Treasury bonds continue to be a stalwart position among income investors and those who opt for credit quality over yield or other characteristics of fixed-income. Treasuries benefit from the highest credit rating possible and are backed by the full faith of the U.S. Government. They are also the most directly susceptible to interest rate fluctuations and would perform poorly during a secular period of rising rates.

One attractive way to own Treasury bonds is through a diversified exchange-traded fund (ETF). This vehicle creates the flexibility to directly hone in on a certain maturity or index methodology in an extremely low-cost and liquid package.

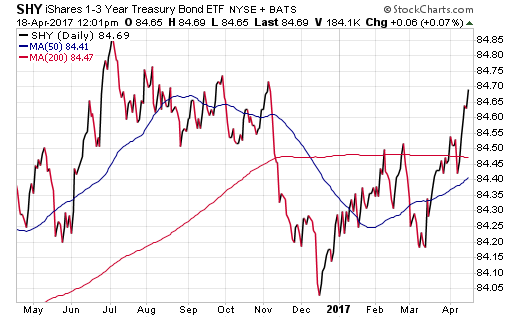

The largest ETF in this category is the iShares 1-3 Year Treasury Bond (NYSE:SHY), which has over $11 billion in total assets. SHY invests in a basket of 75 Treasury bonds with durations of less than three years. The effective duration of the fund is 1.93 years, which means the price fluctuations are going to be similar to a 2-Year Treasury bond. SHY also contains a minimal expense ratio of just 0.15% annually to administer the fund.

SHY carries a 30-day SEC yield of 1.16% and income is paid monthly to shareholders. That may not seem like a very attractive yield compared to junk bonds, emerging market bonds, or other riskier fixed-income alternatives. However, the relative low price volatility of this ETF alongside its intra-day liquidity makes up for those shortcomings.

This type of fund may be most appropriate for those who are looking to reduce their interest rate risk, shore up the credit quality of their bond holdings, or attain a small yield in lieu of money market funds. Some investors may opt to use this type of fund as a short-term holding while they seek out other investment opportunities. Furthermore, it may also comprise a portion of a Treasury bond ladder, which seeks to control exposure to certain segments of the yield curve by owning different maturity dates.

The second largest ETF in this category is positioned near the middle of the yield curve. The iShares 7-10 Year Treasury Bond (NYSE:IEF) has $7.6 billion dedicated to a just 17 intermediate-term Treasury bonds. The fund carries an effective duration of 7.59 years and offers a 30-day SEC yield of 2.19%.

An ETF of this nature is going to demonstrate similar duration and yield characteristics as an aggregate bond index such as the iShares Core US Aggregate Bond (NYSE:AGG). IEF may be appropriate as a strategic position for those that want to overweight their treasury bond exposure or as a pure-play on falling U.S. interest rates (i.e. rising bond prices).

The larger effective duration of this fund versus a conservative ETF like SHY creates far different risk dynamics for fixed-income investors. IEF also charges a modest 0.15% expense ratio as well.

The third-place slot in terms of total asset size is a run-off between the iShares 3-7 Year Treasury Bond (NYSE:IEI) and iShares 20+ Year Treasury Bond (NASDAQ:TLT) . Both funds have over $6 billion in total assets and have been known to flip-flop in their size over varying cycles. As its name implies, IEI is the bridge in defined maturity between SHY and IEF. By contrast, TLT covets the longest duration Treasury bonds to capture the securities with the highest sensitivity to interest rate fluctuations.

The Bottom Line

While most investors retain core bond exposure through aggregate or multi-sector funds, the use of Treasury bond ETFs can play an important role in many ways. They allow you to overweight or hone in on a certain maturity spectrum or balance the credit quality of other riskier holdings.

Choosing an ETF strictly by size doesn’t guarantee that it is going to be the best performer among its peers. However, generally these funds carry the reputation of being heavily traded (liquid), low-cost, and often have some of the longest performance track records. They have attained their size by building a reputation as a dependable vehicle to access a specific market or asset class.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI