In this week's Tech Edge, we dive into the impact of tariffs on the AI trade and identify the areas with the best opportunities.

Impact of Tariffs

Tariffs are dominating the headlines, and investors are worried that a recession is coming. Here is what investors should keep in mind:

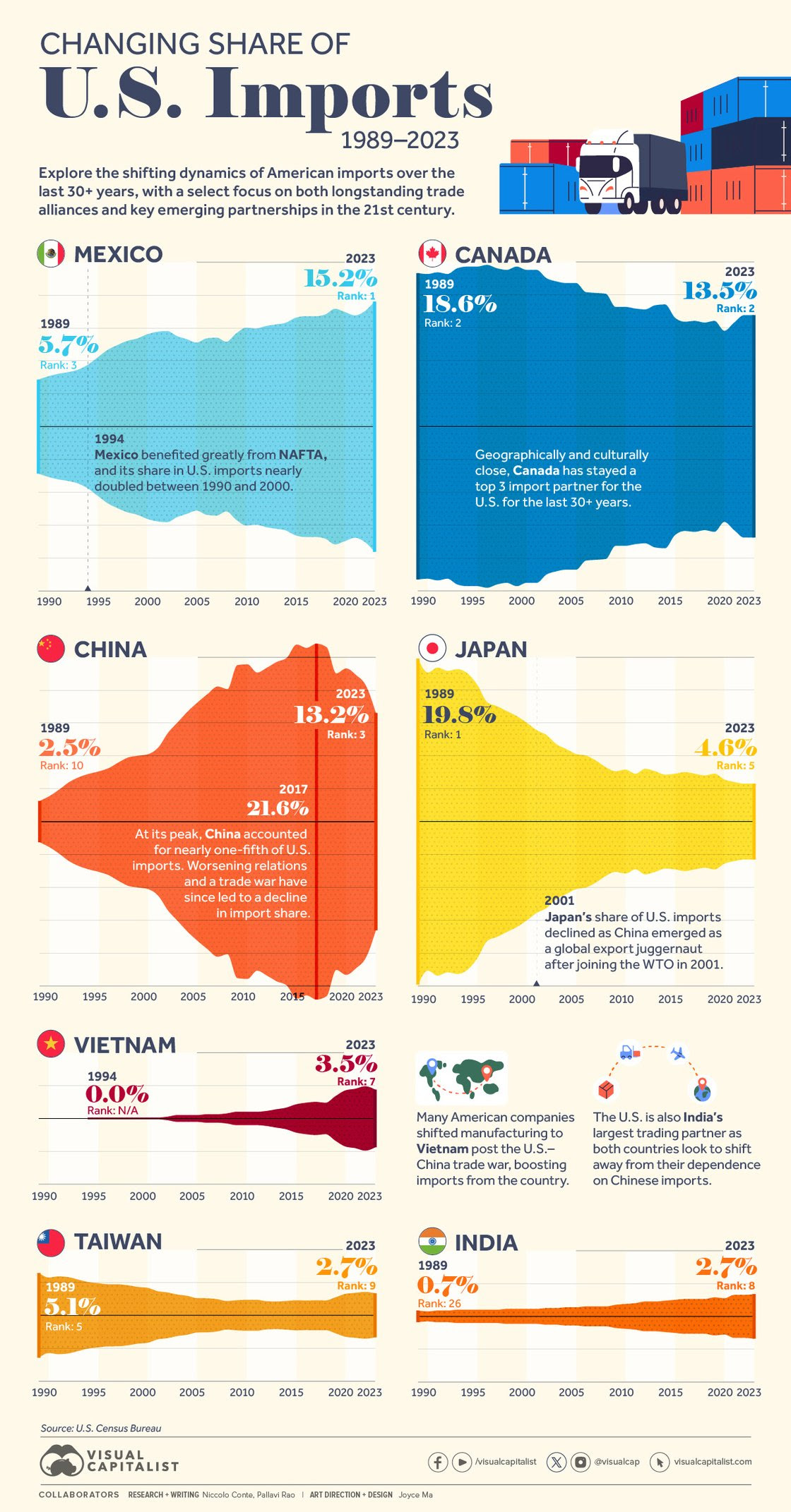

- The Base Case: The import tariffs that went into effect are 25% on Canada, 25% on Mexico, and 10% on China. The key question is the duration of the tariffs. Experts suggest that the Canada/Mexico tariffs will be rolled back, and the China tariff will remain.

- Impact on Mexico and Canada: The impact on the Canadian and Mexican economies would be significant, as exports represent 16% and 14%, respectively, making it very likely that these countries will be incentivized to negotiate. Experts estimate that the impact on their GDP will be in the ~(-2%) range.

- Historical Framework: We can use the 2018 tariff as a framework. At the time, the Federal Reserve estimated that a 1% increase in the average tariff would lower GDP by 0.14% and raise inflation by 0.09%.

- Impact on the US: Based on the above framework, Mexico, Canada, and China represent 40%+ of total imports (see visual below).

The impact from the current tariffs would be ~1% drag on GPD and 0.5-1% impact on inflation.

