A disclaimer: I am long and/or trading several regular ‘bull stocks’ (as well as short a couple). Don’t interpret the sober message below as a ‘sell your stocks right now!’ style bearish warning. Indeed, after an expected choppy start to December I think more bull market mania, errr… rallying, could still be ahead. But it would be just dandy if people would keep their perspective along the way.

Closing the 2008 ‘Gap’

In 2008, market and economic participants suffered a hard downside ‘gap’ in the prices of their assets and in the levels of their expectations. The bull market that began in March of 2009 is doing a fine job of closing that gap and fully resetting the herd from the utter fear mode of Q4, 2008 to a 2007 or even 1999 style greed mode today.

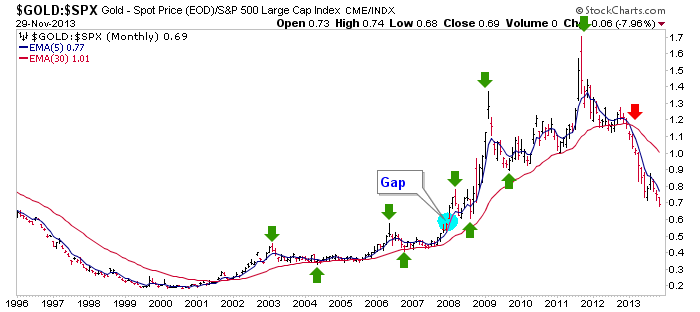

The chart of gold vs. the S&P 500 [below] shows a gap up in 2007, presumably as Lehman knocked down the first of many dominoes that would fall until the previously inflated cyclical bull market totally fell apart in Q4 2008 and bottomed in Q1 2009.

Gold is ‘risk off’ now. It is so risk off that many of its supporters are frightened of the monetary metal because today market risk is decidedly ‘on’, at the behest of policy making that has created a sea of liquidity going straight to equity assets. Think about that; people have been so thoroughly conditioned by the ‘risk on’ atmosphere of the current bull market that they are afraid of insurance. Insurance against what? Insurance against market risk and monetary policy induced systemic maladjustment.

Gold has gone ‘risk off’ and that is where you want your insurance to be. You don’t cheer lead and root for insurance. You hold it and hope it is not needed. That is what gold is and maybe the current situation for speculative minded gold bugs (i.e. just another flavor of casino patron) is filling a gap in their expectations as well. When enough people have learned that gold is about value only, not price, maybe this phase can end.

Visually, the gap in Au-SPX appeared after the system began unraveling in 2007. Is it so hard to imagine that the psychology (gap) of that time (as fear gapped up into what would become a historic market top and meltdown) should be ‘closed’ by the current bear market in sound thinking and bull market in risk taking?

Gold stopped making higher highs and higher lows in SPX units a long time ago. It then triggered important moving averages down and has made some genuine technical signals that imply an end to its bull market and also I might add, a beginning to a new era of ‘risk on’ that by long-term signals at least, appears as though it has much further to run.

Appearances… isn’t that what the brilliant Bernanke Fed has been all about?

NFTRH was launched in late September, 2008 just before the acute phase of the crisis and I considered myself lucky to have such great contrarian signals coming in clusters, day after day just after launch. It was the contrarian bullish opposite to today’s developing bearish contrarian structure.

From NFTRH 9 (11.22.08):

“Okay, everybody’s got the memo; deflationary depression it is. Well not everybody… I’ll go with the old pros and stick to my story that there will be recovery – born of inflation – and there will be places to invest and places to avoid. With the entire world now expert on deflation and 1930’s history, I have got to believe we have a huge counterparty of ‘sissies’* waiting to take the other side of the trade.

I personally believe any coming stock market rebound is a trade only [ed., it was, as the bottom was ultimately in spring, 2009] and things could get worse [ed., they did] before they get better. But if I were a deflationist I would be uncomfortable with the level the major media and by extension, the public are up to speed on the concept just as I was uncomfortable with every Tom, Dick and Harry on board the inflation express [ed., in the run up to the 2007 top].”

So the point of this article's opening segment is to simply remind all of us what is actually happening out there. Expectations have been realigned. In 2008 there were long-term technical breakdowns as well. For instance, the Dow and S&P 500 each made lower lows to their 2002 lows. So gold (insurance, monetary common sense, whatever label you want to place on it) is breaking down in stock market terms and making big picture technical violations. Does this at least provide some context?

The utter fear and angst of the 2008 timeframe is being corrected. Most people do not currently see it that way. They want to make ‘coin’ in stocks and now gold is not even on the radar for most people. I am not here to cheerlead insurance. I am here to point out that something opposite to 2008 is going on.

If in 2008 the idea was to get separate from fearful masses and be bullish for coming asset price opportunities, should the idea today not be to think about getting separate from them again in their new guise as increasingly manic US stock market bulls?