It has been about a month since the last earnings report for Texas Instruments Incorporated (NASDAQ:TXN) . Shares have lost about 3.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Texas Instruments Tops Q2 Earnings & Revenue Estimates

Texas Instruments or TI’s second-quarter 2017 earnings and revenues came ahead of expectations.

Earnings of $1.03 per share surpassed the Zacks Consensus Estimate by 8 cents. Revenues of $3.7 billion beat the consensus mark by $139 million.

Revenue

Revenues were up 8.6% sequentially and 12.8% year over year and came at the higher end of the guidance range of $3.40 billion and $3.70 billion. The automotive market continued to be strong. The company also saw broad-based improvement in the industrial market. The communications market and personal electronics grew well. Enterprise systems revenues were flat.

Growth of analog and embedded processing applications business was strong. It typically yields a more stable longer-lived business as well as strong margins. The Other segment declined. The company continues to return cash to investors in the form of share repurchases and dividends.

Segment Revenues

The Analog, Embedded Processing and Other Segments generated 65%, 24% and 11% of quarterly revenues, respectively.

The Analog business was up 6.9% sequentially and 18% from the year-ago quarter. The year-over-year growth was driven by strong performance in product lines - power and signal chain, and high volume.

The Embedded Processing segment, which includes processor, microcontroller and connectivity product lines, was up 8.1% sequentially and 15% year over year. The year-over-year growth was driven by stronger sales across all product lines - processors and connected microcontrollers.

The Other segment, which includes DLPs, custom ASICs, calculators, royalties and some legacy wireless products, was up 20.7% sequentially but down 14% year over year. The decline was mainly due to custom ASIC and royalties moving to other income and expenses beginning in the first quarter of 2017.

Margins and Net Income

Texas Instruments’ gross margin of 64.3% was up 126 basis points (bps) sequentially and 309 bps from the year-ago quarter. The company’s gross margin has been improving consistently as more production shifts to its 300mm line. Operating expenses of $894 million were up 0.2% sequentially and 0.9% from the last year. Operating margin was 40.1%, up 327 bps sequentially and 595 bps from the year-ago quarter.

The Analog, Embedded Processing and Other segments generated operating margin of 29.2%, 7.3% and 11.2%, respectively. Analog, Embedded Processing and Other segment margin contracted 1220 bps, 2260 bps and 1120 bps, respectively on a sequential basis. Analog, Embedded and other segment margins however expanded 530 bps, 140 bps and 640 bps, respectively year over year.

Pro forma net income was $1.1 billion, or a 28.6% net income margin compared with 1 billion, or 29.3% in the previous quarter and $779 million, or 23.8% in the year-ago quarter.

Balance Sheet and Cash Flow

Cash and short-term investments balance was $3 billion, down $50 million during the quarter.

The company generated $917 million in cash from operations, spending $151 million on capex, $650 million on share repurchases and $498 million on cash dividends.

Texas Instruments is one of the few technology companies that return a significant amount of cash to investors. Over the trailing 12 months, the company returned 4.1 billion of cash through a combination of dividends and stock repurchases.

At quarter-end, TI had $3.1 billion in long-term debt and $499 million in short-term debt. As of Mar 31, 2017, the company’s net debt position was $599 million.

Guidance

The company provided guidance for the third quarter. It expects revenues between $3.74 billion and $4.06 billion (up 5.4% sequentially at the mid-point). The annual effective tax rate and the rate to be applied for the third quarter is around 29%. Earnings for the quarter are expected to be in the range of $1.04 to $1.18 per share. The capex target remains at 4% of revenues.

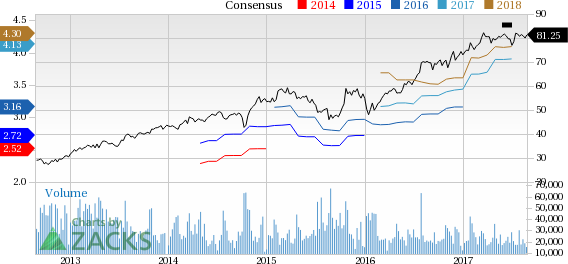

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Texas Instruments' stock has an nice Growth Score of B, a grade with the same score on the momentum front. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall,the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is suitable for momentum and growth investors.

Outlook

The stock has a Zacks Rank #2 (Buy). We are expecting an above average return from the stock in the next few months.

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Original post