- Impact on the market: In 2018, Industrials, Materials, Information Technology and Financials were the most impacted areas from a stock price perspective, each pulling back ~15%. But the impact on fundamentals, e.g. margins and demand, was ultimately very minimal, creating outsized investment opportunities.

In conclusion, while tariffs are never good for an economy, we expect that the fundamental impact will be much less than investors are currently pricing in. The 1% negative GDP impact is likely to get offset by a boost from lower tax rates and AI-driven productivity improvement.

Why is the AI Trade Most Impacted?

There are two main reasons:

- First, when investors reduce exposure (e.g., worried about tariffs, employment), they sell what they own, not necessarily what makes sense. These positioning unwinds can only last so long before fundamentals kick in.

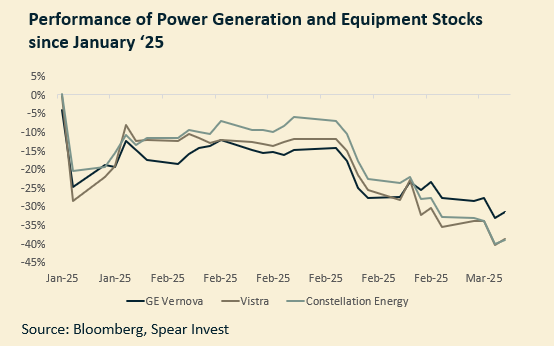

Here is one example: tariffs will generally incentivise more domestic production and, therefore, the need for more power generation. But guess which stocks are among the hardest hit from this news cycle: domestic power gen!

- Second, there is a product generation shift going on this year that is specific to Data Center Hardware. Due to the increased complexity, the new generation of chips is taking longer to ramp, both on the Nvidia Blackwell side and on the ASIC side. This is why, while hardware numbers are coming out very strong, they are not exceeding consensus by a wide margin. But the set-up looks very different in 2H25. More details are in the next section.

Data Center Hardware Earnings

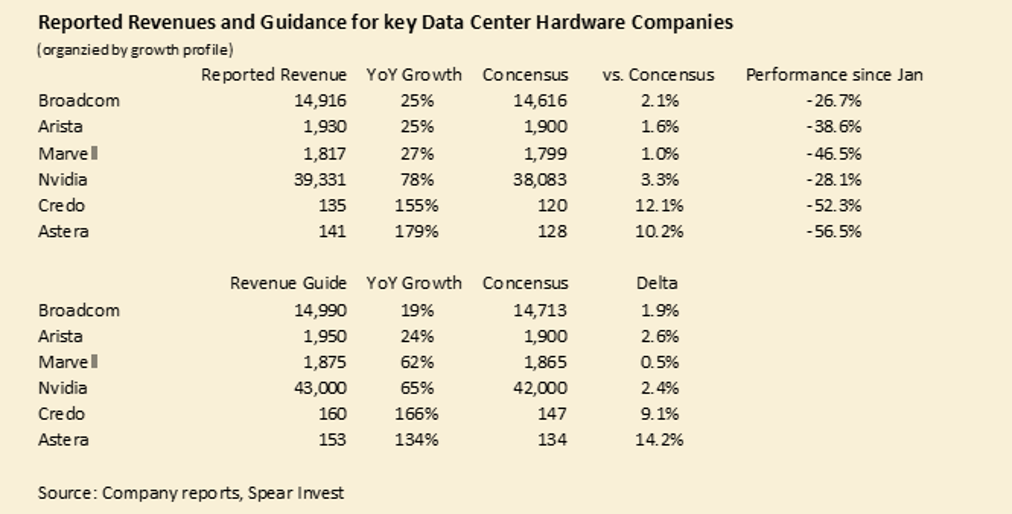

Data Center Hardware companies have been reporting outstanding results with reported and projected growth ranging from 25% to >150% YoY. But investors have been hard to impress.

Overall, the surprise vs. consensus has been lower than in prior quarters, with Marvell (NASDAQ:MRVL) on the lower end surprising by only 1% and Credo and Astera Labs surprising by >10% on both reported revenues and the guide.

But even the >10% surprises were not good enough.

With stocks generally down >10% on the day of the reports and down 30% to >50% since their January peaks, depending on the risk profile.

Why are the beats smaller than in the past?

The main reason is that the next generation of chips is taking longer to ramp:

(1) First, Nvidia's (NASDAQ:NVDA) Blackwell is a significantly more complex architecture than the Hopper.

(2) Second, on the custom ASICs side, this is essentially the first generation of this kind of custom chips, with Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOGL) now in volume production but ramping in 2H25 and Microsoft (NASDAQ:MSFT) on a TBD timeline ('26 or beyond).

On the positive side, visibility on demand from hyperscalers and enterprises is robust, with all companies reporting ramping CapEx budgets and supply constraints.

Demand rather than supply is key for this cycle. As long as demand is there, it is only a matter of time until supply ramps.

Between the tariff scare and this supply/demand dynamic, 1H25 may prove to be an epic entry point.