Tetragon Financial Group Ltd (AS:TFG) achieved a 1.6% NAV total return in the third quarter of 2017, taking NAV total return to 4.5% for the first nine months of the year. A strong performance from ‘other equities and credit’ has contributed to this asset class increasing to 9.9% of NAV. TFG Asset Management declined to 19.2% of NAV, as a result of the refinancing of Equitix, while all five of the established asset managers saw valuation uplifts during the quarter. Tetragon commenced a tender offer to purchase up to US$65m of its own shares in November 2017 and, if fully subscribed, this would lift Tetragon’s NAV total return for the year to between 6.1% and 6.7%, prior to considering net income generated in the fourth quarter.

Positive Q317 and 9M17 performance

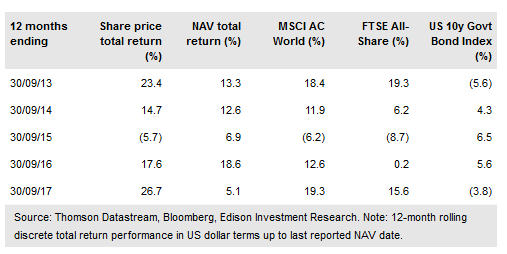

Tetragon’s NAV increased by US$28.6m to US$2,010.4m in the third quarter of 2017, with NAV per share rising from US$20.22 to US$20.37, which continued the positive performance realised in the first half of the year. NAV total return for the third quarter was 1.6%, taking Tetragon’s NAV total return for the first nine months of 2017 to 4.5%. All asset classes other than hedge fund strategies contributed positively during the quarter, with a notably strong contribution from ‘other equities and credit’, which comprises direct balance sheet investments.

To read the entire report Please click on the pdf File Below: