Last week I briefly reviewed the case for casting a wary eye on expecting the standard stock-bond asset allocation to fulfill its historical role as a risk-management tool. Let’s extend this thought experiment by comparing results for possible bond replacements in the classic 60/40 stock/bond portfolio.

As a quick refresher, a recent GMO research note argued rather persuasively that low yields on bonds create headwinds for fixed income as a strategy for smoothing out market volatility in portfolios when stocks take a beating. Ben Inker writes:

“The recent fall in cash and bond yields for those developed countries that still had positive yields has left government bonds in a position where they cannot provide two of the basic investment services they have traditionally provided in portfolios – meaningful income and a hedge against an economic disaster.”

Recent history offers support for his warning. During the coronavirus market crash in March, bond returns were negative in countries where yields were effectively at zero or lower.

A sign of things to come in the US if yields continue to move closer to zero or below? Although no one can be sure if US bonds will lose their ability to offset equity market losses in portfolio in the years ahead, we can test how fixed-income alternatives perform in a traditional 60/40 portfolio. As an initial step, let’s review four bond replacements based on numbers since 2008.

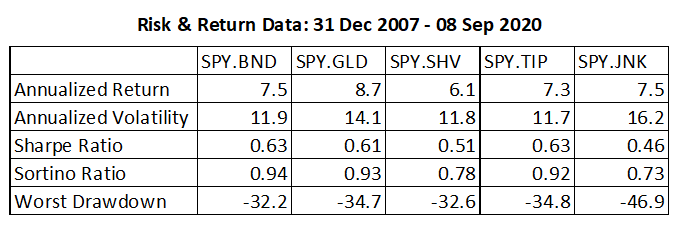

The baseline portfolio holds a 60% weight in SPDR S&P 500 (NYSE:SPY) and 40% in Vanguard Total Bond Market (NASDAQ:BND). This portfolio is rebalanced to the target weights every Dec. 31. The alternative strategies are managed identically — except that the bond slice is replaced with one of four ETF substitutes representing gold (NYSE:GLD), cash (NASDAQ:SHV), inflation indexed Treasuries (NYSE:TIP) and junk bonds (NYSE:JNK). These are far from the only possibilities, but it’s a useful starting point. Here’s how the numbers stack up:

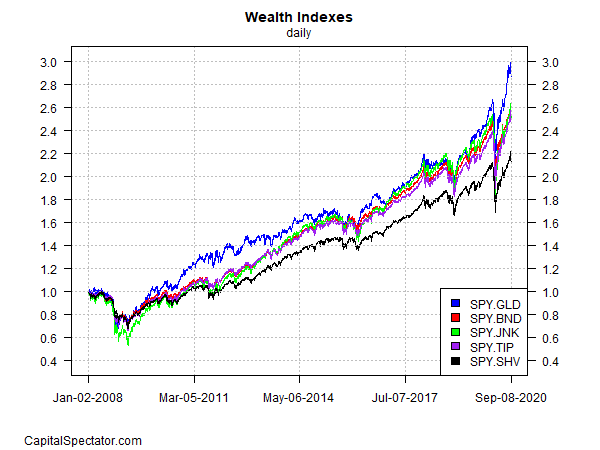

For a visual summary, here are the results for investing $1 in each strategy on Dec. 31, 2007:

In raw performance terms, the stock/gold mix won the race with an 8.7% annualized total return – comfortably ahead of the baseline strategy’s 7.5%. The other three strategies either matched the baseline return or trailed it.

Looking at the results through a risk prism reminds that there are no perfect substitutes for the standard bond allocation.

Using junk bonds, for example, offers the potential for significantly higher yields, but at a price of substantially higher risk for the portfolio. The maximum drawdown for the stocks/junk mix during 2008-2020 was a steep 46.9% decline—considerably deeper than the 32.2% peak-to-trough decline for the baseline portfolio.

The other three alternative strategies offer a comparable maximum drawdown to the baseline strategy but each comes with its own set of pros and cons. Inker predicts:

“Investors will need to think more creatively than they have had to historically in order to get the services they used to get from bonds or to build a portfolio that doesn’t require those services in the first place. That task is by no means impossible, but in a world where historical performance is much less relevant for forward-looking expectations, it will require more thought and creativity than it once did.”