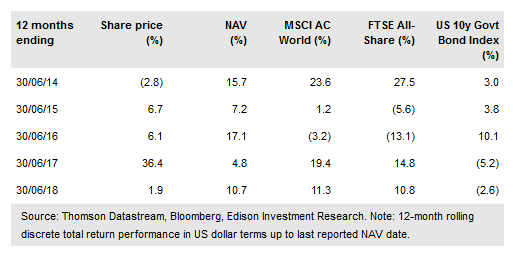

Tetragon Financial Group Ltd (AS:TFG) delivered a strong relative performance in H118, with its +4.4% NAV total return comparing with the -0.1% and -0.7% US dollar total returns of the MSCI AC World and FTSE All-Share indices. The portfolio has been substantially diversified away from collateralised loan obligations (CLOs – now only 16% of NAV) across a range of other alternative asset classes in recent years, accompanied by lower returns. However, with positive returns from all but one asset class in the half year, Tetragon’s return on equity (ROE) moved up to an annualised 10.5% in H118, back within its long-term 10-15% pa target range. Recent discount widening appears inconsistent with Tetragon’s NAV performance, as well as its progressive dividend and peer group-leading 5.5% yield.

Positive performance across asset classes in H118

Tetragon achieved a +4.4% NAV total return and a 5.2% ROE in H118. Net investment gains totalled US$144.6m compared with US$99.5m in H117. Apart from hedge fund strategies, which included a US$12m loss on the closure of the Polygon Distressed Opportunities Fund, all asset classes in the portfolio generated positive returns, with half of the net investment gains coming from TFG Asset Management. Tetragon’s net asset value increased by US$80.4m to US$2,074.9m during H118, with NAV per share rising from US$21.08 to US$21.64.

To read the entire report Please click on the pdf File Below: