Texas Instruments Incorporated (NASDAQ:TXN) or TI yesterday took the wraps off its first educational robot designed for middle and high school students.

Known as TI-Innovator Rover, the company claims it to be the first-of-its-kind calculator-controlled robotic car. The machine will have a wider rollout in the United States and Canada this fall and in Europe early next year.

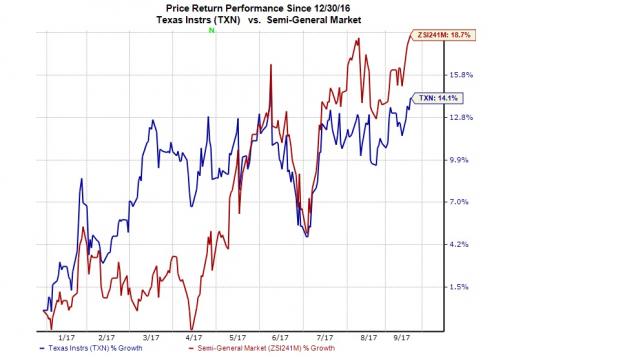

We observe that Texas Instruments stock has gained 14.1% year to date, underperforming the 18.8% rally of the industry it belongs to.

How Does It Work?

Students can write programs on Rover’s graphing calculator based on which it moves and draws things. The basic idea is to help students learn science, technology, engineering and math (STEM) subjects in an easy, interesting, enjoyable and interactive way.

The machine helps students individually or collaboratively explore various STEM topics and concepts and efficiently work on basic as well as advanced STEM, coding and robotics projects. Even students less accustomed to coding and robotics, can use Rover through basic programs. It has been built particularly for classroom use.

President of TI Education Technology, Peter Balyta stated, "Given the sheer joy we have seen on students' faces as they learned to code during our testing phase, we are excited to see how Rover will inspire more young minds through an introduction to robotics."

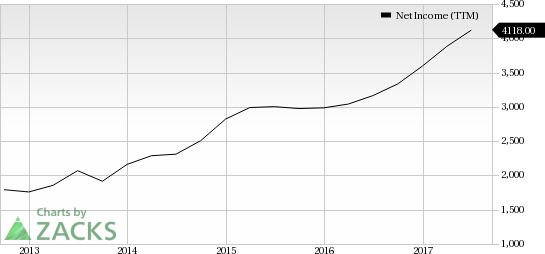

Texas Instruments Incorporated Net Income (TTM)

Our Take

TI’s robotic subsystem aims at building new capacities and features for robots used in industrial, medical, logistics and service applications. The latest move appears to be a part of this effort. The company leverages on its expertise in analog and embedded products and systems in the process.

The move is evidence of Texas Instruments’ R&D investments in several high-margin, high-growth areas of the analog and embedded processing markets. This is gradually increasing its exposure to industrial and automotive markets and increasing dollar content at customers, while reducing exposure to volatile consumer/computing markets.

Zacks Rank and Stocks to Consider

Texas Instruments carries a Zacks Rank #2 (Buy). Other stocks worth considering in the broader technology sector include Activision Blizzard, Inc. (NASDAQ:ATVI) , Applied Materials, Inc. (NASDAQ:AMAT) and Lam Research Corporation (NASDAQ:LRCX) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Activision, Applied Materials and Lam Research is projected to be 13.6%, 17.1% and 17.2%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research