Textron Inc. (NYSE:TXT) reported fourth-quarter 2017 adjusted earnings from continuing operations of 74 cents per share, which missed the Zacks Consensus Estimate of 77 cents by 4.1%. Adjusted earnings were down 7.5% from 80 cents in the year-ago quarter.

Excluding one-time items, the diversified U.S. conglomerate reported loss of 40 cents per share, compared to the year-ago quarter’s earnings of 78 cents.

For 2017, the company posted adjusted earnings of $2.45 per share, which again missed the Zacks Consensus Estimate of $2.48. Year over year, the adjusted earnings figure reflected 6.5% decline.

Revenues

Total revenues in the quarter were $4,017 million, lagging the Zacks Consensus Estimate of $4,040 million by 0.6%. Reported revenues however, improved approximately 5% from the year-ago figure of $3,825 million on higher contribution from Bell and Industrial segments.

Manufacturing revenues were up 5.1% to $4,002 million, while revenues at the Finance division declined 16.7% to $15 million.

For 2017, the company generated revenues of $14.20 billion, which again missed the Zacks Consensus Estimate of $14.24 billion. Year over year, the top line figure reflected 3% improvement.

Segment Performance

Textron Aviation: Revenues during the quarter fell 3.2% to $1,391 million from $1,436 million in the year-ago quarter due to lower military volumes.

The company delivered 58 new Citation jets, flat with last year’s number, 2 Beechcraft T-6 trainers and 31 King Air turboprops compared with 8 and 28, respectively, in the prior-year quarter.

The segment registered profits of $120 million in the fourth quarter, down from $135 million in the year-ago quarter due to higher research and development expenses. Order backlog at the end of the quarter under review was $1.2 billion, up by $15 million sequentially.

Bell: Segment revenues were $983 million, up 11% from the year-ago level of $887 million on higher military volumes, partially offset by lower commercial volumes.

Segment profits were down by $12 million to $114 million, primarily related to a change in commercial mix. Bell’s order backlog at the end of the quarter was $4.6 billion, down by $407 million from the preceding quarter.

Textron Systems: Revenues during the quarter came in at $489 million, down from $532 million a year ago, mainly because of lower volumes of Weapons and Sensors.

Segmental profits declined to $37 million from $53 million.

Textron Systems’ backlog at the end of the quarter was $1.4 billion, down by $67 million from the end of the third quarter of 2017.

Industrial: Segmental revenues grew 20% to $1,100 million primarily driven by the Arctic Cat acquisition.

Segmental profits were up by $10 million from the fourth quarter of 2016.

Finance: Finance segment revenues declined by $3 million to $15 million while profits increased by $2 million.

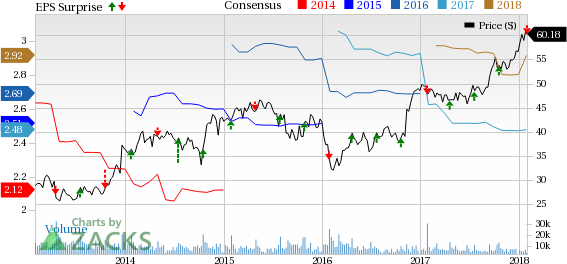

Textron Inc. Price, Consensus and EPS Surprise

As of Dec 31, 2017, cash and cash equivalents were $1,079 million compared with $1,137 million as of Dec 31, 2016.

Cash flow from operating activities totaled $947 million at the end of 2017, compared to $988 million in the prior-year quarter.

Capital expenditure during 2017 was $423 million compared with $446 million at the 2016-end.

Long-term debt was $3,074 million as of Dec 31, 2017, up from $2,414 million as of Dec 31, 2016.

Guidance

Textron has provided its guidance for 2018. The company expects earnings per share from continuing operations in the range of $2.95-$3.15 on revenues of $14.6 billion.

The company expects its net cash provided by operating activities of continuing operations of the manufacturing group to be between $1,170 – $1,270 million, during 2018.

Zacks Rank

Textron carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Northrop Grumman (NYSE:NOC) reported fourth-quarter 2017 earnings of $2.82 per share, beating the Zacks Consensus Estimate of $2.75 by 2.5%.

Raytheon Company (NYSE:RTN) reported fourth-quarter 2017 adjusted earnings from continuing operations of $2.03 per share, surpassing the Zacks Consensus Estimate of $2.02 by 0.5%.

General Dynamics (NYSE:GD) reported fourth-quarter 2017 earnings from continuing operations of $2.50 per share, beating the Zacks Consensus Estimate of $2.37 by 5.5%. Reported earnings were up 6.8% from $2.36 in the year-ago quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research