It has been more than a month since the last earnings report for Tesla Inc. (NASDAQ:TSLA) . Shares have added about 7% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Tesla Q2 Loss Narrower Than Expected, Revenues Beat

Tesla’s adjusted loss was $1.33 per share in the second quarter of 2017. The loss was narrower than the Zacks Consensus Estimate of a loss of $1.94.

Revenues skyrocketed almost 200% to $2.79 billion from $1.27 billion recorded in second-quarter 2016. The figure also surpassed the Zacks Consensus Estimate of $2.55 billion.

Tesla delivered 47,077 vehicles in the first half of 2017. In second-quarter 2017, the combined sales of Model S and Model X surged 52% from the year-ago figure.

Revenues from Automotive sales rose to $2.01 billion in the reported quarter from $1.03 billion a year ago.

Energy generation and storage revenues soared from $3.9 million in the second quarter of 2016 to $286.8 million in the reported quarter, a massive rise of 7166%.

Services and Other revenues rallied to $216.2 million from $84.2 million in the year-ago quarter.

Tesla’s second-quarter automotive gross margin was 25%, down 285 basis points (bps) from first-quarter 2017 due to variation in product mix and the absence of one-time advantage of Autopilot software, recognized in the same period.

Energy generation and storage gross margin declined 11 bps sequentially in the quarter.

Financial Position

Tesla had cash and cash equivalents of $3.1 billion as of Jun 30, 2017 compared with $3.39 billion, as of Dec 31, 2016.

Cash used in operating activities amounted to $200.2 million in the second quarter compared with the flow of $150.3 million a year ago. Capital expenditures jumped to $959.1 million from $294.7 million in the year-ago quarter.

Business Expansion

During the reported quarter, Tesla opened 29 new stores and service locations. The company aims to at least double its Supercharger locations globally in 2017 to over 10,000.

Model 3 Update

Tesla is currently under the final stages of Model 3 vehicle production. It aims to steadily increase production to 1,500 vehicles in third-quarter 2017 and achieve a run rate of 5,000 units per week in 2017 and 10,000 vehicles per week in 2018. Equipment is also being installed for volume production of cells, modules, battery packs and drive units at Gigafactory 1 to support the Model 3. Tesla expects positive gross margin in fourth quarter and is targeting a margin of 25% in 2018 from the Model 3.

Outlook

In the second half of 2017, Tesla expects to increase the delivery of Model S and Model X in comparison to the first half. It also estimates an increase in revenue for the same period, owing to which, there will be a strong improvement in the operating leverage. However, operating expenses will remain flat with the same from the first half of 2017.

The company also anticipates a capital expenditure of approximately $2 billion in the same period. It will continue with its Gigafactory 1 construction and expansion of Supercharger locations, auto stores, delivery hubs and service networks.

In the second half of 2017, several factors will influence the gross margin of Model S, Model X and the soon-to-be launched Model 3. Driven by mix shift, gross margin for Model S and Model X in the third quarter will slightly decline from the reported one.

Also, during the initial phase of Model 3 in the third quarter, the volume produced will be less in comparison to the installed production capacity. Due to this, the gross margin will be hurt by an excessive allocation of labor and overhead costs and depreciation over this tiny volume.

However, gross margin in the third quarter would be positive, resulting in beneficial cash contribution. With better utilization of capacity, the gross margin of Model 3 will further improve in the fourth quarter and witness a rapid growth in 2018.

How Have Estimates Been Moving Since Then?

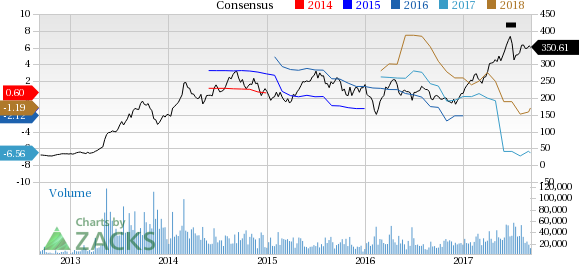

It turns out, fresh estimates have trended downward during the past month. There have been four revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 12.7% due to these changes.

Tesla Inc. Price and Consensus

VGM Scores

At this time, Tesla's stock has a poor Growth Score of F, though its Momentum is doing a lot better with a C. The stock was allocated a grade of F on the value side, putting it in the lowest quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is suitable solely for momentum investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Tesla Inc. (TSLA): Free Stock Analysis Report

Original post

Zacks Investment Research