A week and a half after I last provided an update on Tesla (NASDAQ:TSLA), I was looking for:

“… a larger multi-day bounce to ideally $825+/-25 before the next leg lower kicks in. … The three waves are currently in progress, and the first wave has likely been completed (red wave-a). The second wave is now underway (red wave-b) to ideally $625+/-25, from where the next move higher (red wave-c) should kick into ideally $825+/-25 for a typical wave-C=wave-A relationship. That targets around the 76.40% retrace of the last decline as well as into the Horizontal Resistance zone.”

Fast forward, and the stock topped indeed for red wave-a the day I wrote my update. Today, its price has reached the red wave-b target zone of $625+/-25 as it bottomed today – so far – at $624.62. Can it get any more accurate? The Elliott Wave Principle (EWP) is almost all I need to reliably, accurately but not perfectly, forecast how assets will move from the smaller to the larger timeframes.

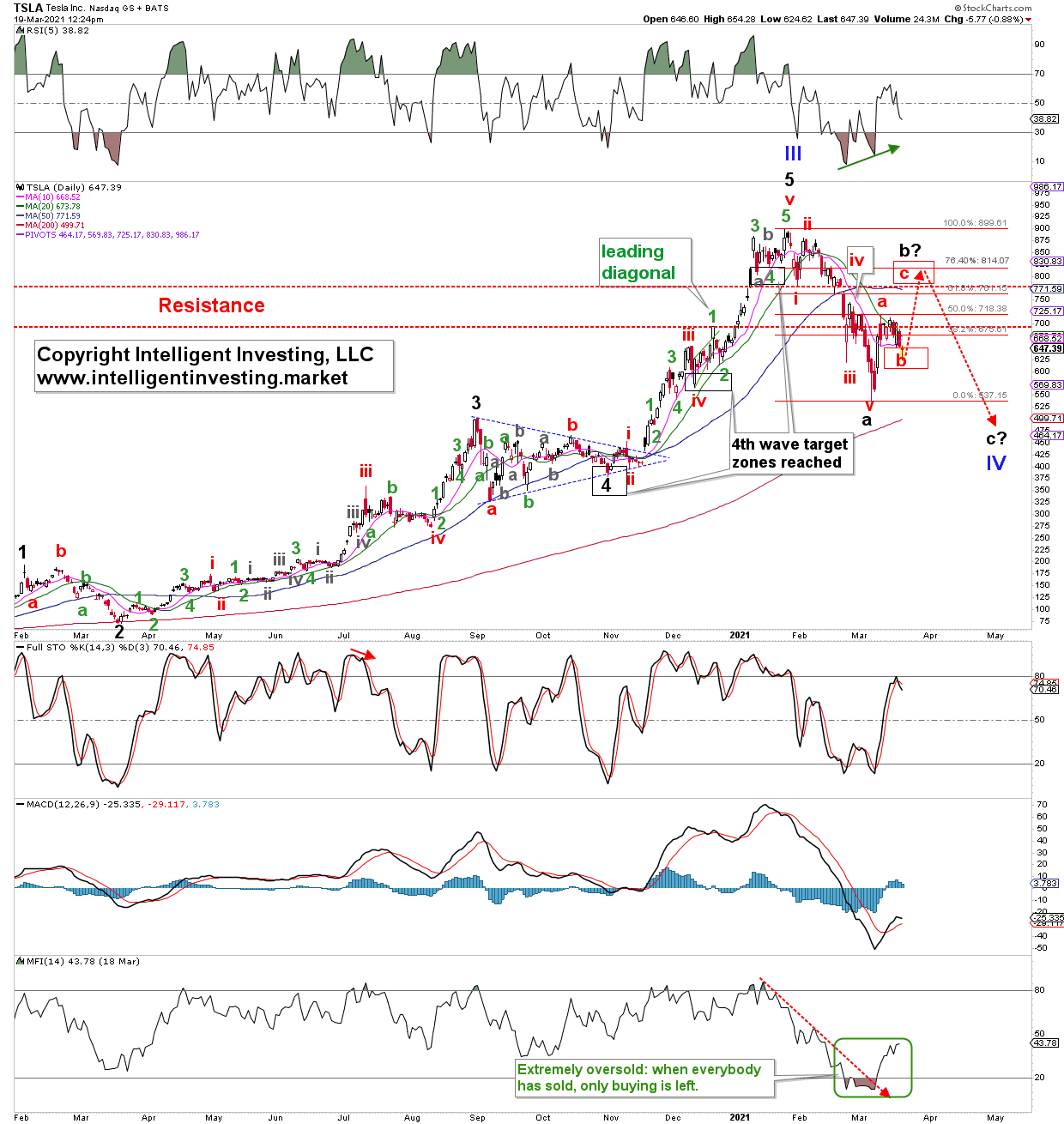

Figure 1. TSLA daily candlestick chart with EWP Count and Technical Indicators:

Thus, as long as $600 holds, which is the lower end of the red wave-b target zone, and ideally today’s low hold, I expect the next move higher towards $800-825 to get going soon, targeting $815 ideally. Once this red intermediate wave-c of black major-b completes, I expect the next leg lower: wave-c of blue Primary-IV to ideally $450+/-25.

Bottom line: The detailed EWP count shown in the previous update appears to be unfolding as anticipated. I now prefer to look higher for Tesla and for the price to reach $815 ideally. From there, I expect the next decline to ideally $450+/-25.