year

The above points really focus on three simple concepts.

1. Increasing earnings

2. Improving financial condition

3. Improvement in efficiency

If you think about this from a business perspective, it makes a lot of sense.

A business increasing net income is always a good sign. It is increasing its business presence, or creating new accounts, or expanding to new territories.

If the current ratio has improved, the asset base has increased as a result of better cash flow and/or working capital management.

Higher asset turnover is an awesome sign in any business. The more asset you turnover, the more cash flow you build, the quicker you can convert inventory to cash and boost productivity and efficiency. It opens the door to things like negotiating better terms with suppliers and buyers and bringing down cost of production.

When you think of the the above three criteria in relation to stocks, it may be oversimplified, but when you tie it in with a real business, there is actually a lot of deep meaning behind it.

How Has the Best Piotroski Criteria Been Performing?

From 2000 to 2012, this strategy has returned 123.64% compared to the SPY’s 22.39% and Russell 2000′s 95.91%.

For the full performance of how this screen has been performing, you can see the stats over the past 10 years from the value stock screener page.

So far for Q1 of 2013, this strategy has earned 11.33%.

Below is the list of the 20 names and their respective performance which makes up the 11.33% performance.

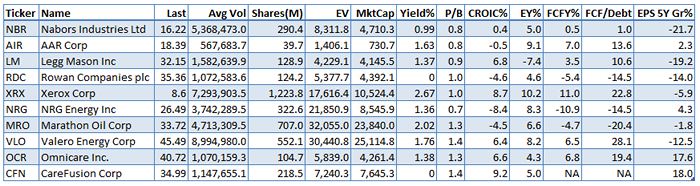

10 Stocks That Meet The Best Piotroski Criteria

Here are 10 stock ideas for you to ponder that meet the criteria of

#1: Positive net income compared to last year

#2: Higher current ratio this year compared to the previous year

#3: A higher asset turnover ratio compared to the previous year

View the full list and more with the following two links.

No positions

Please Share if You Find this Useful

If you find this useful, please help out Old School Value by sharing this article using the social sharing buttons.

The more you share, the more I know what type of content you really like and I will be able to provide more quality content.