Texas Instruments Incorporated ( (NASDAQ:TXN) ) just released its fourth-quarter financial results, posting adjusted earnings of $1.09 per share and revenues of $3.75 billion.

Currently, TXN is a Zacks Rank #2 (Buy) and is down 4.98% to $114.03 per share in trading shortly after its earnings report was released.

Texas Instruments:

Matched earnings estimates. The company posted adjusted earnings of $1.09 per share, matching the Zacks Consensus Estimate of $1.09. Including $0.75 of tax reform-related expenses not in the company's original guidance, Texas Instruments posted earnings of $0.34 per share.

Beat revenue estimates. The company saw revenue figures of $3.75 billion, beating our consensus estimate $3.74 billion.

Revenue in the company’s Analog division grew 11% year-over-year, while revenue in its Embedded Processing division gained 20%. Texas Instruments said that operating margin increased in both businesses.

“Revenue increased 10 percent from the same quarter a year ago. Demand for our products continued to be strong in the industrial and automotive markets,” said CEO Rick Templeton in a press release.

Texas Instruments expected first-quarter revenue in the range of $3.49 billion to $3.79 billion and earnings per share between $1.01 and $1.17. Our current consensus estimates are calling for earnings of $1.07 per share and revenue of $3.64 billion.

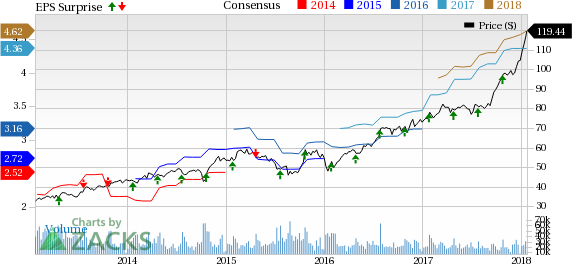

Here’s a graph that looks at TXN’s earnings surprise history:

Texas Instruments Incorporated (TI) is a global semiconductor design and manufacturing company that develops analog chips and embedded processors. TI also produces TI DLP technology and education technology products.

Check back later for our full analysis on Texas Instrument’s earnings report!

Want more analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Texas Instruments Incorporated (TXN): Free Stock Analysis Report

Original post

Zacks Investment Research