In the recently reported third-quarter fiscal 2017 results, Tetra Tech Inc. (NASDAQ:TTEK) posted earnings from ongoing operations of 53 cents, missing the Zacks Consensus Estimate of 55 cents by 5.5%. Tetra Tech missed earnings estimate for the first time in 11 quarters. Earnings came in the middle of the company’s guided range of 50–55 cents.

Tetra Tech fared better year over year, with ongoing earnings up 6% from the prior-year quarter’s figure of 50 cents. Decent top-line growth and greater operating efficiency, resulting from cost-management initiatives, fueled bottom-line growth.

Inside the Headlines

Net revenue was up 3% year over year to $685.5 million, comfortably beating the Zacks Consensus Estimate of $537 million. Revenues surpassed the upper end of the company’s estimated range of $510–$540 million, and were at a record third-quarter high. Moreover, Tetra Tech’s ongoing revenues grew 17% to $498 million on a year-over-year basis.

The top line was supported by the expansion of the U.S. Federal, and U.S. State and Local markets, which grew at double-digit organic rates. Primarily, strong performance of the Water, Environment and Infrastructure segment supplemented the quarterly sales performance.

Water, Environment and Infrastructure revenues continued the solid growth trajectory, rising 9.8% year over year to $210.1 million. This segment primarily benefited from robust performance of the North American infrastructure and U.S. environmental business lines.

However, net revenues from Resource Management and Energy declined 5.7% year over year to $287.4 million. While the U.S. federal development projects drove the sales’ performance, sluggish oil and gas markets (particularly in Canada) restricted top-line growth.

In the quarter under review, total backlog from ongoing operations reached a record $2.53 billion, marking an impressive jump of 12% year over year, driven by strong orders in the federal and state, and local markets. This is the sixth consecutive quarter of backlog growth for the company.

Some of the notable contracts clinched by the company during the quarter include the $170 million worth of international development task orders, the $150 million USACE Mobile A-E contract, a $77 million U.S. FAA ASH Contract and $352 million worth of commercial contracts.

Additionally, ongoing operating income was up 6.9% year over year to $47.2 million.

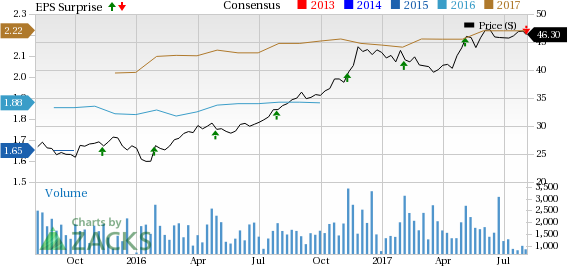

Tetra Tech, Inc. Price, Consensus and EPS Surprise

Liquidity & Cash Flow

At the end of the quarter, Tetra Tech’s cash and cash equivalents were $138.8 million, up from $160.5 million as at Oct 2, 2016. At the end of the fiscal third quarter, the company’s long-term debt was $310.3 million, down from $331.5 million as of Oct 2, 2016.

For the first nine months of fiscal 2017, the company’s cash generated from operations came in at $71.6 million, significantly lower than the year-ago figure of $89.8 million.

Share Repurchase

Tetra Tech is highly committed toward rewarding its shareholders through dividends and share buyback programs. On Jul 31, 2017, the company declared a quarterly dividend of 10 cents per share payable on Sep 1, 2017, to stockholders of record as of Aug 17.

Currently, Tetra Tech has $140 million remaining under the previously approved $200 million share repurchase program. The company expects to spend $100 million in share repurchases for fiscal 2017, of which, $60 million was spent in the first nine months.

Outlook

Concurrent with the quarterly earnings release, Tetra Tech provided revenue and earnings guidance for both the upcoming quarter and fiscal 2017. The company expects fourth-quarter fiscal 2017 ongoing earnings per share to be in the range of 60–62 cents. Net revenue for the fiscal third quarter is projected to be within $500–$520 million.

The company also tweaked its ongoing earnings per share guidance for fiscal 2017. It now projects earnings to be in the range of $2.10–$2.12 compared with the earlier guided range of $2.10–$2.25. Also, based on the current market scenario, Tetra Tech revised its revenue guidance and expects it to be within $2.00–$2.02 billion, instead of the earlier guided range of $2.05–$2.10 billion.

Our Take

In a bid to maximize growth opportunities, the company is currently focusing on high-end consulting and engineering services that is helping it promote its high value and high margin business, thus differentiating it from peers in the marketplace. For fiscal 2017, Tetra Tech remains bullish about its growth across all four client sectors, namely, the U.S. federal, the U.S. state and local, the U.S. commercial work and international.

The company’s U.S. state and local clients – in both the municipal water and smart water services domains – are anticipated to be its strongest growth drivers for the upcoming quarters. The broad-based bipartisan support for infrastructure investment in the U.S., which can range from $500 billion to $1 trillion, can prove to be extremely beneficial for the company. Steady growth in local budgets and local capital spending has been adding to this Zacks Rank #3 (Hold) company’s strength.

However, the company is concerned about its oil and gas operations, which have become increasingly challenged, particularly in Canada.

Stocks to Consider

Some better-ranked stocks in the broader space include Barnes Group Inc. (NYSE:B) , A.O. Smith Corporation (NYSE:AOS) and Regal Beloit Corporation (NYSE:RBC) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Barnes Group has a solid earnings surprise history for the trailing four quarters, having beaten estimates each time for an average of 11.6%.

A.O. Smith also has a decent earnings surprise history, with an average beat of 3.3% over the trailing four quarters, beating estimates thrice.

Regal Beloit generated two beats over the trailing four quarters, for an average positive surprise of 1.5%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Smith (A.O.) Corporation (AOS): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Tetra Tech, Inc. (TTEK): Free Stock Analysis Report

Original post

Zacks Investment Research