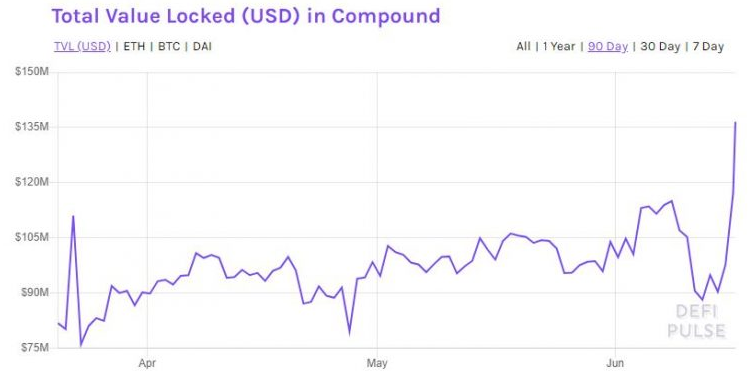

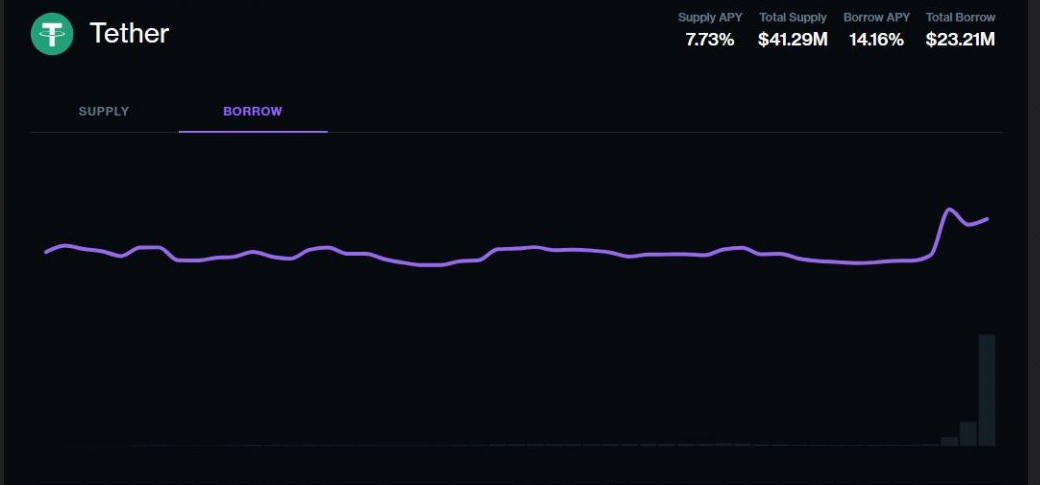

Tether yields surge on Compound as usage on the DeFi protocol soars over the past two days. Tether lenders are yielding over 7%, and borrowers are paying over 14% on Compound, as the protocol launches its governance token, COMP. Compound usage has surged over the past two days, with the total locked value up from around $90 million to $140 million. The dramatic uptrend comes as the platform launches its governance token, COMP. Compound’s governance tokens began trading on Monday on Uniswap for $62. COMP tokens mark the protocol’s first steps towards decentralization, with token holders and their delegates able to “debate, propose, and vote on all changes to Compound.” According to the distribution schedule, the protocol will distribute just under 3,000 COMP tokens a day into the eight Compound lending markets. Users will earn COMP in proportion to their Compound balance. As Robert Leshner, the Compound protocol founder said: “The individuals, applications and institutions that use the Compound protocol are capable of collectively stewarding it into the future — and are incentivized to provide good governance.” Tether interest rates on the Compound protocol are the highest in DeFi, with lenders yielding around 7% and borrowers paying roughly 15%. That compares to borrowing rates of 8% on Fulcrum. The cost of USDT only three days ago on Compound was approaching 20%. Compound is currently the third-ranked protocol in the DeFi ecosystem, according to DeFi Pulse.Key Takeaways

Compound Use Surging

Tether Interest Rates Jump

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Tether Yields Surge On Compound Following COMP Token Launch

Published 06/16/2020, 05:15 AM

Tether Yields Surge On Compound Following COMP Token Launch

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.