In last week’s edition of Forex Setup Week, I pointed to the “quiet” strength of the Swiss franc (Rydex CurrencyShares Swiss Franc (NYSE:FXF)) with a particular focus on its trade against the euro (Rydex CurrencyShares Euro Currency (NYSE:FXE)) in EUR/CHF. Although the euro continued to weaken through the week, the franc did so as well. So now, EUR/CHF is essentially where it was a week ago. Overall, I think the strengthening trend will continue, even at the current snail’s pace.

This week, the stubborn resilience of the Australian dollar (Rydex CurrencyShares AUD Trust (NYSE:FXA)) has my attention. The “Aussie” has continued to make gains against every major currency I follow…except for the U.S. dollar. GBP/AUD is at levels last seen in early April. EUR/AUD is challenging the low from last month which in turn was a level last seen in November of last year. AUD/JPY is breaking out and sits now at a level last seen in early June…of 2013. Only the US Dollar is holding its own against this currency which, according to the Reserve Bank of Australia (RBA), should be much, much weaker at this point in the economic cycle.

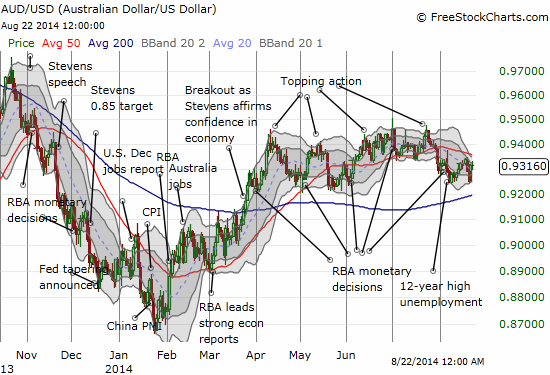

Only the U.S. dollar is holding its own against the Australian dollar in what actually looks like a topping pattern in slow motion

As I have stated in earlier posts, I like to follow AUD/JPY as a gauge of sentiment, the classic risk-on/risk-off dichotomy. The AUD/JPY breakout is then very consistent with the freshly bullish run in the (U.S.) stock market. The stubborn resilience of the Australian dollar suggests there is yet more upside to come in the stock market.

However, I remain just as stubbornly bearish on the Australian dollar – I guess I listen to and read the RBA too much. I have been net short for a while but trading in and out of hedges, mainly against the euro. I was even more bearish on the euro than the Australian dollar for quite some time. Now I think the euro is likely over-extended in its weakness (in the short-term). I prefer to bet against the Aussie with the U.S. dollar and the British pound. The pound has failed to deliver the strength I was counting on, but I think it now has the greatest upside potential against the Australian dollar whenever it goes on its next cycle of weakness (and it WILL happen at “some point”).

I hope to soon give a trader’s perspective on the RBA’s recent appearance at Australia’s House of Representatives Standing Committee on Economics. The opening statement by Governor Glenn Stevens and the transcript from the proceedings were fascinating and illuminating reads. In the meantime, be careful out there!

Full disclosure: Net short the Australian dollar